Q4 2023 Market Wrap: the US Avoided a Recession in 2023

With so much uncertainty surrounding the Fed’s monetary policy and the contagious effects their aggressive rate hiking cycle would inflict on the economy, we entered 2023 with great pessimism and uncertainty. Most economists and financial strategists predicted and braced for what they believed was an almost certain recession in the year’s second half. Not only did the U.S. avoid a recession, the first three quarters grew at 2.2%, 2.1%, and 4.9%, respectively, with the Atlanta Fed GDPNow model estimating fourth quarter growth at 2.3%.

Like 2022, the common themes wreaking market havoc in 2023 were linked to the Fed’s monetary policy, resulting market yields, and inflation. While the US economy is showing some signs of softening, the labor market has remained robust. The Fed’s war on inflation appears to have proven successful, as price pressures continue to grind lower towards their 2% target while avoiding a ’hard landing’. Yield volatility resulted in equity market gyrations over the last two years, and in 2023, the equity markets looked past the multiple regional banks collapses, growing geopolitical tensions globally, and several quarters of negative year-over-year earnings growth on their way to recording gains few predicted. Investors were rewarded in 2023 in many ways, including:

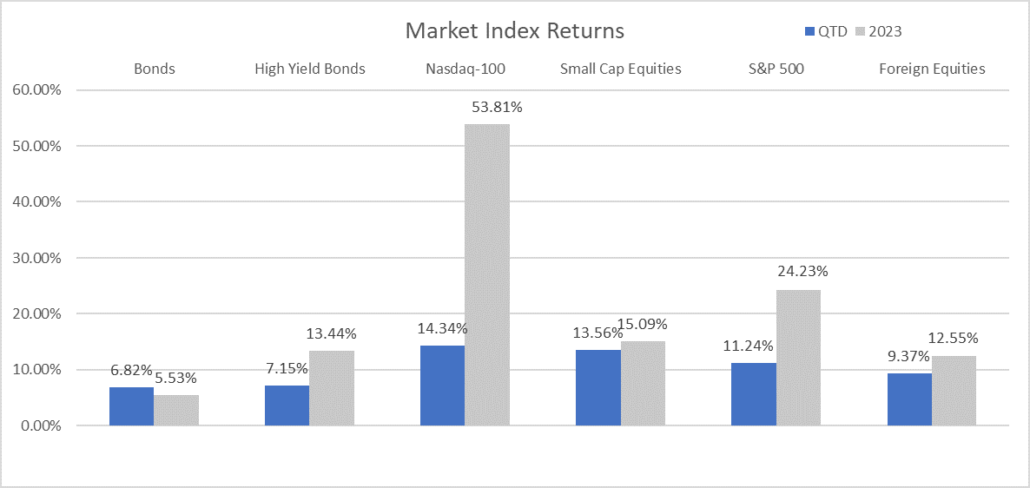

- The S&P 500 index surged $8 trillion and closed up 24.23% in 2023, finishing the year on a strong note. Notching nine straight weeks of gains – the longest such streak since 2004, the S&P 500 index closed the year ~0.56% shy of new all-time highs.

- The NASDAQ 100 benefitted from the Artificial Intelligence (AI) craze to gain 53.81% for year, the index’s best return since 1999.

- The Magnificent Seven, comprised of the seven-largest technology stocks (Apple, Amazon, Alphabet, Microsoft, Meta Platforms, Nvidia, and Tesla), were responsible for approximately 64% of the S&P 500’s 2023 return. Investors flocked to size and profitability and believe the Magnificent 7 companies’ scale and financial flexibility place them in the best position to capitalize on artificial intelligence.

- Global stocks, as measured by the MSCI All-Country World Index, struggled to keep pace with their U.S. counterparts, registering gains of 12.59%.

- Bloomberg Barclays U.S. Aggregate Bond Index snapped its two-year losing streak. The index advanced 5.53% in 2023, and with yields plummeting over the final two months of the year, global bonds recorded their best two-month surge on record, according to Bloomberg.

Taking the Fed’s rhetoric from December’s meeting and the path of inflation, market participants went all-in, and are now anticipating the Fed is set to pivot in the first quarter of 2024 and cut interest rates significantly over the course of the year. This move would lift asset prices across all major markets, delivering most of the calendar year returns for several indices in November and December. Given the robust rally to close out the year, we keep asking the two primary questions: Have the markets gotten ahead of themselves? And is a recession still on the table for 2024?

