Market Month in Review – October 2024

At a Glance

Inflation & Labor Data: With inflation data continuing to decline, illustrated by the latest headline and core PCE data of 2.1% and 2.7%, respectively, the focus has turned to the labor market. September’s labor report included noise related to Hurricanes Helene and Milton and the Boeing strike, making it difficult to assess the latest reading of labor market health. The unemployment rate remains at 4.1%.

U.S. Election: Donald Trump was elected the 47th President, and markets are likely to experience short-term volatility as they adjust to the results and the subsequent implications for broader markets.

Fed & Monetary Policy: The Fed cut interest rates by 50-bps in September, with an additional 50-bps of cuts forecasted by Fed officials through the end of 2024. Monetary policy decisions continue to be data dependent, meaning markets have become more data dependent, creating volatility ahead of future Federal Open Market Committee (FOMC) meetings, including the next one on November 6.

Equity Markets: As of month-end, the S&P 500 is experiencing the best first 10 months of an election year since 1936. Additionally, the third quarter earnings season is off to a solid start, with positive, albeit slowing, quarter-over-quarter earnings growth.

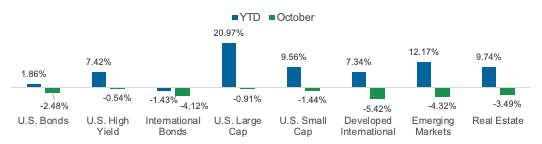

Asset Class Performance

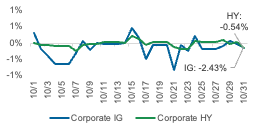

International markets fared the worst in October, with bonds, developed international equities, and emerging market equities all down over 4%. U.S. large cap equities were slightly down for the month and experienced volatility ahead of the November U.S. election but remain up 20% on a year-to-date basis. High yield bonds performed better than investment grade bonds in the U.S.

Source: YCharts. Asset class performance is presented using total returns for an index proxy that best represents the respective broad asset class. U.S. Bonds (Bloomberg U.S. Aggregate Bond TR), U.S. High Yield (Bloomberg U.S. Corporate High Yield TR), International Bonds (Bloomberg Global Aggregate ex-USD TR), U.S. Large Cap (S&P 500 TR), U.S. Small Cap (Russell 2000 TR), Developed International (MSCI EAFE TR), Emerging Markets (MSCI EM TR), and Real Estate (Dow Jones U.S. Real Estate TR).

Markets & Macroeconomics

3Q Earnings Season – Slower but Solid Growth

U.S. equity markets continue to surprise investors in 2024 with their solid performance. Even amidst the volatility and uncertainty in the lead-up to the U.S. Election throughout October, major equity indices, like the S&P 500 and Nasdaq-100, continued their run-up and reached all-time highs over the month, with both indices up 20% year-to-date through October 31. In fact, the S&P 500 experienced the best first 10 months of an election year since 1936, and this trend may continue depending on the election outcome.

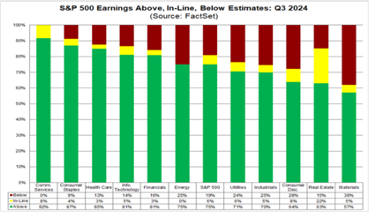

Looking at third quarter (Q3) earnings data, 70% of companies in the S&P 500 have reported earnings as of month-end, with eight out of the eleven sectors reporting year-over-year growth. A lot of this has to do with the larger macroeconomic picture, where the U.S. is seeing a resilient consumer and a strong labor market, both of which have contributed to solid corporate profits. Additionally, the percentage of companies in the S&P 500 reporting earnings above consensus estimates is the predominant trend across most sectors, depicted by the green bars in Exhibit 1 below.

Exhibit 1: Earnings Scorecard

The S&P 500 is currently reporting 5.1% earnings growth as of month-end, and, if this trend continues through the end of earnings season, it will mark the fifth-straight quarter of earnings growth. The magnitude of growth, however, illustrates a slowing trend, compared to the 10.9% and 11.3% growth seen in Q1 and Q2 of this year, respectively. This slowdown in Q3 is largely being driven by the energy sector.

