Q3 2024 MARKET WRAP: Despite Hurdles, The Hot Streak Continues

Markets in the summer months are historically sleepy as individuals go on vacation and gear up for a new school year, but the third quarter brought anything but sleep to investors worldwide. Equities were marred with bouts of negative activity throughout the quarter – markets experienced a historic 180% surge in the VIX to an intraday high of 65.7 on August 5, yet, despite the volatility, both stocks and bonds pushed higher to end Q3. The market’s resilience caused the month of September to post its first gain in five years. While initially overreacting to adverse events, markets quickly put them in the rearview mirror as the S&P 500 witnessed the best nine-month start to a year since 1997, which also coincided with the best start to an election year ever, all while registering its 42nd all-time high of the year. The busy quarter witnessed the following:

- Yen Carry Trade – On the heels of the Bank of Japan’s rate increase announcement, global hedge funds that capitalized on the arbitrage opportunity presented by zero long-term rates in Japan for years, realized the music was about to stop in early August. Quickly unwinding their trades, Japan’s Nikkei stock market experienced the largest single day loss dating back to “Black Monday” in 1987, resulting in a single-day decline of 12.4% on August 5.

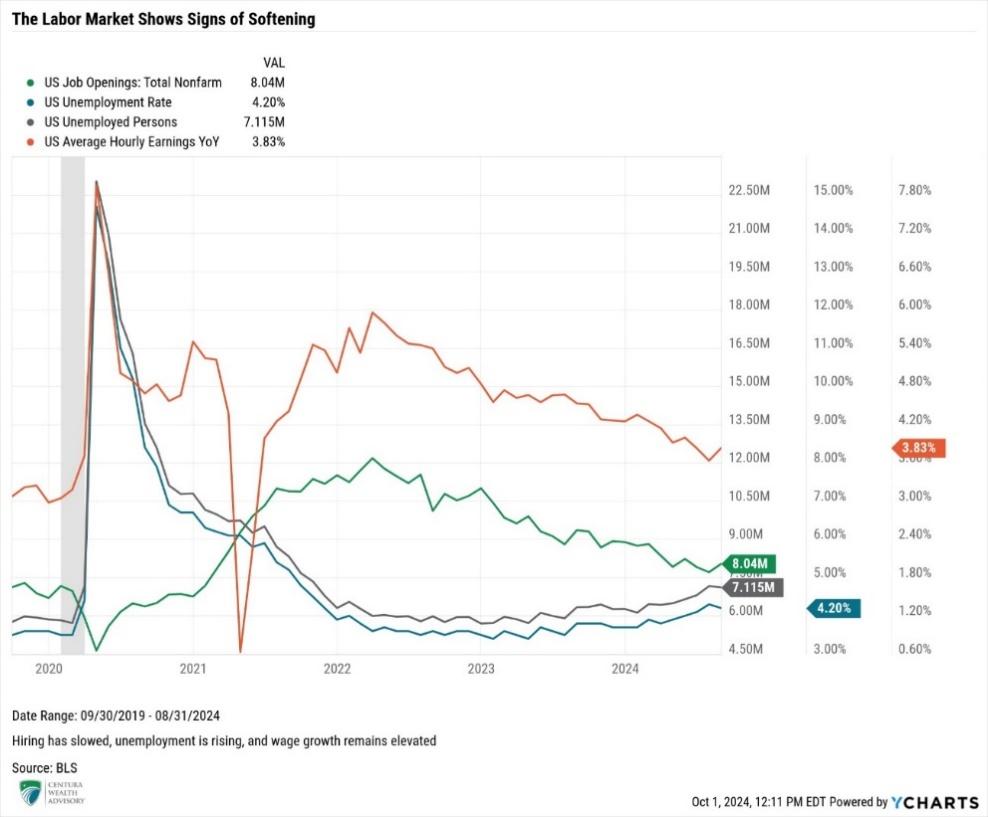

- Softening Labor Market – The Bureau of Labor Statistics announced an 818,000 revision lower for the prior 12-months jobs added through March of 2024. The labor reports for June, July, and August confirmed softening with the revised additions of 118,000, 61,000, and 142,000, respectively. Every month in the quarter came in below expectations, as the unemployment rate continued to rise – ending at 4.2% through August.

