Wealth management isn’t just about accumulating assets; it’s also about ensuring they are used effectively to benefit you, your loved ones, and the causes you care about. Advanced gifting strategies, such as donating appreciated assets, offer a powerful way to reduce your tax burden while making a meaningful impact.

By gifting assets like stocks, real estate, or other investments that have grown in value, you can bypass the capital gains taxes you’d owe if you sold them. This strategy also allows you to lower your taxable estate and maximize the value of your wealth transfer. Whether your goal is to support family members, fund a charity, or enhance your estate planning, understanding how to use appreciated assets as part of a gifting strategy can provide significant financial and tax benefits.

Understanding Appreciated Assets

Appreciated assets are investments that have increased in value since their purchase. Instead of selling these assets and incurring capital gains taxes, you can gift them directly to others.

Examples include:

- Stocks and Mutual Funds: These are among the most common types of appreciated assets. Transferring ownership can be done quickly and efficiently.

- Real Estate: Gifting property that has appreciated over time can significantly reduce your taxable estate.

- Collectibles and Art: Items such as antiques, rare coins, or artwork that have increased in value are also viable options for gifting.

- Business Interests: For business owners, gifting a portion of business equity can serve as a strategic method for transferring wealth while maintaining operational control.

Who benefits? Both individuals (e.g., family members) and charitable organizations can gain from these gifts.

Tax Advantages for the Giver

The primary benefit of gifting appreciated assets lies in the significant tax advantages for the giver. These include:

- Avoiding capital gains tax: By gifting an appreciated asset instead of selling it, you sidestep the capital gains tax that would otherwise be due.

- Reducing taxable estate: For high-net-worth individuals, gifting can help reduce the value of your estate, potentially lowering estate tax liabilities.

- Maximizing annual gift exclusions: Each year, you can give up to $19,000 (as of 2025) per recipient without triggering gift tax filing requirements. This amount is adjusted periodically for inflation, so it’s essential to check current IRS limits.

Tax Advantages for the Recipient

Recipients of appreciated assets also benefit, but it’s essential to understand the nuances:

- Stepped-Up Basis for Inheritances: While gifts do not receive a step-up in basis, inherited assets often do. Understanding the differences between gifting and inheritance is crucial for long-term tax planning.

- Lower Capital Gains Tax Rate: If the recipient is in a lower tax bracket, their tax liability when selling the asset may be much less than yours.

- Charitable Organizations: Nonprofits are exempt from paying capital gains taxes. This means they can sell gifted assets and use 100% of the proceeds for their mission.

Charitable Giving with Appreciated Assets

For philanthropically inclined individuals, gifting appreciated assets to charitable organizations provides a unique opportunity to maximize your impact while reducing your tax liability.

Benefits for the Donor:

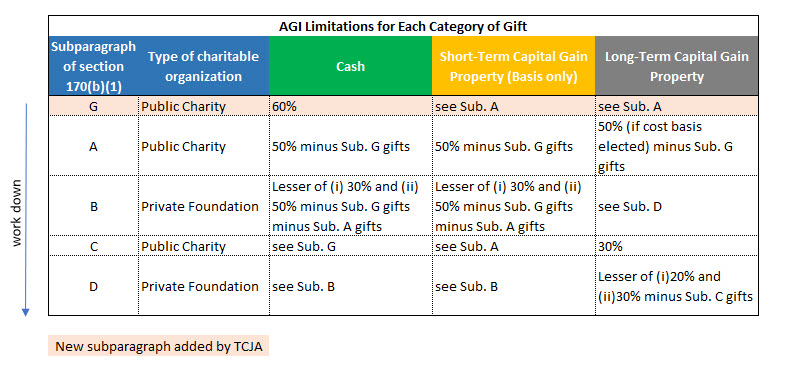

- Fair Market Value Deduction: When donating appreciated assets to a qualified nonprofit, you can deduct the fair market value of the asset from your taxable income, subject to IRS limits (typically 30% of your adjusted gross income for appreciated assets).

- No Capital Gains Tax: You avoid paying taxes on the appreciation, which increases the overall value of your donation.

Benefits for the Charity:

- Full Use of Proceeds: Charities can liquidate the asset without incurring taxes, ensuring they can use the full amount to further their mission.

Best Practices for Gifting Appreciated Assets

To maximize the benefits of gifting appreciated assets:

- Consult Financial and Tax Advisors: Ensure your gifting strategy aligns with your overall financial goals and complies with current tax laws.

- Select Appropriate Assets: Choose assets that have appreciated significantly and consider the recipient’s tax situation.

- Understand IRS Limits: Be aware of annual and lifetime gift tax exclusions to avoid unintended tax consequences.

- Maintain Proper Documentation: Keep detailed records of the gifted assets, including their fair market value and date of transfer, to substantiate tax deductions.

Common Pitfalls and How to Avoid Them

Despite its advantages, gifting appreciated assets can come with challenges. Avoid these pitfalls to ensure a smooth process:

- Overlooking Recipient Tax Implications: Recipients may be subject to capital gains taxes when they sell the asset. Discuss this aspect beforehand to prevent surprises.

- Exceeding Gift Tax Limits: Gifts exceeding the annual exclusion limit may require filing a gift tax return and could reduce your lifetime exemption.

- Neglecting to Update Your Estate Plan: Ensure your gifting strategy aligns with your overall estate and wealth management plans.

- Failing to Consult Advisors: Without professional guidance, you may inadvertently create tax complications for yourself or the recipient.

Final Notes

Gifting appreciated assets is an advanced strategy that combines financial savvy with generosity. By understanding the tax advantages, planning carefully, and seeking expert advice, you can reduce your tax burden, benefit loved ones or charitable causes, and maximize the impact of your wealth.

Whether you’re looking to support your family or make a meaningful difference in your community, appreciated assets are a powerful tool for reducing taxes while preserving your legacy.

Connect With Centura

At Centura Wealth Advisory, we go beyond a traditional multi-family office wealth management firm to offer advanced tax and estate planning solutions which traditional wealth managers often lack in expertise, knowledge, or resources to offer their clients.

We invest heavily into technology and systems to provide our clients with fully transparent reporting and tools to make informed decisions around their wealth plan.

Read on to learn more about our 5-Step Liberated Wealth Process and how Centura can help you liberate your wealth.

Disclosures

Centura Wealth does not make any representations as to the accuracy, timeliness, suitability, or completeness of any information prepared by any unaffiliated third party, whether linked to or incorporated herein. All such information is provided solely for convenience purposes and all users thereof should be guided accordingly.

We are neither your attorneys nor your accountants and no portion of this material should be interpreted by you as legal, accounting, or tax advice. We recommend that you seek the advice of a qualified attorney and accountant.For additional information about Centura, please request our disclosure brochure as set forth on Form ADV using the contact information set forth herein, or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you engage our firm for advisory services.