Q2 2024 Market Wrap: Dependency Issues

After rising more than 10% in the first quarter of 2024, the S&P 500 stumbled out of the gate in the second quarter. The index contracted more than 4% in April and produced the first negative month of the year as the market reassessed the timing of the Fed’s first rate cut. While the Fed’s higher for longer mantra has not changed, they are stressing their dependence on data, which has proven mixed. The market, on the other hand, has become Fed-dependent, placing great emphasis on each major economic reading, primarily inflation, labor, and economic production. With hopes that the Fed will initiate rate cuts sooner, the market applauds lower inflation and negative growth signals, like a slowing economy or consumer spending. Conversely, traditionally well-received data points, such as a robust and resilient labor market, can trigger market selloffs. This counterintuitive reaction occurs because positive economic news suggests that the Federal Reserve might delay its first rate reduction, extending the timeline for monetary easing.

Following two positive reports that inflation is trending lower, the S&P 500 witnessed solid rebounds of 4.80% and 3.47% in May and June, respectively, driven primarily by gains in Big Tech stocks. With hopes of an early rate cut, the equity markets continued to fuel the Nvidia-led AI frenzy. The sustained AI rally is heavily influenced by expectations surrounding the timing of monetary policy adjustments.

In line with the April selloff in equities, bonds saw the yield on the 10-year US Treasury whipsaw 0.37% higher, from 4.33% to 4.70%, before peaking on April 25. Like their equity counterparts, longer-dated bonds have become too reliant on the path of monetary policy, with return expectations tied to the timing of the Fed’s first cut. As the Fed provides clarity on their path forward, yield volatility should ultimately subside, leading to more stable outcomes. Until then, we expect continued bond volatility.

Market Recap

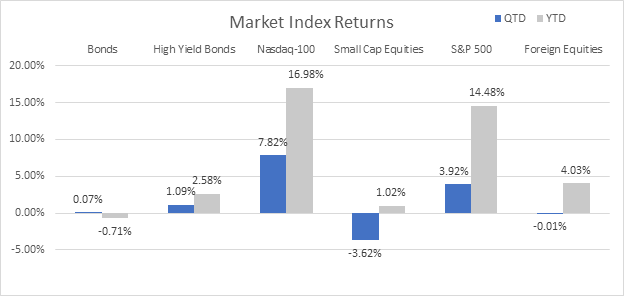

Equities – Unlike the ‘everything rally’ that closed out 2023, where small caps and technology stocks – both sensitive to elevated interest rates – were the largest benefactors, 2024 has witnessed further decoupling amongst asset classes. Any projected rate cut speculation has tended to support higher returns by the Magnificent Seven and technology stocks, though small caps have lagged behind. Small caps, measured by the Russell 2000, produced only about half the return of their large cap counterparts in the first quarter. The second quarter witnessed smaller companies contract -3.62%, bringing the year-to-date gains to a paltry 1.02%. Meanwhile, the S&P 500’s price advances for the second quarter was 3.92%, bringing the index’s return for the year to 14.48%.

Bonds – As yields reversed course, bonds kicked off the quarter in the red, adding to their multi-year downward trend. With stronger-than-expected economic data and Fed uncertainty, the market repriced Fed expectations, and the yield on the 10-year U.S. Treasury rose sharply. As inflation readings and consumer spending data continued trending lower, the market again reassessed their rate cut projections, sending the 10-year U.S. Treasury yield back to 4.2% and bringing the bond index back into positive territory for 2024. The Fed’s messaging that it needs to witness several months of sustained data before feeling comfortable lowering rates prompted another yield reversal upward with the 10-Year U.S. Treasury closing the quarter at 4.36%. While the market has appeared to reprice monetary policy changes, robust U.S. debt issuance and the demand for U.S. Treasury securities remains relatively weak, failing to absorb supply and applying additional upward pressure on yields. The Bloomberg U.S. Aggregate Bond Index rose by a modest 0.7% in the quarter, while it declined -0.71% for the year.