Market Recap

Equities – The combination of stronger economic data, U.S. Treasury debt issuance, foreign investor sales of U.S. debt, and Fed uncertainty that plagued equity markets in August and September rolled into the final quarter of 2023, pushing stock and bond returns to correction territory in October. While the index started the quarter declining more than 2% in October, the NASDAQ-100 bounced 16.77% in November and December to produce a fourth-quarter advance of 14.34%. The U.S. Treasury announced their debt issuance would focus on the front end of the yield curve. The labor market showed signs of softening, and the Fed started their dovish posturing. These shifting dynamics forced longer-term bond yields lower from nearly 5% on the 10-Year U.S. Treasury to 3.88%, subsequently igniting the ‘everything rally’ to close out 2023’s final two months. The largest benefactors were those asset classes like small caps and technology, which tend to be the most sensitive to higher interest rates.

Unlike most of the year, the fourth quarter market surge was more broad-based, as evidenced by the average stock, represented by the S&P 500 Equal Weight ETF (RSP), besting the concentrated market-cap weighted S&P 500 with returns of 11.81% and 11.24%, respectively. Lower rates and looser financial conditions boosted the outlook for smaller companies, as the small-cap Russell 2000 index rallied 13.55% amid the fourth quarter collapse in the 10-Year U.S. Treasury yield and nearly produced the entire year’s return for the index in the final two months.

While talk of the most anticipated recession evaporated, and a ‘soft landing’ to ‘no landing’ is all but expected, the market appears to have received the clarity from the Fed they were looking for and have declared the Fed is done raising rates, with rate cuts on deck. Participants continue to react counterintuitively to good news, treating it as bad news, while reacting to bad news as though it is good news. Should core inflation remain sticky and economic data like labor remain strong, we would not be surprised to see volatility ensue as investors start to unwind some of the optimism surrounding a Fed pivot they poured on in late 2023.

Bonds – As yields continued to spike, bonds continued their downward trend, adding to losses accumulated since August 2020. With stronger-than-expected economic data, Fed uncertainty, and robust U.S. debt issuance, the demand for U.S. Treasury securities continued to wane, not absorbing supply and forcing higher yields. The yield on the 10-Year U.S. Treasury started the quarter yielding 4.59% and nearly closed above 5% (4.98%) before plummeting 1.10% to finish the fourth quarter yielding 3.88%. Falling bond yields resulted in strong returns, as the Bloomberg U.S. Aggregate Bond Index increased 6.82% in the quarter, dragging its performance out of negative territory for the year.

Source: YCharts. The Bloomberg US Aggregate Index was used as a proxy for Bonds; the Bloomberg US High Yield 2% Issuer Capped Index was used as a proxy for High Yield Bonds; the Russell 2000 Index was used as a proxy for Small Cap Equities; and the MSCI ACWI Ex USA Index was used as a proxy for Foreign Equities.

With stronger economic data, base case expectations are that the Fed will successfully achieve a ‘soft landing’, avoiding a recession altogether. However, as certain economic data has continued to surprise to the upside, growth metrics are moderating.

Economy: The Consumer is a Rabid Spending Engine

Growing at more than double the pace of the first half of 2023, the final revision to third-quarter GDP growth accelerated to 4.9%, marking the fastest expansion rate since Q4 of 2021. The third quarter GDP reading was characterized by strong consumer spending, exports, and private inventory increases. Consumers are the engine driving us forward, making up roughly two-thirds of the nation’s economic output. Showing signs of abating in Q2, spending only grew 0.8%, with the third quarter witnessing consumers accelerate spending by nearly 4X to 3.1%. While consumer behavior is important to monitor, the acceleration does not appear troublesome to the Fed, as the Atlanta Fed’s GDPNow model for the fourth quarter has been lowered to 2.3%.

Given our nation’s reliance on consumption as a key component of GDP[1], consumer health is important to monitor. Fresh off a strong third quarter spending clip, the consumer has showed little signs of slowing, as indicated by holiday spending. The five-day holiday shopping period encapsulating both Black Friday and Cyber Monday saw record sales of $38 billion, a 7.8% increase over last year. The two retail holidays produced a combined $22.2 billion in sales, representing year-over-year growth of 7.5% and 9.6%, respectively. While strong spending in general is good, how consumers have been spending gives rise for concern.

