Meet Centura: Not Your Traditional Wealth Advisors

Who We Are

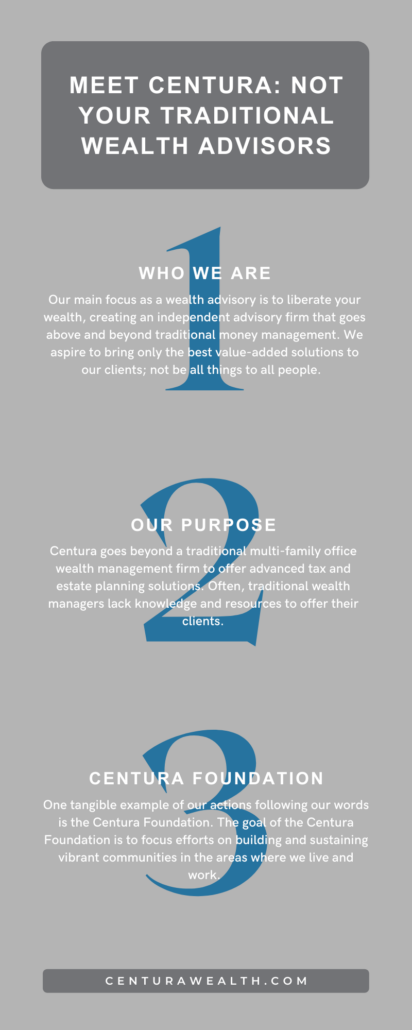

Centura Wealth Advisory deviates from the traditional standards of everyday wealth advisories. Our main focus as a wealth advisor is to liberate your wealth, creating an independent advisory firm that goes above and beyond traditional money management. We aspire to bring only the best value-added solutions to our clients; not be all things to all people.

As financial advisors, we want to help our clients Liberate their Wealth and shape a future.

Our Purpose

Centura goes beyond a traditional multi-family office wealth management firm to offer advanced tax and estate planning solutions. Often, traditional wealth managers lack the knowledge and resources to offer their clients the best financial planning.

“We believe everyone has a purpose in life, and ours is to help wealthy individuals and families achieve their purpose through a proactive and comprehensive wealth management process called Liberated Wealth®.”

The Centura Foundation

One tangible example of our actions following our words is the Centura Foundation. The goal of the Centura Foundation is to focus efforts on building and sustaining vibrant communities in the areas where we live and work.

The Centura Foundation was established to harness the charitable nature of our founders and clients for the purpose of directing resources to underfunded established organizations. Built on the concept of Think Global, Act Local, we are dedicated to focusing on community-building activities that address key social issues that create a healthy and vibrant community.

At Centura Wealth, we strive to be the best in our chosen lines of business, not the biggest. Learn more about what liberated wealth means for you today.