Source: YCharts. The Bloomberg US Aggregate Index was used as a proxy for Bonds; the Bloomberg US High Yield 2% Issuer Capped Index was used as a proxy for High Yield Bonds; the Russell 2000 Index was used as a proxy for Small Cap Equities; and the MSCI ACWI Ex USA Index was used as a proxy for Foreign Equities. All returns are based on price returns as of 06/30/2024.

Though economic data remains mixed, base case expectations still call for the Fed to successfully achieve a ‘soft landing’ and avoid recession. However, many growth metrics continue to moderate, leading many to question the Fed’s decision to keep rates elevated for longer.

Economy: The Consumer continues to slow

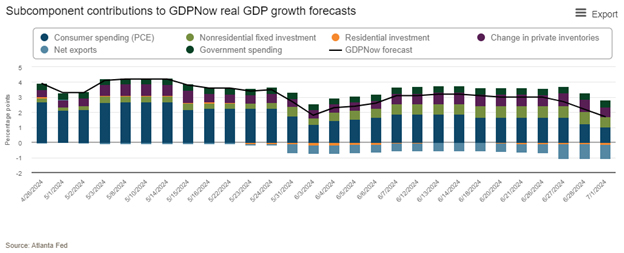

After growing approximately 2.5% in 2023, the U.S. economy continues growing at a moderate pace. Driven primarily by softening consumer spending, the first quarter of 2024 GDP grew 1.4%. Reflecting an uptick over the first quarter, as of July 2, 2024, the Atlanta ‘Fed’s GDPNow model for Q2 has been revised from 2.2% to 1.7%. This revision is primarily due to lower projections for consumer spending and net exports, which have contracted from the initial growth forecast.

Source: Atlanta Fed GDPNow

The combination of unwavering spending in the face of rising prices and a robust labor market has underpinned the strong economic growth of recent years. However, with the $2 trillion of pandemic savings now exhausted as of March, household debt has reached record levels, and delinquencies are beginning to mount, threatening the sustainability of the nation’s growth. Despite elevated borrowing costs, the consumer continues to spend, albeit at a slower pace, thanks in large part to a strong labor market, producing wage increases that have outpaced inflation for more than a year. While the market is hoping for the labor market to soften and result in an earlier Fed rate cut, too much labor market deterioration could result in further spending reductions, ultimately leaving little room for the Fed to thread the needle and both produce a ‘soft landing’ and avoid a recession.

Unemployment

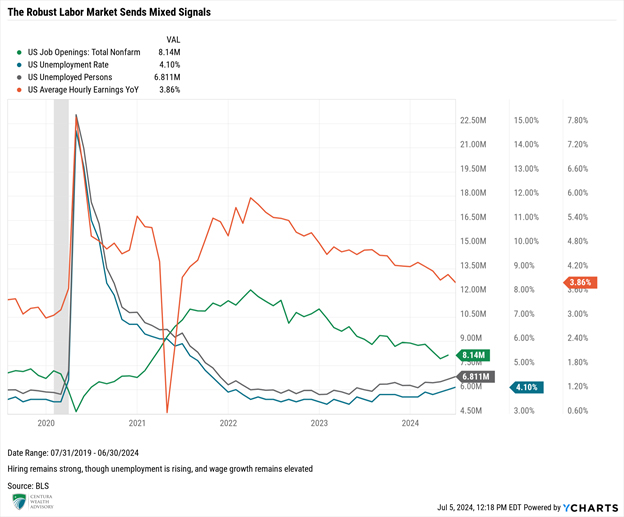

June’s Labor Market Report registered the 42nd consecutive month of job gains. Estimates called for 200,000 jobs in May, and the market once again surprised to the upside with the addition of 206,000 jobs. On the other hand, the unemployment rate edged up slightly to 4.1%, the highest level since October 2021.