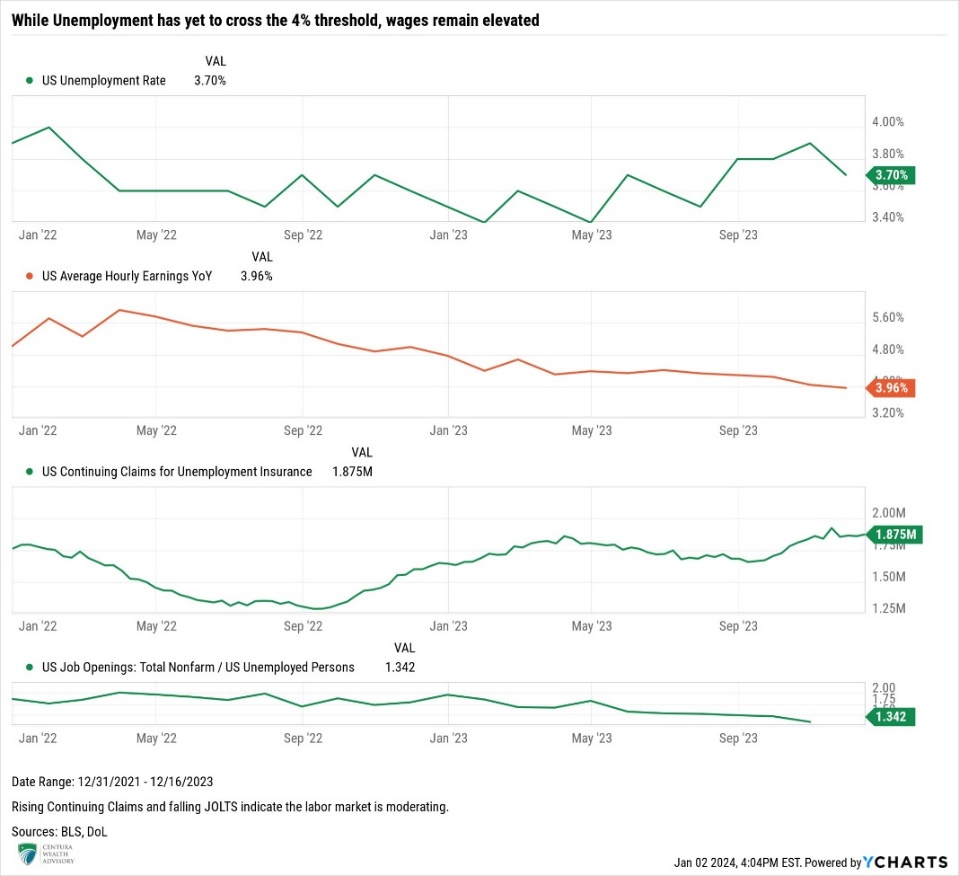

The post-pandemic, stimulus-infused savings are being exhausted and many consumers are adopting a buy now, pay later (BNPL) mentality and paying on credit. Most credit spending involves floating rates, so while consumers run up their balances, their cost of debt is also rising. Further deterioration in the labor market could spell trouble for the consumer, though for now, falling price pressures and sticky wage growth continue to support the consumers’ appetite for spending.

