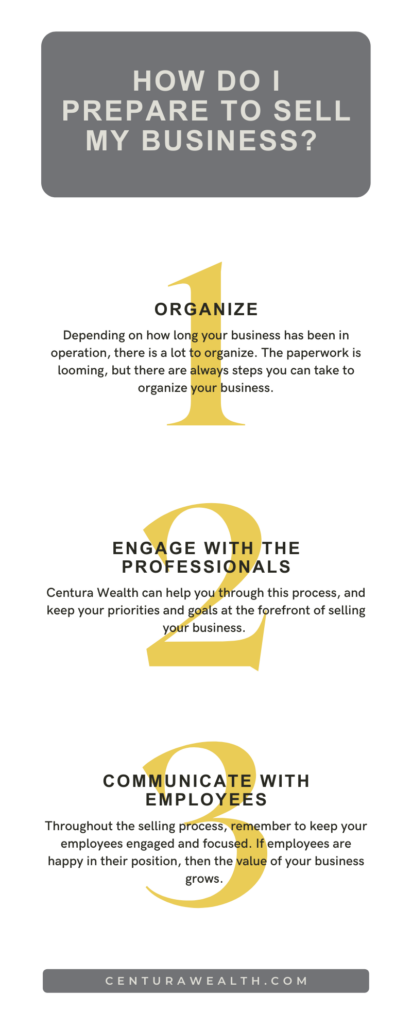

How Do I Prepare to Sell My Business?

So… you want to sell your business. You’re not alone in the crazy market right now.

While there are many risks to owning a business, there are many reasons why you might be considering selling. Whether you are retiring, moving, or seeking new opportunities, here are some steps you can take to make this process as easy as possible.

Organize

Depending on how long your business has been in operation, there is a lot to organize. The paperwork is looming, but there are always steps you can take to organize. In general, financial planning is always a great goal to have as a business owner.

Some documents to gather and organize include:

- Tax returns

- Three years worth of profit and loss (P&L) statements and balance sheets

- Copy of current lease

- An updated list of everything that will be sold from business

- Contact and clients list

- Sales transactions

- A summary of monthly sales

After organizing these financial documents, the next step is to review them with your accountant.

Engage with the Professionals

Centura Wealth can help you through this process, and keep your priorities and goals at the forefront of selling your business. Mark Morris speaks to the importance of On the “Live Life Liberated” podcast by the Centura Wealth team. The podcast follows the one idea of minimizing your taxes — through the ING trust. Mark Morris highlights the following subjects for anyone looking to sell their business:

- The major hurdles that the ING strategy helps you overcome

- What the new California legislative proposal entails — and its implications, if it’s successfully passed

- Why Mark strongly recommends that the sale of the business happens this year for optimal results, but options if it doesn’t

- How to take advantage of the ING trust even if you don’t yet have a buyer for your business

Click here to learn more about the ING trust from a professional’s point of view!

Benefits

Besides making sure your business looks the best it can, there are various strategies you can follow to make smart decisions, including defined Benefit Plans (DB) and Defined Contribution Plans (DC).

Defined Benefit Plan

A Defined Benefit Plan (DB) is an “employer-sponsored retirement plan where employee benefits are computed using a formula that considers several factors,” according to Investopedia. These factors can include the length of employment and salary history.

With a DB plan, the general rule of thumb is that an employee cannot take out funds from their 401(k) plan.

Defined Contribution Plans

A Defined Contribution Plan (DC) on the other hand is, “a retirement plan that is typically tax-deferred like a 401(k) or a 403(b), in which employees contribute a fixed amount or a percentage of their paychecks to an account that is intended to fund their retirements,” according to Investopedia.

With a DC plan, participation by employees is voluntary.

Find a Trustworthy Buyer

Finding a buyer can be a lengthy process, but it’s worth waiting for the right fit for multiple reasons. Here are a couple of tips to be aware of when looking for a buyer:

- Have multiple options as deals fall through all the time

- Allow cushion room for negotiation

- Keep your values top of mind—does this buyer follow them?

- Keep potential buyers updated to help build trusty relationships

- It never hurts to network

Communicate with Employees

Throughout the selling process, remember to keep your employees engaged and focused. If employees are happy in their positions, the value of your business grows.

Consider their perspective as an employee throughout the selling process. Telling them too early could cause confusion. Telling them too late can be offensive to the work they are doing. Timing is everything.

One of the key elements of liberating your wealth is planning in a way that unpacks your family’s values and dreams, following an overall purpose. This is a great perspective to have going forward after having a conversation with your parents.

For those who are interested in liberating their own wealth, please contact us at Centura Wealth Advisory today to see how we might partner!

Our process does not discriminate between uniqueness versus common and therefore is well-adjusted to serve our audience. Just as important is our passion for finding and solving complex problems.

Centura Wealth does not make any representations as to the accuracy, timeliness, suitability or completeness of any information prepared by any unaffiliated third party, whether linked to or incorporated herein. All such information is provided solely for convenience purposes and all users thereof should be guided accordingly.

We are neither your attorneys nor your accountants and no portion of this material should be interpreted by you as legal, accounting, or tax advice. We recommend that you seek the advice of a qualified attorney and accountant.

For additional information about Centura, please request our disclosure brochure as set forth on Form ADV using the contact information set forth herein, or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you engage our firm for advisory services.