- Assassination Attempts – Former President Trump survived two assassination attempts in the quarter as the Presidential race picks up steam, further adding to the market’s anxiety amid election uncertainty.

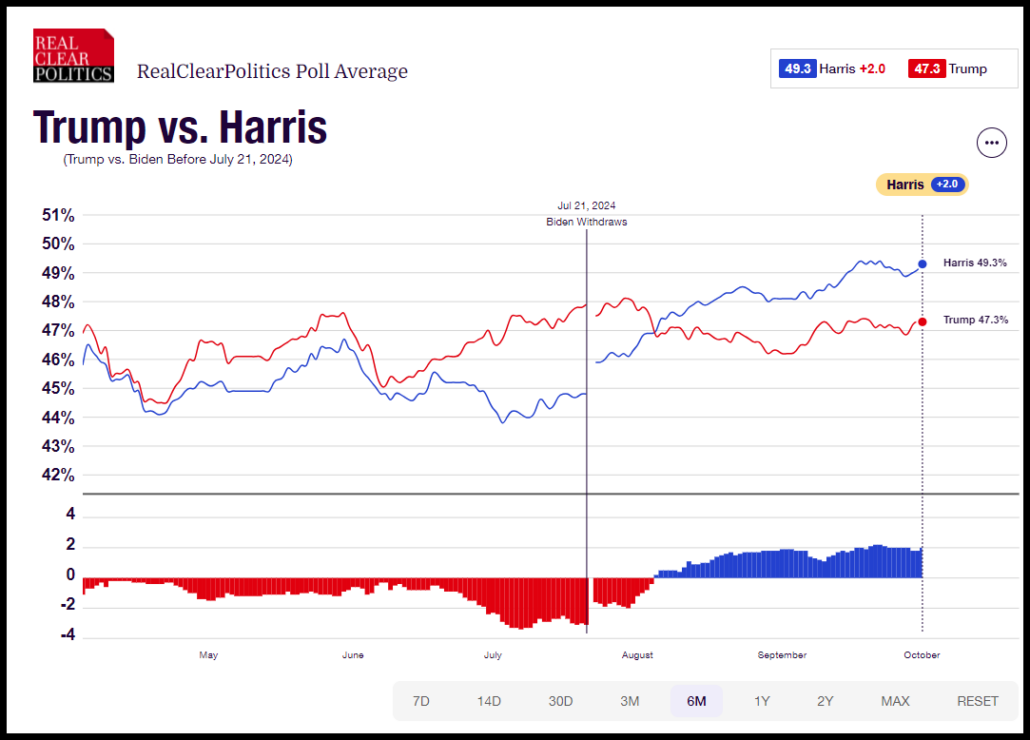

- Candidate Swap – President Biden dropped out of the Presidential race, paving the way for Vice President Kamala Harris to grab his bid. Since Harris’s party nomination, Democrats have seen a sharp reversal of fortunes, and now hold a slight advantage in the polls as of 10/1.

- Fed Rate Cut – In line with traders’ expectations — though surprising to many economists and investors — the Fed aggressively cut rates in September for the first time since 2019, front-loading their easing cycle with a 0.50% reduction in their overnight borrowing rate. This led many to question the Fed’s perception of the economy and whether the central bank could manufacture a soft landing and avoid a recession.

- Port Strike – As of 12:01 am Eastern Standard Time on October 1, a union labor strike forced ports on the Eastern US and Gulf Coasts to shut down, threatening the economy. JPMorgan Chase & Co. anticipate the closures will result in economic losses between $3.8 billion to $4.5 billion per day, and will likely cause supply chain disruptions and perhaps transitory inflation. Oxford Economics projects a week-long strike would take about a month to clear the shipping congestion.