The labor market continues to post robust results. While trending lower since peaking in 2022, job openings (JOLTs) surprisingly broke its three-month trend of fewer job openings in May. They reversed back above eight million (8.14 million), bringing the ratio of job openings to those unemployed to down to 1.22:1. While the ratio of 1.22:1 is still elevated above levels historically witnessed, the ratio has fallen significantly from nearly two job openings for every job posting in 2022, indicating slack is working itself out of the system and the labor market is showing signs of tightening. The number of open jobs has fallen, while the number of unemployed job seekers has trended higher, as evidenced by the additional 687,000 unemployed persons from January to May.

For now, the strength and resiliency of the labor market have given the Fed the confidence to keep rates higher for longer. However, the data point that is giving the Fed continued anxiety is wage growth. Despite falling below the key level of 4% in April for the first time since 2021, wage growth has exhibited stickiness and has been hovering around the 4% threshold, rising 4.1% and 3.9% year-over-year in May and June, respectively. While wage growth outpacing inflation bodes well for continued consumer spending, prolonged, elevated wage growth raises concerns about a potential resurgence in inflation. Several readings below the 4% threshold would certainly be welcomed by the Fed.

Inflation

On the surface, all major inflation readings have fallen below 4%, with both PCE readings coming in at 2.6% in May. Core services increased by 0.2% in May, lifted by higher housing, utilities, and healthcare, and financial services, while insurance costs declined by 0.3% after five consecutive months of growth. Housing, financial services, and insurance costs were among the major drivers supporting elevated services costs, so witnessing a reversal in two of the three variables presents a positive affirmation that inflation is indeed heading lower.

Just as elevated wage growth is troublesome to the Fed, the stickiness of core services, particularly housing, fortifies the decision to exercise patience before cutting rates. Federal Reserve Chair Jerome Powell stated “we want to be more confident that inflation is moving down towards 2%” before lowering rates.

More Evidence Needed

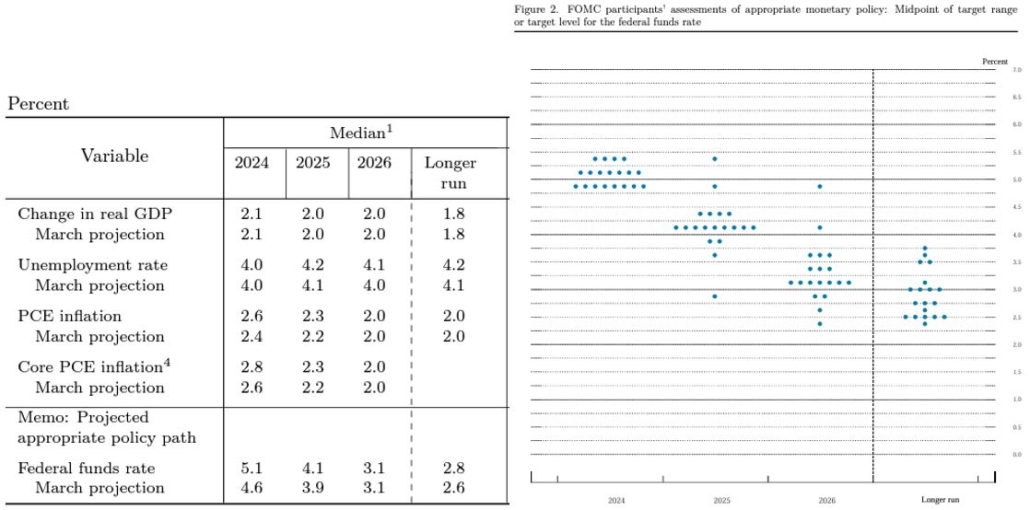

The Federal Open Market Committee (FOMC) elected to keep rates unchanged in June for the seventh consecutive meeting. While the Fed’s decision was largely expected, the big news was centered around the Fed’s changes to their Summary of Economic Projections, particularly their median projection for rate cuts, where policymakers adjusted their expectations from three rate cuts in 2024 to only one 0.25% rate cut. The Committee also raised its projection for 2025 as well, indicating a slower pace of change as the Fed adopts a more patient data-dependent position. The number of Fed officials who projected no cuts in 2024 doubled from two to four, and not one official anticipated cutting rates more than twice. We also saw the Fed lift economic projections for 2024 increasing their 2024 inflation expectations and revising their 2025 rate normalization path.