Source: FactSet. Data as of 11/01/24

With the slower growth trend in Q3 earnings, investors may be wondering why equity markets continue to reach new highs, and, while earnings are generally supportive of current market valuations, the S&P 500 remains relatively rich in today’s environment, placing even greater focus on future company earnings growth potential.

Prudent investors understand that markets don’t go up forever, nor do company earnings, and while we have witnessed solid performance in the ongoing Q3 earnings season, as well as in 2024 as a whole, it does not mean this trend will continue in perpetuity. The U.S. will have to contend with falling interest rates, a new political regime, and potential policy changes, all of which could have trickle-down effects on corporate earnings, making this and future earnings seasons ever-important to watch.

The Bottom Line: Thus far, third quarter earnings have been relatively solid, surprising investors to the upside, illustrated by above-estimate earnings growth, and while we are starting to see this growth moderate from recent quarterly trends, corporate profits remain on solid footing amidst an uncertain macro and fiscal backdrop.

Looking Ahead

U.S. Election, Fiscal Policy & Muni Markets

The 2024 U.S. Presidential election has shaped up to be one for the history books, with major policy decisions surrounding international trade, health care, and, perhaps most importantly, taxes, on the docket. The uncertainty surrounding these potential policy changes may concern some investors, but it is important to keep in mind that policy implementation takes time and is not a foregone conclusion given how close races across Congress have been.

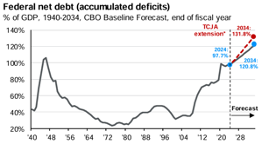

One of the most important policy decisions that will have to be addressed is the Tax Cuts and Jobs Act (TCJA), which is scheduled to sunset at the end of 2025, unless the newly elected President moves to extend it. Choosing to extend all, or part, of the TCJA could impact corporate tax rates, individual income tax rates, alternative minimum tax (AMT) exemptions, to name a few, and most importantly, any extension is expected to increase the federal deficit. The Congressional Budget Office (CBO) estimates that, if extended, the TCJA could cause federal net debt-to-GDP to increase to nearly 132% by 2034, as illustrated in Exhibit 2, from the current level of approximately 98%.

Exhibit 2

Source: J.P. Morgan Asset Management. Data as of 10/31/24

These potential tax changes offer investors the opportunity to assess their tax ramifications and diversify their fixed income exposure, particularly in the tax-exempt, or municipal, bond market. Municipal bonds are issued to fund local projects and agencies, including initiatives related to schools, parks, airports, and toll roads. The interest on municipal bonds is typically exempt from federal, often state, and even local taxes, making them attractive for higher-taxed individuals and entities. Unlike the federal government, municipal governments are not facing the same level of fiscal challenges as they are required to have a balanced budget, making them a potentially important diversifier as the federal deficit expands.

It does not appear either party in the U.S. is equipped to deal with the rising federal deficit, and, while worrisome, investors should focus on what they can control: managing risk and exposure of their investments. Diversifying exposure by looking to other areas of fixed income, like municipal bonds, can help provide greater stability and manage risk related to fiscal and tax policy decisions on the horizon.

Remember, policy changes take time and require collective government action, and, while investors wait for any changes to occur, they can enjoy elevated tax equivalent yields across the municipal curve and a strong outlook for fixed income amidst the falling interest rate and fiscally challenged environment.

The Bottom Line: With voting for the U.S. Election closed and markets digesting the results, the focus will begin to turn to fiscal policy, particularly as it relates to tax policy and the 2017 Tax Cuts and Jobs Act. Given continued rising fiscal deficits, the timing may be appropriate for investors to consider diversifying exposure across the entire fixed income spectrum, including in municipal securities, which are currently offering higher income advantages relative to historical averages, and, in many cases, traditional fixed income on a tax-adjusted basis.

Capital Markets Themes

What Worked, What Didn’t

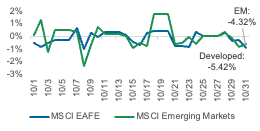

•International Markets Had Tougher October: International markets, including both developed international and emerging markets equities, performed the worst for the month of October, down over 5% and 4%, respectively.

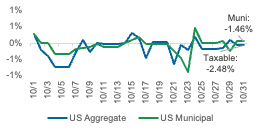

•Municipal Bonds Outperform Taxable: Municipal bonds underperformed in October but outpaced taxable bonds by 100 bps, with high yield municipals delivering the strongest performance and highest yield advantages.