- Israel-Iran – Iran fired nearly 200 missiles into Israel escalating tensions in the Middle East. Israel cited it would retaliate, and this pledge caused Gold (GLD) prices to reach record highs, a U.S. stock market sell off, losses in Crude oil (USO), and a gain in defense sectors.

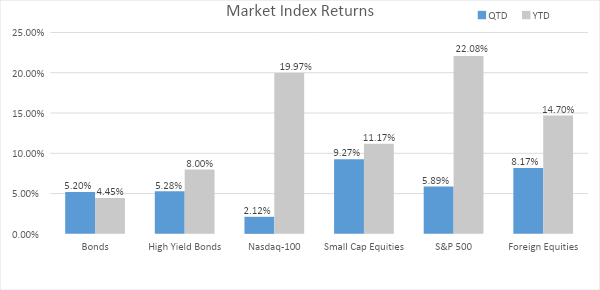

In face of the strife and a broadening out in earnings growth, the Fed signaled the start of its easing cycle in July, pointing markets to their first rate cut at the September FOMC meeting. While markets experienced hurdles throughout the quarter, economic growth, fueled by resilient consumer spending, continued to surprise to the upside, and investors chose to focus on these positives, causing both the S&P 500 and bonds, as measured by the Bloomberg U.S. Aggregate Index, to advance more than 5% over the quarter. This solid performance in the face of market angst and during a historically slow period demonstrated that investors’ animal spirits are alive and well.

Market Recap

Equities – After contracting 3.62% in the second quarter, rate cut speculation supported higher returns among the profit-hungry and interest-rate sensitive small caps. The Russell 2000 led the way, up 9.27% in 3Q. Lagging their small cap counterparts, the S&P 500 witnessed a broadening out of market participation away from the Magnificent Seven on its way to a 5.89% return for the quarter, and a 22.08% advancement for the year.

Bonds – Amidst moderating yet conflicting economic growth signals, bond yields fell aggressively during the quarter in anticipation of the first Fed rate cut. Entering July, the yield on the 10-year U.S. Treasury dropped sharply from 4.48% to 3.66%, leading up to the looming rate cut in mid-September. Generating fewer headlines over the quarter, the Treasury market continued to grapple with robust U.S. debt issuance and weakening demand for U.S. Treasury securities. We believe supply absorption concerns will likely continue to apply upward pressure on yields, illustrated by yields slightly reversing course to close the month of September. The 10-Year U.S. Treasury closed the quarter at 3.81%. The Bloomberg U.S. Aggregate Bond Index rose 5.20% in the quarter, erasing the negative 0.71% return in the first half of 2024, finishing up 4.45% through September 30.

Source: YCharts. The Bloomberg US Aggregate Index was used as a proxy for Bonds; the Bloomberg US High Yield 2% Issuer Capped Index was used as a proxy for High Yield Bonds; the Russell 2000 Index was used as a proxy for Small Cap Equities; and the MSCI ACWI Ex USA Index was used as a proxy for Foreign Equities. All returns are based on total return levels as of 09/30/2024.

Economic data remains mixed, and base case expectations still call for the Fed to successfully achieve a ‘soft landing’ and avoid recession. However, as the Federal Reserve’s attention shifts from price to job stability, the path of monetary policy will likely be driven by the health of the labor market.