Powell acknowledged that inflation has begun trending lower, yet expressed concerns that cutting rates too early may jeopardize the progress made towards reducing inflation. Interestingly, the Core PCE print in May was 2.6%, which is higher than the Fed’s year-end projection for Core Inflation. This indicates that the Fed anticipates a slight increase in prices from this point, which would likely be accompanied by ensuing market volatility.

Source: US Federal Reserve Summary of Economic Projections, June 2024

Barring any resurgence of inflation, we believe the Fed has finished its rate-hiking regime and is nearing its first rate cut. Our base case assumptions have not changed given the Fed’s steadfast commitment to bringing inflation down. We continue to believe the earliest the Fed will cut rates is September, which now aligns with current market expectations. However, any prolonged stickiness or resurgence of inflation would likely push our expectations for rate cuts into the fourth quarter this year.

Centura’s Outlook

The Fed’s goal to lower inflation to its 2% mandate and avoid recession is now the base outcome expected by the Fed and most market participants. However, given the slowdown in consumer spending, the Fed will need to monitor the state of the labor market deterioration closely if they are to fully avoid an economic contraction. Successfully delivering lower inflation and monetary policy normalization should bode well for equities and bonds. However, there are several potential risks looming and investors should proceed carefully.

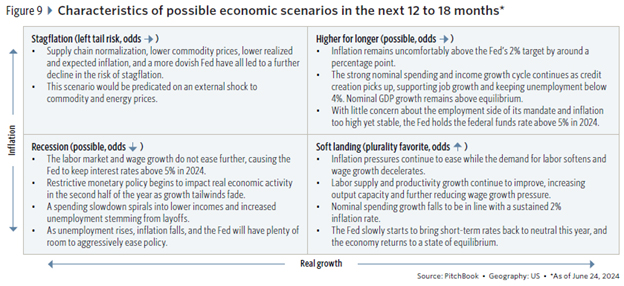

In the chart below, Pitchbook outlines four likely paths forward: scenarios of stagflation, higher for longer, recession, or a soft landing. While any of the four scenarios could occur and the risk of recession has fallen, this risk remains above average due to the restrictive level of interest rates. Ultimately, our expectations fall into the lower right-hand corner: the soft-landing camp. We believe inflationary pressures will continue to ease while labor demand and wage growth will soften, resulting in the Fed slowly beginning to bring short-term rates down.

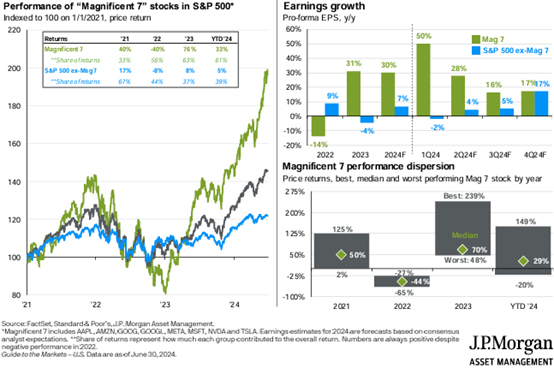

In the face of higher borrowing costs, corporate profits have remained surprisingly resilient, illustrated by the S&P 500 posting positive earnings growth for the third consecutive quarter in the first quarter of 2024, rising 5.9%. As of June 21, FactSet estimates second-quarter earnings to accelerate and grow at 8.8% year-over-year. Last year, the Magnificent Seven were responsible for most of the market’s earnings growth, increasing 31%, versus the -4% contraction of the remaining 493 companies’ earnings in the S&P 500. While this trend is expected to hold in 2024, with gains of 30% and 7%, respectively, we are encouraged that JPMorgan is expecting the remaining companies outside the Magnificent Seven to catch up and accelerate earnings over the remainder of the year. Both groups are expected to experience year-over-year earnings growth of 17% in the fourth quarter. A broadening of earnings growth should bode well for increased market breadth and carve a path for higher broad-based returns on equities.