Inflation & Interest Rates

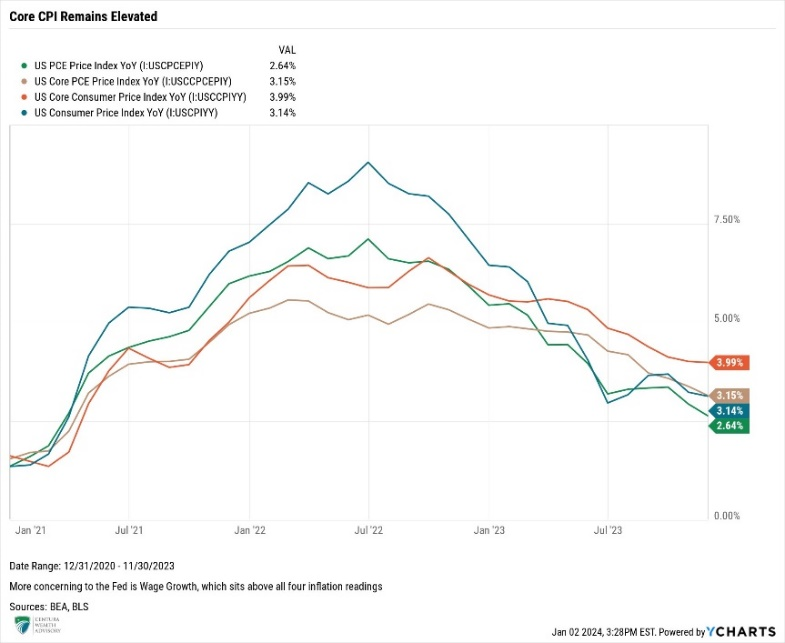

Inflation remains elevated, though the downward trends have been persistent. November’s headline Consumer Price Index (CPI) came in at 3.10%, while core CPI (excluding energy and food) remained stuck at the 4% year-over-year threshold for the second consecutive month. The once-persistent pricing pressure on core services, particularly, shelter, appears to have broken lower.

Shelter represents about 1/3 of CPI, making the variable impactful on the overall inflation gauge, as shelter has accounted for nearly 70% of the total increase in core CPI over the past year, according to the Bureau of Labor Statistics. Slightly declining to 6.5% in November from its 8% cycle peak, registered in March of this year, and rents declining nationally, shelter inflation should continue to move lower in 2024.

Adding to the optimism over inflation is the downward pressure on the Fed’s preferred inflation gauge, the Personal Consumption Expenditures (PCE). Entering the year elevated, with the headline PCE and core PCE registering 5.44% and 4.87%, respectively, the Fed’s war on inflation has proven successful. Both metrics have broken through the 4% threshold, with headline breaking below 3%. Through October, headline PCE was 2.64%, while core PCE fell to 3.15%. While the Fed’s actions appear to have been successful, it’s still too early for their victory lap, as wage growth remains above 4%. Wage growth trending above inflation creates the concern that persistence of this trend could result in a wage price spiral, ultimately leading to a resurgence of inflation. For the Fed to feel comfortable inflation will not reverse course, they will want to see both core CPI and wage growth trend below the 4% threshold for multiple readings.

Unemployment

November’s Labor Market Report registered the 35th consecutive month of job gains. Estimates called for 190,000 jobs in November, however the market barely beat to the upside when 199,000 jobs were added and unemployment fell 0.2% to 3.7%. The labor market continues to post strong, albeit moderating, results. Providing comfort was the rebound in the participation rate to 62.8%, matching the post-pandemic high, along with job openings (JOLTs) falling sharply to 8.73 million and bringing the ratio of job openings to those unemployed to 1.34:1. While the ratio of 1.34:1 is still elevated above levels we have historically witnessed, the ratio has fallen significantly from nearly two job openings for every job posting in 2022, indicating that some of the slack is working itself out of the system and the labor market is showing signs of tightening. While unemployment claims are at extraordinarily low levels, the upward trend in Continuing Claims continues to point towards labor softening. The metric reached the highest level since late-2021, indicating out of work Americans are finding it more difficult to secure new employment, which could have a hand in slowing consumer spending.

Time to Pivot?

The Fed has remained resolute in bringing inflation back to its long-term target of 2%. Since March 2022, the Fed has raised rates eleven times, bringing the target range for the Fed Funds rate to 5.25% to 5.50%. During this period, Fed Chairman Jerome Powell has also been reducing the Fed balance sheet by ~$95 billion per month, shedding nearly 14%, or approximately $1.25 trillion, since peaking in April 2022 at $8.965 trillion.

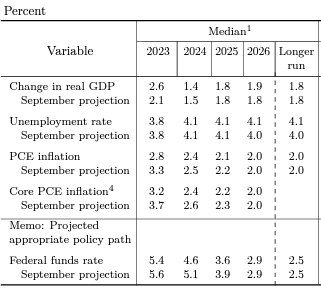

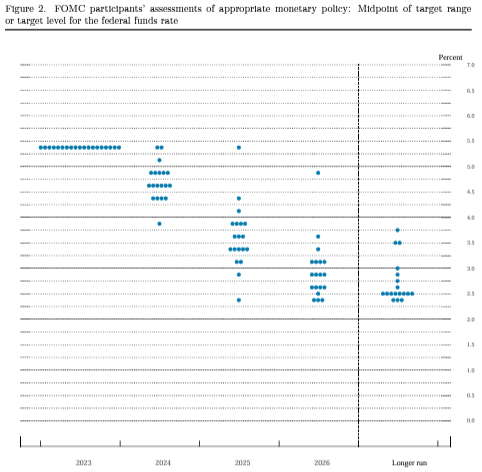

As anticipated, the Federal Open Market Committee (FOMC) elected to keep rates unchanged in December for the third consecutive meeting. While the Fed’s decision was largely expected, their dovish commentary surprised investors. With moderating jobs data and promising inflation figures likely supporting their tone, the Fed indicated their efforts to dampen 40-year high inflation are proving successful, stating growth has slowed and “inflation has eased over the past year but remains elevated.”