Economy: The Consumer Surprises

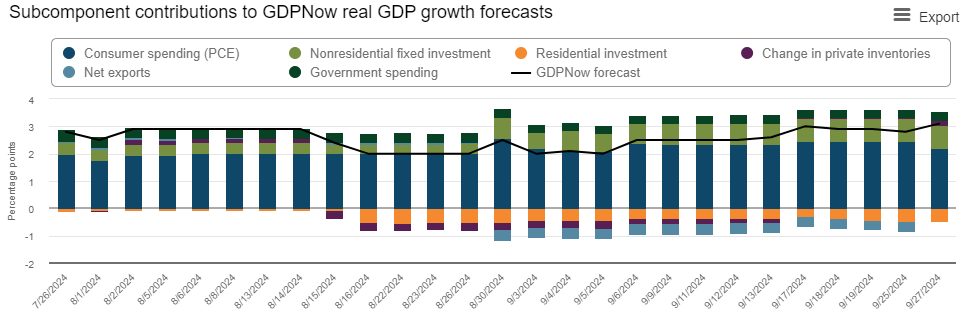

In contrast with the nation’s revised first quarter GDP growth of 1.6%, which was held down by softer consumer spending of 1.9%, the second quarter surprised to the upside. A lift in personal income fueled a resurgence of consumers’ penchant to spend, as spending jumped to a 2.8% pace, and an 8.3% increase in business investment helped push U.S. growth higher at a 3% annualized pace. Building on the first two quarters of 2024, as of September 27, 2024, the Atlanta Fed’s GDPNow model for Q3 has been revised from 2.9% to 3.1%, indicating a stable, albeit moderating economic growth engine. This revision reflects the sustained trends of a resilient consumer and further business investment, though an economy hindered by negative residential investment.

Unemployment

August’s Labor Market Report registered the 44th consecutive month of job gains. Estimates called for 161,000 jobs in August, and the market once again surprised to the downside with the addition of 142,000 jobs and further downward revisions to June and July’s reports to 118,000 and 61,000, respectively. Conversely, the unemployment rate retraced slightly to 4.2%, which is still nearly 1% higher than the 55-year low of 3.4% in April 2023. The deterioration of the labor market has quickly grabbed the attention of the Fed, as softness became evident across several pockets of the economy.

The Bureau of Labor Statistics announced an 818,000 revision lower for the prior 12-months jobs added, through March of 2024, reflecting weaker job growth than anticipated. Since peaking in 2022, job openings (JOLTs) have continued to trend lower, bouncing around from month-to-month. For example, job openings fell to their lowest level since January of 2021 to 7.71 million in July, only to reverse course back above eight million in August, bringing the ratio of job openings to those unemployed down to 1.13:1. While the ratio of 1.13:1 is above historical levels, the ratio has fallen significantly from nearly two job openings for every job opening in 2022, indicating the labor market is showing signs of tightening. Over the course of the year, the number of open jobs has trended lower, while the number of unemployed job seekers has trended higher, as evidenced by the additional 991,000 unemployed persons from January to August.

Since the Fed embarked on its tightening journey and increased rates, the strength and resiliency of the labor market gave them confidence to keep rates higher for longer. Ultimately, the Fed would like to see wage growth continue to trend lower from its current, elevated level of 3.83%. Given the slowing pace of hiring and the increase in unemployment figures, labor market stability has become a primary concern for the Fed. Fears surrounding further labor market weakening cast doubt on the Fed’s ability to avoid a recession and produce a soft landing. The surge in late July Unemployment Claims helped fuel the market selloff in early August that witnessed the S&P 500 enter a nearly 10% correction, although claims have since retraced. Unemployment Claims (both Initial and Continuing) are released weekly and provide the most up to date insight on the health of the labor market. As mentioned, Initial Claims have fallen from 250,000 on July 27 to 218,000 on September 21, while Continuing Claims have been range-bound between 1.73 million and 1.87 million since the start of the year. Both of these levels are nowhere near levels seen in prior periods leading up to a recession, though remain important to monitor.

Inflation

The Fed appears to be in a position to win the war on inflation. However, we would not be surprised to see a few battles lost from month-to-month as pricing pressure moves towards the Fed’s 2% target. All inflation measures are below wage growth of 3.8%, with both of the Fed’s preferred inflation measures (PCE) coming in at 2.7% or lower. Core inflation, as measured by CPI and PCE, remains stickier: core CPI stayed at 3.2% year-over-year, while core PCE saw a slight uptick in August to 2.7%.

Further evidence of falling price pressures should provide Federal Reserve Chair Jerome Powell the confidence to continue down the path of monetary easing, supporting further rate cuts. Threatening the falling trend in inflation measures are the recent port closures across the Eastern seaboard and the Gulf. We are paying close attention to these closures and hoping for a quick resolution. A prolonged strike could result in serious supply chain constraints, potential price increases for goods, and a slowing in economic output.

