A Brief History of the Estate Tax and Potential Implications for the Upcoming Election

Executive Summary

With a swoop of a pen, could thousands of households suddenly face an Estate Tax? If so, is there anything that can be done about it? Why would someone now face this wealth tax when they haven’t before? How does this relate to the current political election?

In this blog post we explore these ideas, and more. Consider the following:

- The upcoming presidential election has the potential to radically change tax laws that govern Estate Planning

- Democrats are targeting a repeal of the Tax Cuts and Jobs Act and have proposed lowering the estate tax exemption from its all time current high of $11.58MM today if they win the White House and senate1

- The possibility of repealing and changing current tax law has created a frenzy of estate planning activity as many more families might face the Estate Tax in coming years

This post discusses a brief history of the estate tax and how it works, explores the current exemption level and highlights potential implications associated with the upcoming election. For a more in depth conversation on your plan, contact Centura Wealth Advisory.

What is the Estate Tax

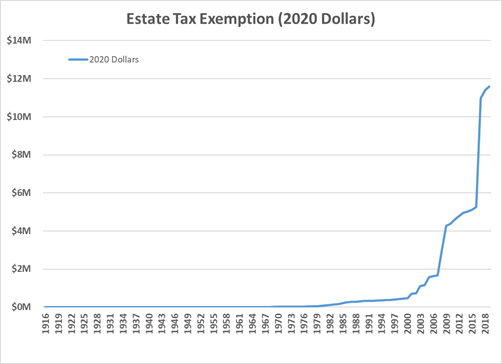

The Estate Tax is a tax on your right to transfer property at your death. Currently, there are very few taxpayers that encounter the Estate Tax and that is because the current exemption level is at an all-time high (see Estate Tax Exemption chart below). A high exemption level ensures that only the wealthiest pay this tax, however a lower exemption level would expose many more American families; and that is the concern as it relates to the upcoming election. To understand the estate tax and how it is used by the federal government, it is important to begin with a historical perspective.

History of the Estate Tax: Prior to 1916

In the United States, the death tax has been used several times to generate revenue in times of war or crisis. In each instance, congress used the death tax as a short term tool to raise funds during times of need and repealed the tax when the need was no longer there. The first example of this was during The Stamp Tax of 1797 when the tax was used to create revenue for an undeclared war with France. The second iteration came with the Revenue Act of 1862, which was used to raise money for troops, ammunitions, and other expenditures during the American Civil War. And finally, when the Federal Legacy tax was created during the Spanish-American War. All these enactments of the death tax were repealed shortly after the wars ended. However, the death tax was once again reintroduced in 1916 during World War I, setting the stage for the Modern Estate Tax.2

History of the Estate Tax: 1916 to present

The Revenue Act of 1916 created the Modern Estate Tax which was a tax on the transfer of wealth from an estate to its beneficiaries. The key caveat here is that this tax was levied on the estate as opposed to an inheritance tax that is levied directly on beneficiaries.

Since inception, the Modern Estate Tax has been amended at least twenty times for various reasons such as, the increase to a $120,000 exemption level at an 18% rate in 1926, and more recently in 2018 when it was amended to an $11.18mm exemption level at a 40% rate due to the Tax Cuts and Jobs Act. Chart 1 shows the Estate Tax Exemption since 1916, adjusted for inflation. As is clear from the chart, the current level of the estate tax exemption (adjusted for inflation) is at an all time high.2

Chart 1– Estate Tax Exemption Over Time (inflation adjusted)

How does the Estate Tax work

There are 2 primary aspects to the Estate Tax: the Exemption Level and the Tax Rate.

- Exemption Level – The estate tax exemption level is the threshold at which an estate is subject to estate tax

- Tax Rate – The estate tax rate is applied to the amount of the estate above the estate tax exemption level

Through manipulation of the exemption level and/or rate, congress can creatively target revenue (in the form of tax dollars) that would otherwise not exist if the current law of the land were to prevail (i.e., Tax Cuts & Jobs Act).1

What could it mean for me and my family?

We know that decreases in the exemption level and/or increases in the rate are tools that can be used to target more money from more estates, but at Centura we are increasingly concerned about this wealth transfer risk due to 2 primary factors:

- Government Debt: An urgency to raise funds to pay off debt associated with the COVID-19 pandemic as current government debt is at $27 Trillion.3

- Revenue Collection Deficit: The current estate tax only affects a small fraction of estates (due to the high exemption level) and raises less than 1% of federal revenue.4

With the U.S presidential election less than 30 days away, the Estate tax has been the subject of significant interest among policy makers, researchers, and the general public. Reasons for this interest range from views on the fairness of the tax to interest in the effects of taxing transfers at death on the overall U.S. economy. No matter what the reason is for reformation, we know that this tax rate is volatile and significant to those affected by it.

Scenario Analysis

A great way to illustrate the potential impact of a revised estate tax is to consider one specific estate, and analyze the tax implications under two different death scenarios. These scenarios differ by the year of death (2021 vs 2026), which has an impact on the estate value, exemption level and potential tax liability. Thus, these are for illustrative purposes and are meant to help the reader contextualize the implications of these political decisions. The four scenarios analyzed are:

- Scenario 1: (Baseline) Estate value of $5.0M in 2021 (at death)

- Scenario 2: Democratic Proposal Retroactive to 01/01/2021

- Scenario 3: $5.0M (2021) Estate in 2026 (Sunset Provision, TCJA)

- Scenario 4: $5.0M (2021) Estate in 2026 with Democratic Proposal 01/01/2021

Table 1– Scenario Analysis

Illustration of Tax Risk

Scenario 1 in Table 1 represents the estate tax due under the current law (Tax Cuts & Jobs Act) and Scenario 2 shows the estate tax due under the proposed democratic policy. Both Scenarios 1 & 2 depict a 2021 date of death scenario since the democratic policy would likely be retroactive to 01/01/2021.

Alternately, for Scenarios 3 & 4 we selected the year of death as 2026 which is when the exemption level is scheduled to sunset, based on current law (Tax Cuts & Jobs Act).5

As is clear from this example, a change in estate tax policy to the democratic proposal could have huge tax ramifications. In addition, these taxes may extend to many more families than they otherwise would at higher exemption levels. Thus, the upcoming election should be of keen interest to families with estates of $3 Million or more.

What can you do?

At Centura, we assist individuals and families with navigating the complicated world of estate planning, specializing in strategies designed to help you efficiently transfer wealth to your loved ones and causes you care about. To help you get started we put together a calculator to help you estimate what your estate tax liability could be.

Depending upon the outcome of the 2020 election, we believe many more estates may be exposed to this long standing tax and we can help in planning to address it. Please contact us to learn more or take advantage of our free calculator.

References:

- https://www.wealthadvisorstrust.com/blog/biden-tax-plan-estate-trust-planning-election-2020

- https://www.irs.gov/pub/irs-soi/ninetyestate.pdf

- https://fiscaldata.treasury.gov/datasets/debt-to-the-penny/debt-to-the-penny

- https://taxfoundation.org/estate-tax-provides-less-one-percent-federal-revenue/#:~:text=Despite%20its%20high%20tax%20rate,has%20dwindled%20in%20recent%20years.

- https://www.congress.gov/115/bills/hr1/BILLS-115hr1enr.pdf