December’s meeting also saw a reversal in the Fed’s future projections. Deviating from their September estimates, the Fed is now projecting 0.75% of rate cuts up from 0.50%, with another 1% of estimated cuts in 2025, which would bring the Fed Funds Target rate to 3.6% by the end of 2025. The FOMC further slashed their inflation estimates from 2.6% to 2.4%. In his post-announcement press conference, Chairman Powell all but declared the Fed is done hiking rates in this tightening cycle,

“We believe that our policy rate is likely at or near its peak for this tightening cycle; the economy has surprised forecasters in many ways since the pandemic.”

While recognizing the lagged effects of monetary policy on the economy, the Fed did leave the door open for additional rate hikes. However, the insertion of the word “any” in the following statement, “any additional policy firming that may be appropriate” to rein in inflation, sent equity markets higher and bond yields lower. In the weeks following the December FOMC meeting, the markets revised their expectations to aggressively price in 1.50% of rate cuts in 2024, beginning as early as March, double what the Fed is currently projecting.

Source: Federal Reserve

Barring any resurgence of inflation, we believe the Fed has finalized its rate-hiking program. We stop short of saying “tightening cycle” because the Fed is still engaged in Quantitative Tightening (QT) through the reduction of their balance sheet by $95 billion per month, which Goldman Sachs believes has resulted in tightening financial conditions and higher yields. Given the Fed’s steadfast commitment to bringing inflation down, we struggle accepting the market’s expectations that the Fed will cut rates as soon as March, rather believing that without some exogenous event or sharp economic contraction, the Fed will likely keep rates unchanged until at least mid-year. Having extensively studied Volcker’s approach in the 1980s, it is unlikely that Powell wants to repeat those mistakes and cut rates too abruptly, which could cause inflation to reverse course as it did in the Volcker Era. Should our base case prove accurate, we would expect volatility to ensue as yields rise and equities sell off, giving back some of the gains realized to close out 2023.

Centura’s Outlook

The Fed’s goal to slow the economy just enough to lower inflation back to its 2% mandate and avoid recession serves as the base outcome expected by the Fed and most market participants. Should this play out accordingly, we expect 2024 to produce solid returns in both equities and bonds. However, the market currently appears priced to perfection so investors should proceed with caution as monetary policy uncertainty, any reversal in yields, the presidential election, and, to a lesser extent, a looming U.S. Government shutdown could all lead to bouts of market angst and volatility. Nevertheless, there are opportunities across all asset classes moving into 2024 though, equities provide an example of how caution is warranted amidst attractive opportunities.

