Active Management and Risk Adjusted Returns

Active versus passive management is a long-standing debate that tends to divide rooms of investment professionals. At Centura Wealth Advisory, we believe in both – but not universally.

We propose investors opt for a blended approach of active and passive management to benefit from the advantages of each. This strategy can deliver the best risk-adjusted after-tax returns.

Let’s review the advantages of a blended management approach, our philosophy, and the research that supports it.

What are the Advantages of a Blended Active and Passive Management Approach?

Active management offers the potential to outperform passive indexing but has become increasingly difficult to do on a consistent basis. Recent research has called into question the merits of active management, but not all markets (i.e., stocks, bonds) are created equal.

Let’s break down our philosophy at Centura.

Our Philosophy: Why a Blended Approach?

At Centura Wealth Advisory, we utilize a blend of both active and passive portfolio management. However, we believe it is the skill of knowing which tactic to employ on which asset classes that contributes to an improved risk-adjusted return.

For example: When constructing diversified portfolios, we usually take a passive approach to equities unless we are actively managing taxes via index replication and tax harvesting.

However, regarding fixed income, we typically utilize a diversified active and passive approach due to the favorable economic backdrop that fixed income markets provide as related to active management.

But, are these philosophies rooted in sound economics and, perhaps more importantly, does research support them?

Does Current Quantitative Research Support Our Thesis?

Fund Selection Criteria

We believe that actively managed funds (equity or fixed income) must meet the following mandate(s) in order to be selected over an index:

- Funds held in a portfolio must add statistically significant alpha versus their respective index*

- Funds held in a portfolio must be accretive to risk-adjusted returns (i.e., Sharpe Ratio)

*To determine whether funds outperform their respective index, net of fees, we employ Fama-French Regression Analysis using a variety of factor returns for both equity and fixed income markets.

Then, we analyze the portfolio of funds over varying periods of time. In these analyses, we assess their return/volatility profile as compared to the appropriate index (or blended index).

Economic Backdrop: Equities vs. Fixed Income

Equity and fixed income markets are very different in their structure, policies, and participants. Therefore, a complete understanding of the subtle nuances is paramount to understanding why the opportunity for outperformance may or may not exist.

Equity Markets

Equity markets are fiercely competitive and well-covered by highly skilled analysts, traders, and various media outlets. This level of competition and sophistication creates an environment that has democratized information, access to markets, and technology.

For these reasons, we believe actively managed equity funds underperform their respective indices on a risk-adjusted, net-of-fees basis most of the time.

Given our belief, we typically look to access market beta for equities as cheaply and efficiently as possible through the use of large, liquid, low-cost index ETFs. This passive, low-cost approach to indexing equities ensures that we will participate in market returns but reduces the risk of underperforming on a net basis due to fee drag.

Equities are not typically an area of the market where we look to source alpha; unless we do so through tax management.

Fixed Income Markets

We believe actively managed fixed-income funds offer more opportunities to outperform based on the following considerations (including, but not limited to):

- Fixed-income investors have different objectives and may have mandates and/or other incentives when making investment selections

- The bond market(s) are dynamic in that thousands of issuers constantly issue new bonds, which provides ample supply of both primary and secondary issues of

- Various yields and maturities

- Bonds are generally held to maturity and therefore trade infrequently

- Trading occurs via over-the-counter (OTC) transactions and not on exchanges

- Infrequent, over-the-counter trading, across thousands of different issues can lead to mispriced assets, negotiated trade prices, and opportunities for outperformance (alpha)

- Return profiles of individual bonds are far more skewed

For these reasons, we utilize actively managed fixed-income funds in our fixed-income portfolio whereas with equities we generally rely on passive strategies alone.

Additionally, we retain a portion of our fixed-income portfolio in the respective index as we recognize there are periods where indexing will still outperform. This allows us to create a blended portfolio.

Let’s Test It: Qualitative and Quantitative Testing

Now that we have outlined our general philosophy and economic rationale supporting it, we will test whether a sample fixed income portfolio that we utilize at Centura Wealth Advisory meets our specified mandate(s).

Test: Part 1 – SPIVA Results

We will use the 2018 year-end Risk-Adjusted SPIVA scorecard provided by S&P Dow Jones Indices to begin our test.

The Risk-Adjusted SPIVA Scorecard measures the performance of actively managed funds against their benchmarks on a risk-adjusted basis, using net-of-fees and gross-of-fees returns.

Risk-adjusted performance in SPIVA is measured by the Sharpe Ratio (i.e., higher = better) and evaluates results over three distinct time periods: five years, 10 years, and 15 years. For purposes of our study, we will utilize these SPIVA findings to evaluate our philosophy on active vs. passive fund selection.

For detailed results, please reference the SPIVA research report for year-end 2018. Key highlights relevant to our analysis include:

- Benchmarks outperformed U.S. Equity Funds 81% to 95% of the time, depending on whether looking at five, ten, or 15-year periods

- Unlike their equity counterparts, most fixed-income funds outperformed their respective benchmarks’ gross of fees

- However, when using net of fees returns, most actively managed fixed-income funds underperformed across all three investment horizons on a risk-adjusted basis

- This gross vs. net performance divergence highlights how the role of fees in fixed income fund performance was especially critical

Do the Results Support our Thesis?

These findings confirm our thesis. This research supports our rationale for taking a passive approach to equities and a diversified active/passive approach to fixed income.