Fed Starts Strong Out of the Gate

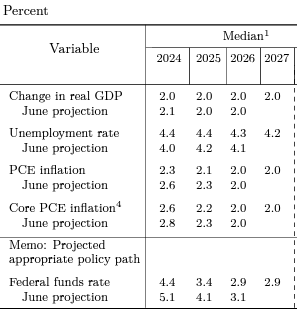

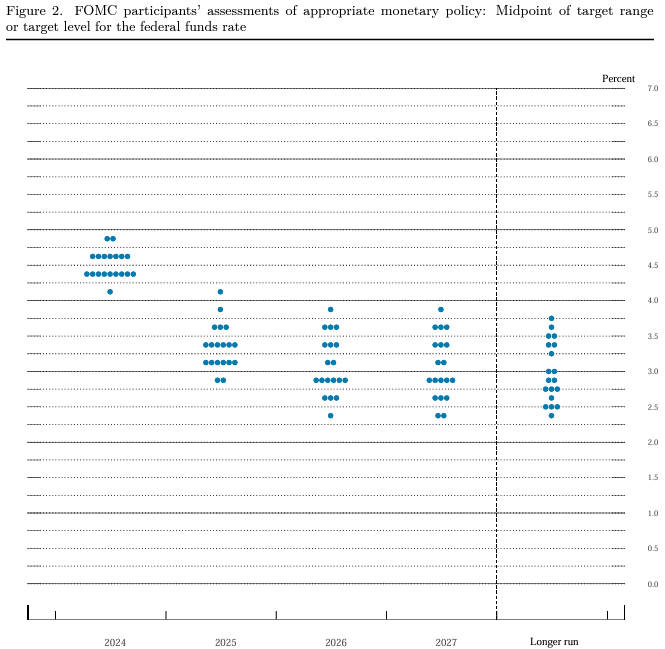

The Federal Open Market Committee (FOMC) elected to lower rates by 0.50% (50 bps) at their September meeting, while leaving the size of future rate cuts open. The Fed’s decision to cut rates was largely expected. The surprise centered around the size of the Fed’s cut and the subsequent updates to their Summary of Economic Projections (SEP). This surprise was best illustrated by the Fed’s updated median projection for total rate cuts in 2024, which increased from a mere 0.25% of cuts projected in the June SEP to a total of 1.00% worth of cuts in the September SEP, signaling to markets that interest rates would be cut at a more accelerated pace than initially expected.

Many expected the Fed to start slow with rate reductions, pointing to the health of the overall economy. A larger cut can indicate the Fed believes the economy is deteriorating quickly and that they waited too long to cut rates; however, the Fed has downplayed this rhetoric, stating that a 50 bps cut was warranted due to the strength the economy has exhibited.

Source: US Federal Reserve Summary of Economic Projections, September 2024

The Committee held its projection for 2025 at 1.00% (100 bps) of cuts, indicating a slower pace of change as the Fed adopts a more patient data-dependent position after front-loading their easing in the final four months of 2024. Barring any exogenous event or resurgence of inflation, we believe Powell’s plan is to settle into a predictable cadence in terms of size and timing as we transition into 2025. We believe the Federal Reserve will align further rate reductions with their quarterly meetings and updated Summary of Economic Projections to the tune of more traditional 0.25% policy changes. We fully anticipate the Fed will hit its policy target for 2024 with 100 bps of cuts. However, the question remains whether they will do so in the form of one more 0.50% or elect a more traditional policy change and reduce the terminal rate by 0.25% in November and December: we are in the latter camp.

Centura’s Outlook

The Fed’s goal to lower inflation to its 2% mandate and avoid recession is still our base expected outcome. However, the Fed will need to monitor the state of the labor market deterioration closely if they are to fully avoid an economic contraction.

Successfully delivering lower inflation and monetary policy normalization should bode well for equities and bonds, however, as always, there are several potential risks looming and investors should proceed carefully.

