Charitable Giving: Breaking Down the 60% Deduction

Executive Summary

The current low interest rate environment affords savvy financial planners certain tax planning strategies that leverage charitable giving. These strategies utilize charitable contribution limits, as a percentage of Adjusted Gross Income (AGI), to plan for and mitigate taxes the current year and up to the next five following years. This article explores the new 60% deduction introduced by Tax Cuts and Job Act (TCJA)5 and highlights the following:

- Charitable giving in the United States is alive and well

- Tax Cuts and Jobs Act provides added incentive for taxpayers to give to charity: a 60% deduction

- Type of gift and recipient organization determine the AGI deductibility percentage

- Rules for determining deductibility are complex and change over time

- Only cash gifts to public charities qualify for new 60% deduction

- 50% limit will still apply on cash gifts to private foundations and gifts including non-cash items

Introduction

Charitable contributions allow taxpayers to deduct gifts of money or property made during the taxable year to nonprofit organizations1. It is generally accepted that these organizations improve society and are afforded the ability to avoid taxation as a result. This avoidance of taxation serves as an incentive mechanism to shift public good to the private sector by encouraging private giving and if done correctly, can help reduce the incentive for politicians to raise taxes in the name of public good.

As such, charitable giving is an integral part of tax and estate planning in the United States. Consider the following statistics from 20172:

- Americans gave $410.02 billion in 2017 (5.2% increase from 2016)

- 70% of total giving came from individuals, 16% from foundations, 9% bequests and 5% from corporations

- Charitable giving accounted for 2.1% of gross domestic product in 2017

- High net worth donors gave on average $29,269 to charity vs $2,514 for the general population

Based on these numbers, charitable giving is alive and well, with high net worth individuals leading the charge. However, many rules affecting tax incentives have changed with introduction of the TCJA including one notable change to charitable giving thresholds; a 60% AGI limitation.

Charitable Giving Thresholds: Spirit & Letter of the Law

Charitable contribution deductions are outlined under Section 170 of the Internal Revenue Code (IRC) and IRC Section 170 has been through countless changes since being enacted in 19173. The spirit of the law has been to allow “wealthy” taxpayers to receive a deduction for charitable giving, but the letter of the law has evolved into a complex set of rules. These rules are designed to maintain an equitable statutory scheme that encourages charitable giving but prevents tax abuse and are therefore purposefully complex3.

Charitable Giving Thresholds: Tax Cut & Jobs Act 2017

When taxpayers make charitable donations, they may utilize those donations as deductions against AGI, to reduce taxable income6. The caveat being that the amount of charitable deduction which could be recognized in any one year was limited to a certain percentage of AGI (e.g., 20%, 30%, 50%) based on the type(s) of assets contributed and the type of organization receiving the benefit. The top AGI percentage limitation was 50% until in 2017, the TCJA introduced a new figure, 60%. But what does it mean and when is it applicable?

Types of Gifts4

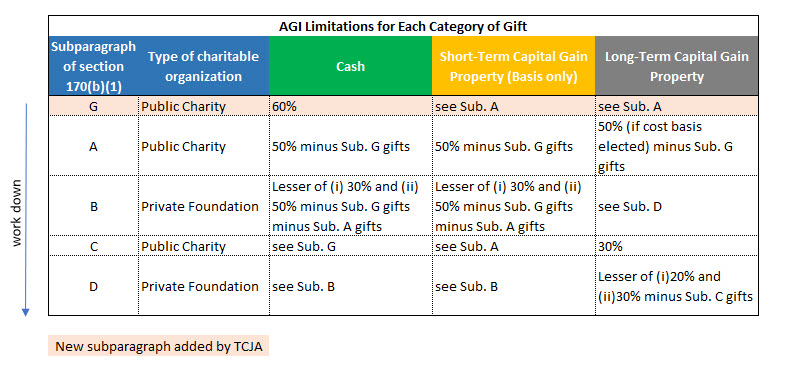

To understand when the 60% limit is applicable, it is necessary to understand how the IRC classifies gifts as not all gifts are created equal. Per section 170(b)(1) of the IRC, there are 5 distinct types:

- Subparagraph G Gifts

- Subparagraph A Gifts

- Subparagraph B Gifts

- Subparagraph C Gifts

- Subparagraph D Gifts

Subparagraph G Gifts

This is where the calculation now begins, and this is the newest section added by the TCJA. Under a new temporary rule enacted under the TCJA, for tax years after 2018-2025, an individual donor may deduct up to 60% of the donor’s contribution base for gifts of cash (and only cash) to a public charity. To qualify, these gifts must be “to” the public charity, not “for the use of”.