Source: JPMorgan Guide to the Markets

The market remains too dependent on the Fed, which has become dependent on poor economic data. Following worsening conditions, the Fed is more likely to pivot and cut rates sooner. We believe economic activity will continue to surprise moderately, putting the Fed on pace to start lowering rates in either September or November, yet any resurgence of inflation will likely spur bouts of volatility in both stocks and bonds.

Persistent, elevated rates will continue to cause issues for some companies, like small caps, though earnings are expected to grow broadly in 2024 and 2025. While equities generally produce positive returns during election years, we expect volatility is likely to increase as we approach the election in the third and fourth quarters. The recent political turmoil in France and India, the first U.S. Presidential Debate, and the ensuing market volatility remind us how sensitive the markets are to political uncertainty. While we anticipate increased volatility as November nears, we do not believe this volatility source is sustainable. Outside of a resurgence of inflation or Fed policy misstep, we believe geopolitical risks pose a major threat and are more fearful of those potential exogenous events that are harder to predict.

While the path may be bumpy, we believe yields should continue to grind lower over the course of the year, presenting attractive opportunities to produce asymmetric returns in bonds. Extending duration within portfolios should allow investors to clip an attractive yield, while also providing them with the opportunity to experience capital appreciation for a total return exceeding what they might clip sitting in money market funds or short-term Treasury bills, particularly in municipal bonds on an after-tax basis.

Elevated interest rates continue to punish private real estate returns, with further slight downward valuation adjustments expected from their previous marks. Real estate serves as an interest rate-sensitive asset class; as rates move lower, we anticipate a pick-up in activity and a subsequent reversal of valuations over the next several years. While we believe we are nearing the light at the end of the tunnel for several real estate sectors like multifamily and industrial, unfortunately, we believe more pain will be experienced, particularly with the underlying debt that real estate operators hold. We anticipate a pickup in defaults across several real estate sectors, likely resulting in further pain across both public and private markets. For the foreseeable future, we remain extremely cautious and selective, focusing on select submarkets and attractive risk-adjusted returns.

Private equity, particularly lower middle market buyouts, appears to have stabilized, potentially presenting attractive investment opportunities relative to public market alternatives. Current yield levels present challenges for private equity valuations, though according to Pitchbook, elevated and expanding public equity market valuations position new buyout investments favorably when compared to their public market counterparts. Generally, when public market valuations are well above historical norms, buyout strategies launched during these periods tend to outperform, particularly smaller and emerging managers, which aligns with our natural preference. With limited private equity exit opportunities today, we also align with Pitchbook’s stance that secondary investments should also create attractive opportunities for investors in this environment.

Given that private credit is predominantly floating and tied to a base rate such as the Secured Overnight Financing Rate (SOFR), closely linked to the Fed Funds overnight rate, we believe the asset class remains attractive. Yields on private credit should remain similar to current levels until the Fed begins to cut rates. Even as the Fed cuts rates, the floating rate on private loans does not adjust immediately. Rather, there is a delay before the loan terms reset lower. Barring a catastrophic event, the Fed is likely to lower rates slowly, supporting higher yields for longer in private credit. According to commentary shared with us from Cliffwater, companies appear to be navigating the higher financing costs well, as interest coverage in their pipeline has increased from 1.75x to 1.93x.

Like markets and the Fed, we are digesting data points as they print, but we remain laser-focused on long-term objectives and minimizing volatility in the short-term amidst this data dependent backdrop.

Thank you for your continued confidence and support. If you have questions or concerns, please contact your Centura Wealth advisor.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on the market and other conditions. These documents may contain certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Centura Wealth Advisory is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Centura Wealth Advisory and its representatives are properly licensed or exempt from licensure. 12255 El Camino Real, St. 125, San Diego, CA 92130.