By most measures, the S&P 500 is overvalued. According to FactSet, as of September 27, the forward 12-month Price-to-Earnings Ratio (P/E) is 21.6x, which is higher than both the 5-year and 10-year averages of 19.5x and 18.0x, respectively. Current valuations pose a risk to the market, as negative sentiment can lead to sharper selloffs. Also posing a risk to the overall market is the concentration of the Top 10 largest stocks in the S&P 500. According to JPMorgan Asset Management, the 10 largest constituents represent 35.8% of the index, as of August 31, while contributing to 28.1% of the earnings. Concentrations of this magnitude make the index vulnerable to significant changes stemming from those underlying companies, which is one of several reasons we favor global diversification across a multitude of asset classes – both public and private.

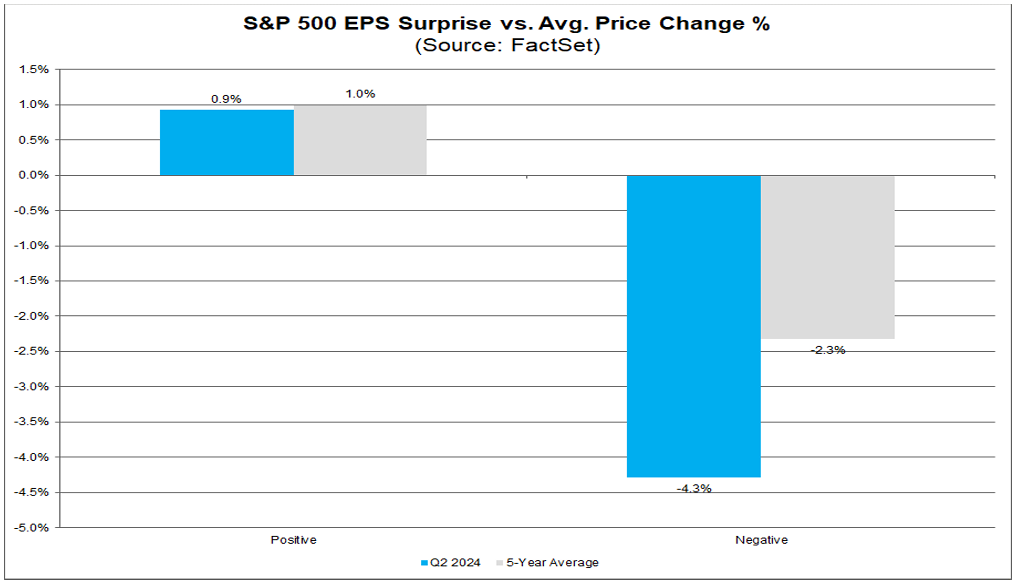

In the face of higher borrowing costs, corporate profits remain resilient, illustrated by the fourth consecutive quarter of positive earnings growth by the S&P 500, rising 5.1% in the second quarter. As of September 27, FactSet estimates third-quarter earnings to expand at a slower pace, only advancing 4.6% year-over-year. We are encouraged by the positive earnings growth trends, though the second quarter saw investors punish negative earnings surprises more than they rewarded positive beats. Relative to the five-year average, stocks that beat earnings guidance in 2Q rose less (0.9% vs. 1.0%), while those companies that missed guidance fell nearly double the 5-year average (-4.3% vs. -2.3%), indicating the market appears overvalued, and investors are overreacting to news and resetting expectations.