Subparagraph A Gifts

These include all gifts “to” (not “for the use of”) a public charity and taxpayers may deduct up to 50% of contribution base, reduced by amount of any subparagraph G deduction allowed, for subparagraph A gifts.

Subparagraph B Gifts

Gifts of cash or short-term capital gain property to a private foundation, and for gifts that are “for the use of” rather than “to” a public charity. Taxpayers may deduct up to the lesser of:

- 30% of contribution base – or –

- Excess of 50% (not 60%) of the donor’s contribution base for the year reduced by the combined amount of subparagraph G gifts and subparagraph A gifts.

Subparagraph C Gifts

This subparagraph operates as a limitation on deductibility of subparagraph A gifts involving long-term capital gain property and sets forth that except for gifts of conservation easements, an individual may deduct up to 30% of contribution base for gifts of long-term capital gain property to a public charity.

Subparagraph D Gifts

Include gifts of long-term capital gain property to a private foundation of which taxpayers may deduct the lesser of:

- 20% of contribution base – and –

- Excess of 30% of contribution base for the year over the amount of subparagraph C gifts

For all types of gifts, excess contributions can be carried forward for up to 5 tax years but may only be used within the same category (i.e., AGI % limitation) in those future years.

Exhibit 1 shows the AGI limitations as percentages of contribution base for each category of gift.

Exhibit 1- AGI Limitations4

The primary takeaway is that the new 60% limitation is only applicable on cash contributions to public charities; period. This means that the 60% limit will be reduced to 50% on cash donations when the taxpayer also donates any non-cash property to any type of charity, whether public or private, or when the taxpayer donates cash to a private foundation.

Conclusion

A donor must rely solely on cash gifts to public charities in order to reach the higher 60% limitation afforded by subparagraph G. While the new 60% limitation may grab headlines, it is limited in its applicability and caution must be paid for donors looking to utilize the 60% limitation in their planning. For example, charitable contribution deductions from prior years, as well as other forms of giving (e.g., household goods, clothing, stocks, bonds, etc.) could void qualification for the 60% limit on cash donations to public charities and reduce it to 50% instead. These rules and limitations are incredibly complex, and ever changing, which means that working with knowledgeable tax professionals is of paramount importance.

At Centura Wealth Advisory, we utilize charitable giving strategies in tax and estate planning, which requires us to be up to date on current tax law and on the cutting edge of tax planning innovation. As a result, we work with select tax, legal and financial planning professionals who keep us armed with intricate knowledge of strategies, related sections of IRC code and applicable case law. In addition, these professionals allow us to seamlessly implement, manage, and if necessary, defend such strategies. We believe that this coordinated approach to advanced tax planning is what sets us apart.

Finally, today’s low interest rate environment affords many charitable planning opportunities that many advisors and donors have never even considered. If you are interested in utilizing charitable contributions to mitigate income taxes for you or your clients, contact us today for a tax planning evaluation.

References

- Internal Revenue Code 170(a)

- National Philanthropic Trust – Charitable Giving Statistics

- Marquette University Law School – The Charitable Contribution Deduction: A Historical Review and a Look to the Future

- Bedingfield, Brad & Dempze, Nancy – The disappearing 60% deduction: new charitable giving limits are not as generous as they appear

- Congress.gov – Tax Cut & Jobs Act

- Section 7520 interest rate

Disclosures

Centura Wealth Advisory (“Centura”) is an SEC registered investment adviser located in San Diego, California. This brochure is limited to the dissemination of general information pertaining to Centura’s investment advisory services. Investing involves risk, including risk of loss.

Centura Wealth does not make any representations as to the accuracy, timeliness, suitability or completeness of any information prepared by any unaffiliated third party, whether linked to or incorporated herein. All such information is provided solely for convenience purposes and all users thereof should be guided accordingly.

We are neither your attorneys nor your accountants and no portion of this material should be interpreted by you as legal, accounting or tax advice. We recommend that you seek the advice of a qualified attorney and accountant.

For additional information about Centura, please request our disclosure brochure as set forth on Form ADV using the contact information set forth herein, or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you engage our firm for advisory services.