Test: Part 2 – Quantitative Analysis

Next, we will evaluate the actively managed funds (held in the portfolio) that we utilize in our fixed income model(s) at Centura. Our goal is to determine:

- If our fixed income portfolio adds statistically significant alpha

- To see if our fixed income portfolio has outperformed the bond index on a risk-adjusted, net of fees basis over the recent one, three, and five-year periods

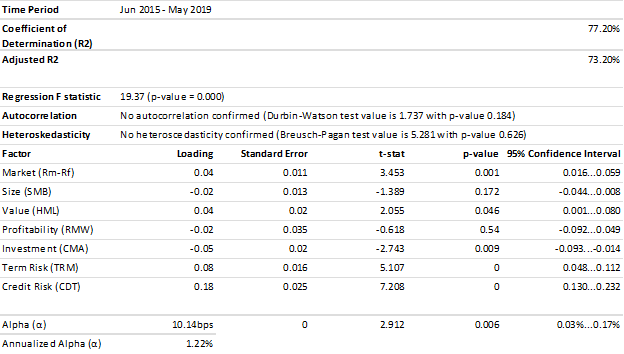

To assess whether our fixed income portfolio produces statistically significant alpha, we run a Fama-French multi-factor regression which includes term and credit.

We run this regression over the longest common period – four years. The result is a statistically significant (p-value = 0.000) model with an adjusted R2 of 73.2% and annualized alpha of 1.22%.

Do the Results Support our Thesis?

These results confirm our first mandate that our fixed income portfolio must add statistically significant alpha.

Table 1 – Regression Results

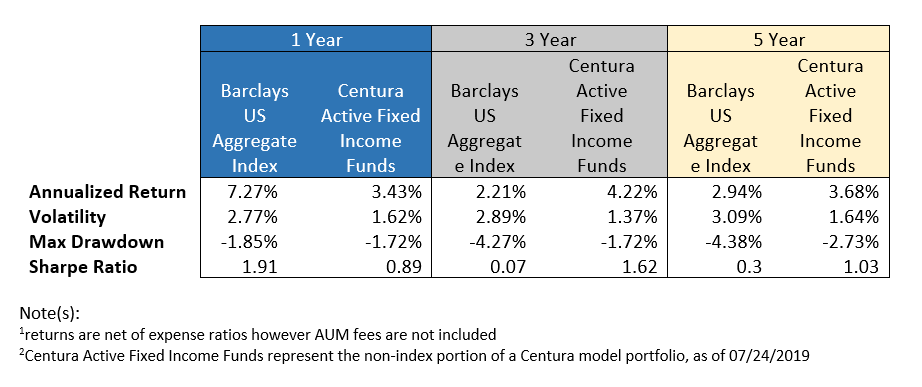

Turning to risk-adjusted returns in a portfolio backtest, we find diverging results between the actively managed funds we have selected and the index itself.

For example, in the tables below we see that the index has outperformed on a risk-adjusted, net of fees, basis over the one-year period. However, over the three and five-year periods, the actively managed funds are preferred.

These outcomes help support the notion of holding both active and passive funds together in a portfolio.

Table 2 – Risk-Adjusted Returns

Note: Returns are net of expense ratios. However, AUM fees are not included.

Test: Part 3 – Stress Testing

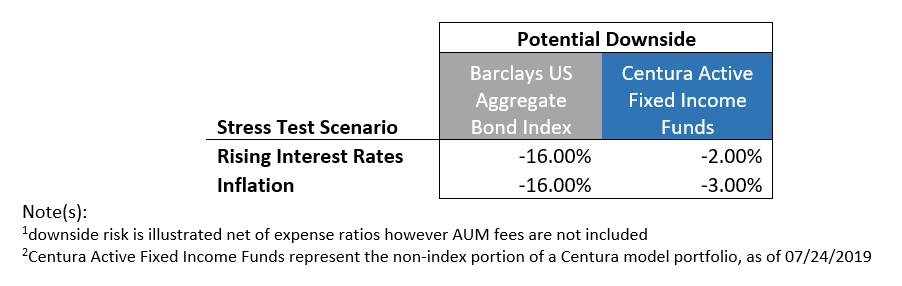

Lastly, we will evaluate our portfolio (versus the index) under simulated stress test scenarios including rising interest rates and inflation; risks paramount to fixed income markets.

We seek to understand how different types of portfolios behave under different types of “stress” conditions. The stress tests conducted include:

- Rising Interest Rates

- Inflation

Table 3 – Stress Test Results: Potential Downside

The table above displays a marked difference between the potential downside risk of unconstrained actively managed bond funds versus the index alone. Thus, we believe active management decreases portfolio risk in ways that may not be captured through returns and volatility data alone.

Consider Centura

At Centura Wealth Advisory, we believe in active fund management for specific markets at specific periods of time. We acknowledge that there are periods of relative outperformance between one strategy and the other—and we caution readers not to try and time these swings.

Rather, skillful portfolio construction and prudent risk modeling can help build a diversified, actively managed fixed-income portfolio that leverages a strong economic backdrop that favors such an approach.

Our team specializes in portfolio risk management; designing our fixed income portfolios to optimize risk-adjusted returns against the index and to mitigate key fixed income risks over time (e.g., rising interest rates and inflation). We leverage industry and academic research paired with rigorous quantitative analysis to do so.

If you have been indexing your fixed-income investments, chances are you can do better. Contact us for a portfolio evaluation and stress test to see if our fixed income solutions could improve your portfolio’s risk-adjusted returns.

Interested in learning more? Read on to learn how Centura supports goals-based investing.