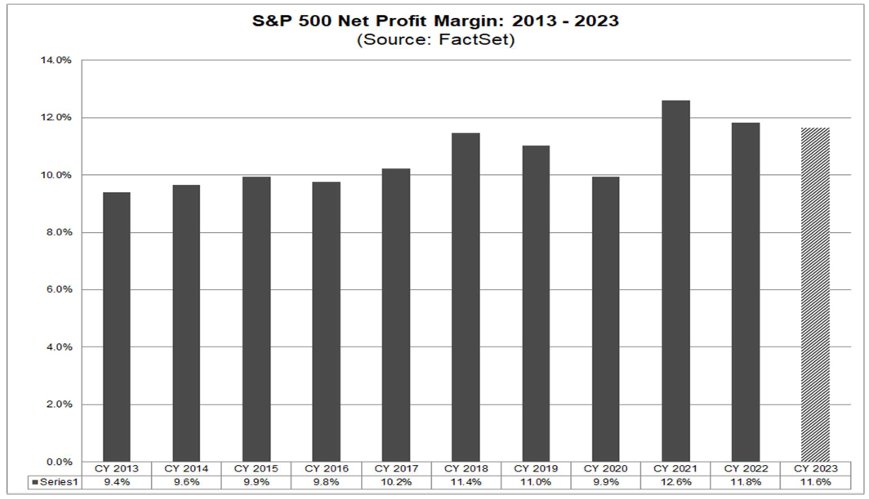

Earnings for the third quarter snapped the three consecutive quarters of negative earnings growth as companies began to experience stronger than expected revenue growth. Revenues grew at 2.4% year-over-year and as earnings advanced 4.9%, according to FactSet. The surprising third quarter results indicated to investors that companies have weathered the Fed’s rate hiking storm better than anticipated. Surprisingly, even in the face of 15-to-20-year high interest rates, companies have been able to maintain solid profit margins through successful cost-cutting measures over the last two years. However, FactSet has witnessed revisions for fourth quarter earnings, dropping from 8.1% on September 30 to 2.4% as of December 15.

Forward 12-month P/E ratios are approximately 19.3x, above both their five-year and ten-year averages of 18.8x and 17.5x, respectively. This shows that equities are slightly overvalued and thus priced to perfection. The fourth quarter saw multiple expansions in price appreciation and meager profits. To limit further multiple expansion, we need to see meaningful earnings growth to make valuations more attractive from their current levels.

The Federal Reserve rhetoric from December’s meeting and waning inflation give us optimism, but we remain cautious. The market remains too dependent on the Fed, which has become reliant on poor economic data, and with worsening conditions, the more likely the Fed is to pivot and cut rates sooner.

Many variables in Q4 surprised to the upside yet continue to moderate. However, as we look forward, the consumer’s health gives us pause, as does the impact of prolonged elevated rates on corporate balance sheets of less than fundamentally sound businesses – both of which could result in increased consumer and business defaults. We continue to believe the two largest immediate risks hinge on a misstep or abrupt change to the expected Fed outcomes and a potential resurgence of inflation, both of which are related.

We enter the year with portfolio allocations aligned with our long-term targets. While higher rates will continue to cause issues for some companies, we expect earnings to grow from 2023 levels in 2024. Additionally, equities generally produce a positive return during election years, so while volatility is likely to increase as we approach the election in the third and fourth quarters, we expect history to repeat itself and deliver gains. According to First Trust, on average, the market was up 11.28% during 19 of the past 23 total elections, or 83% of the time, since the S&P 500 began producing positive results.

Yields should continue to grind lower over the course of the year, presenting attractive opportunities to produce asymmetric returns in bonds. While a strong bounce in the fourth quarter slightly dampened our 2024 return expectations for fixed income securities, we believe portfolios should extend duration. Extending duration should allow investors to clip an attractive yield, while also providing them with the opportunity to experience capital appreciation for a total return exceeding what they will clip sitting in money market funds or short-term Treasury bills.

Elevated interest rates continue to punish private real estate returns, with further slight downward valuation adjustments expected from their previous marks. Real estate is an interest rate-sensitive asset class; as rates continue to move lower, we anticipate a pick-up in activity, and a subsequent reversal of valuations. While we believe we are nearing the light at the end of the tunnel for several real estate sectors like multifamily and industrial, unfortunately, we believe further paper losses are likely in the short term.

Though yields have fallen sharply, private credit is predominantly floating and tied to a base rate such as the Secured Overnight Financing Rate (SOFR), which is closely linked to the Fed Funds overnight rate. Yields on private credit should remain at their current levels until the Fed begins to cut rates. Even as the Fed cuts rates, the floating rate on private loans does not adjust immediately. Rather, there is a delay before the loan terms reset lower, with private loans typically resetting coupons quarterly. Barring a catastrophic event, the Fed is likely to lower rates more methodically than they hiked them, supporting higher yields in private credit. Combining traditional bonds with private credit should produce a balanced and diversified approach toward income production and total return in 2024.

As the door closes on 2023 and we enter 2024, we do so cautiously optimistic, as we believe the market has gotten a little ahead of itself, and there is still a high-level of uncertainty. We will continue to move forward with our constant focus on quality. Thank you for your continued confidence and support. If you have questions or concerns, please contact your Centura Wealth advisor.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on the market and other conditions. These documents may contain certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Centura Wealth Advisory is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Centura Wealth Advisory and its representatives are properly licensed or exempt from licensure. 12255 El Camino Real, St. 125, San Diego, CA 92130.