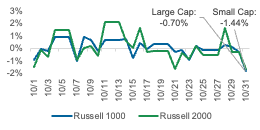

Large vs Small Cap Equity

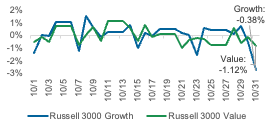

Growth vs Value Equity

Developed vs Emerging Equity

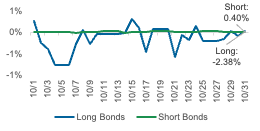

Short vs Long Duration Bonds

Taxable vs Municipal Bonds

Investment Grade vs High Yield Bonds

Source: YCharts. Data call-out figures represent total monthly returns

On Alternatives

Supply/Demand Dynamics in Multifamily Real Estate

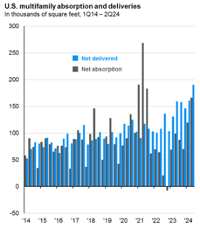

The multifamily real estate market is currently experiencing a historic wave of new supply in 2024, with over 671,000 units projected to be completed this year according to RealPage, the highest level since 1974. This supply/demand dynamic is illustrated in Exhibit 3, where deliveries in the multifamily sector have outpaced absorption since 2022 when the Fed started raising interest rates. While this current surge in supply is meaningful, it is likely to be temporary, as the increased cost of financing due to higher interest rates have halted new construction projects. Experts project multifamily supply will start to dry up after 2025, causing the supply/demand dynamic to shift once again.

Exhibit 3

Source: J.P. Morgan Asset Management. Data as of 9/30/24

The current oversupply within multifamily severely hampers rent growth, which benefits tenants, but restricts the property’s ability to drive revenue growth. Coupled with higher interest rates, operating expense growth has outpaced rent growth, a trend that is expected to continue until supply dwindles in 2026.

While the multifamily sector is trying to absorb the excess supply hitting the market, demand remains somewhat strong, due in large part by the lack of home affordability across the nation. Along with high interest rates, mortgage rates have also been historically high, with the 30-year mortgage rate around 6.7%, causing home affordability to reach a 10-year low, both illustrated in Exhibit 4. In fact, the median price of a home in the U.S. is currently around $420,000, a 32% increase over the past 5 years.

While the home affordability metrics are grim, they create a significant tailwind for multifamily housing as the double-whammy of high mortgage rates and low home affordability have priced many tenants out of single-family homes, pushing them into multifamily housing instead.

It may be a bumpy ride along the way as supply/demand dynamics shift back into favor, but beyond 2025, we expect properties to perform well and rent growth to pick back up in the multifamily sector, particularly as the Fed continues to cut interest rates.

Exhibit 4: Home Affordability vs. Mortgage Rate

Source: YCharts. Data as of 10/31/24

The Bottom Line: The multifamily real estate sector is currently experiencing a surge of new supply, hampering rent growth amid rising expenses due to high interest rates, labor costs, and insurance. Demand remains robust as home affordability in the U.S. has reached a 10-year low. These supply and demand dynamics are expected to shift after 2025 when the influx of new supply falls off a cliff.

Asset Class Performance Quilt

Markets are ever-changing, making diversification across asset classes and sectors a critical component to portfolio construction. As illustrated below, a Balanced 60/40 portfolio provides greater consistency of returns and less volatility over time.

Source: YCharts. Asset class performance is presented using market returns from an exchange-traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by Centura Wealth Advisory. The performance of those funds may be substantially different than the performance of broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High Yield Bonds (iShares iBoxx $ High Yield Corp Bond ETF); Intl Bonds (Invesco International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares Core MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares US Real Estate ETF). The return displayed as “60/40 Allocation” is a weighted average of the ETF proxies shown as represented by: 40% U.S. Bonds, 12% International Stock, and 48% Large Blend.

Disclosure: CCG Wealth Management LLC (“Centura Wealth Advisory”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Centura and its representatives are properly licensed or exempt from licensure. Insurance products are implemented through CCG Insurance Services, LLC (“Centura Insurance Solutions”). Centura Wealth Advisory and Centura Insurance Solutions are affiliated. For current Centura Wealth Advisory information, please visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Centura Wealth Advisory’s CRD #296985.