Source: FactSet Earnings Insight

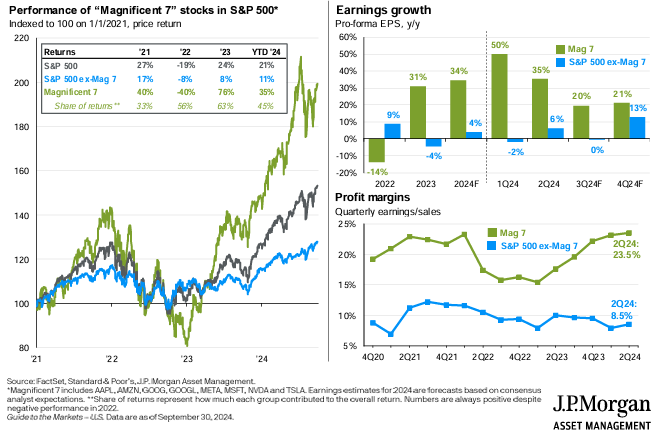

Since 2023, the Magnificent Seven have been responsible for most of the market’s earnings growth, increasing 31%, versus the 4% contraction of the remaining 493 companies’ earnings in the S&P 500 last year. While third quarter earnings for the 493 companies are expected to be flat for 3Q, we remain optimistic by the fact that JPMorgan is expecting the remaining companies outside the Magnificent Seven to catch up and accelerate earnings throughout the remainder of the year. Both the Magnificent Seven and the S&P 500 ex-Mag Seven are expected to experience double-digit year-over-year earnings growth in the fourth quarter of 21% and 13%, respectively. A broadening of earnings growth should bode well for increased market breadth and carve a path for higher broad-based returns on equities, outside of the Magnificent Seven.

Source: JPM Asset Management Guide to the Markets

Persistent, elevated rates will continue to cause issues for certain companies, such as small caps, though earnings are expected to grow broadly through the remainder of 2024 and 2025; the Fed’s pivot to lowering rates should alleviate some of the pressure on company financials.

While equities generally produce positive returns during election years, we expect volatility will likely increase as we approach the election through October and early November. The recent political turmoil has created a great deal of market uncertainty, particularly given the differing policy initiatives of both candidates. In the face of uncertainty, we generally avoid making changes to investment portfolios in advance of an election, as the policy expectations could change greatly. Markets tend to rally once the election has concluded. We encourage clients to avoid making rash decisions and stay invested, as we are strong believers that long-term investment outcomes are improved by time in the market, rather than timing the market. We suggest investors concerned with historical market behavior leading up to, and after an election, listen to the podcast we recorded with Michael Townsend, Managing Director, Legislative and Regulatory Affairs at Charles Schwab & Company.

The stock market’s resilient momentum, a more favorable rate environment, a potential post-election rally, and expected earnings growth all serve as potential tailwinds to push equities to further highs. However, a fair amount of uncertainty and risks pose headwinds for markets. Outside of further labor market deterioration or a resurgence of inflation leading to a Fed policy misstep, significant geopolitical risks are present and could result in additional volatility, especially if there are escalations in the Middle East, Eastern Europe, or China. For instance, on October 1, Iran fired nearly 200 missiles into Israel escalating tensions in the Middle East. Israel cited it would retaliate, and, as a result, Gold (GLD) prices reached record highs, U.S. stocks sold off, Crude oil (USO) experienced losses, and investors flocked to safe haven investments and sectors.

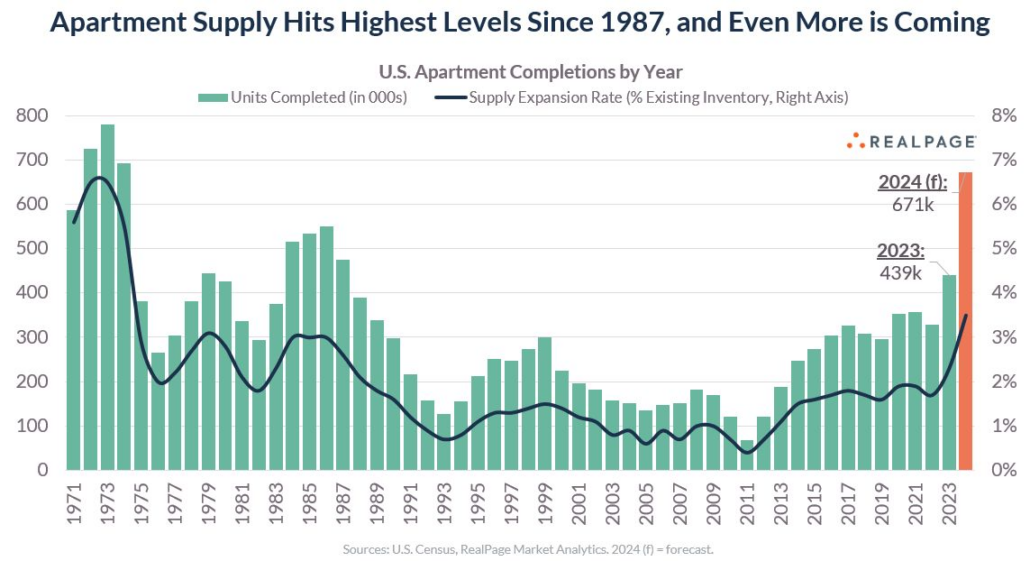

Real estate tends to be an interest rate-sensitive asset class; as rates continue to move lower, we anticipate a pick-up in activity and a subsequent reversal of valuations over the next several years. We may not have found the bottom of the real estate market cycle quite yet, though based on improving fundamentals and discussions with our real estate partners, we may be bouncing off the bottom, from a valuation adjustment perspective. Access to nearly-free credit post-pandemic resulted in record numbers of new construction, particularly in commercial real estate sectors like multifamily and industrials. As a result of the Fed’s rate hiking cycle, those new constructions screeched to a halt as the cost to borrow and build has been unfeasible. However, 2024 is still expected to deliver more than 650,000 multifamily units, the most since 1974. Like most goods, price is determined by supply and demand, and real estate is no different. Currently, demand, or absorption, is failing to keep pace in multifamily, applying downward pressure on rents. Furthermore, new higher-quality inventory generally attracts higher rents, forcing older vintage properties to offer rent concessions to remain competitive and applying downward pressure on net operating income (NOI). On the opposite side of the ledger, expenses have outpaced income, particularly the cost of insurance and labor.

We believe we are approaching the light at the end of the tunnel. While valuations may trend sideways over the next 12-18 months, we are optimistic that increased activity resulting from lower interest rates, combined with supply concerns evaporating as we enter 2026 and few-to no new construction starts, should bode well for private real estate in the long-term, with 2024 and 2025 vintages potentially producing strong results at disposition. We continue to remain extremely cautious and selective, focusing on select submarkets, signs of possible distress, and attractive risk-adjusted returns.

Private equity, particularly lower middle market buyouts, appears to have stabilized, potentially presenting attractive investment opportunities relative to public market alternatives. Current yield levels still present challenges for private equity valuations, though, like real estate, lower rates should lead to increased exit activity and higher valuations moving forward. With limited private equity exit opportunities since mid-2022 and our expectation for increased activity, we favor managers specializing in co-investments, GP-led secondaries, and late-stage primaries that offer the potential for superior risk-adjusted returns in this environment, a potentially quicker return of capital, and generally lower fee structures.

Private credit is predominantly floating and tied to a base rate such as the Secured Overnight Financing Rate (SOFR) and closely linked to the Fed Funds overnight rate, as such the asset class has benefited from the Fed’s restrictive monetary policy, though we believe the asset class remains attractive. However, yields on private credit will start to come down as the Fed continues to cut rates, though with a lag to the Fed’s timing as the floating rate on private loans does not adjust immediately. Rather, there is a delay before the loan terms reset lower. Should our Fed rate path expectations prove accurate, we expect private credit to continue to produce a high level of income, particularly on a relative basis.

While the third quarter brought both hurdles and strong market performance, we remain laser-focused on long-term objectives and minimizing volatility in the short-term amidst this data-dependent backdrop.

Thank you for your continued confidence and support. If you have questions or concerns, please contact your Centura Wealth advisor.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on the market and other conditions. These documents may contain certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Centura Wealth Advisory is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Centura Wealth Advisory and its representatives are properly licensed or exempt from licensure. 12255 El Camino Real, St. 125, San Diego, CA 92130.