Q4 2024 Market Wrap: Is a Bear or Stock Market Three-Peat Coming in 2025?

Global markets saw significant developments in the fourth quarter of 2024, concluding a year marked by economic shifts, policy changes, and geopolitical events. The S&P 500 achieved 57 new all-time highs, delivering a remarkable annual gain of 25% and marking its strongest back-to-back performance since 1997/1998. In the fourth quarter, the “Trump Trade” returned in full force following the November election results, significantly influencing market dynamics and delivering the strongest monthly performance of the year.

With Donald Trump securing another term as President, market participants quickly shifted their strategies to align with expected policy changes, including key proposed initiatives like deregulation, international trade, and lower taxes. As investors anticipated a favorable environment for corporate profits, U.S. equity markets, particularly those sectors with high exposure to domestic economic activity, benefited immensely. Focus on the “Trump Trade” also fostered renewed optimism in venture capital and the small-cap sector, which gained from speculation that domestic-focused companies would be prime beneficiaries under Trump’s administration. Below are highlights from the fourth quarter and year:

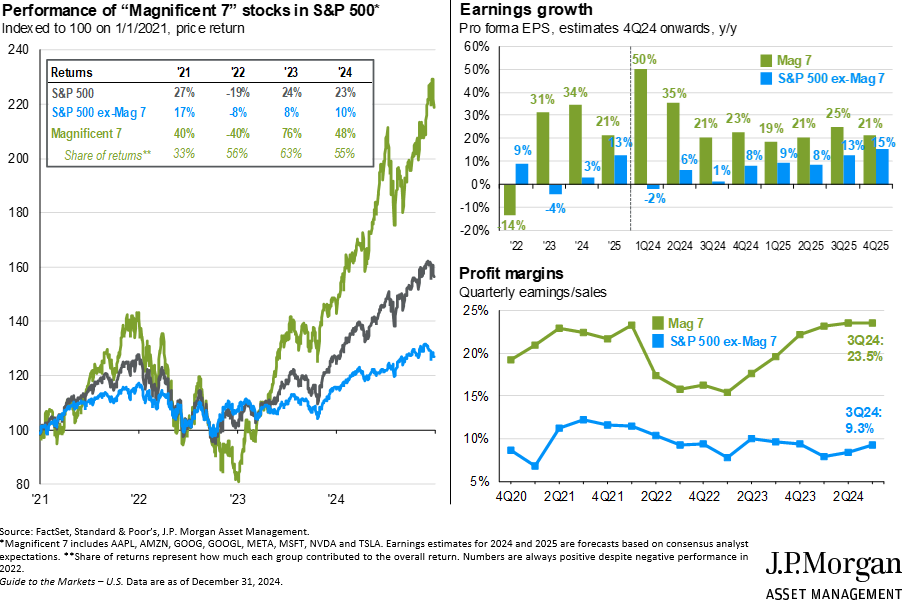

- The S&P 500 and NASDAQ 100 both rallied +25% through year-end despite geopolitical headwinds, economic challenges, and the final five trading days of the year failing to materialize a Santa Claus Rally. Their strong performance was aided by the tech sector, which benefitted from the AI boom and contributed significantly to their growth. Magnificent Seven giants like Nvidia (NVDA), Meta (META), and Tesla (TSLA) propelled the indexes to new heights as these companies harnessed the transformative potential of AI and similar technologies, capturing investor interest and driving substantial returns.

- The Magnificent Seven, comprising the seven largest technology stocks (Apple, Amazon, Alphabet, Microsoft, Meta Platforms, Nvidia, and Tesla), make up approximately 35% of the S&P 500 and nearly 50% of the NASDAQ. Investors fueled inflows into the stocks given their expanding service segments and innovative product lines, which resonated well with consumers worldwide. Given their size and profitability, investors believe that the Magnificent 7 companies’ scale and financial flexibility best position these companies to capitalize on artificial intelligence. While there has been some rotation out of the Magnificent Seven, given their exorbitant valuations, their complex interplay of innovation, market leadership, and strategic expansions contributed 55% of the S&P 500’s gains for 2024, with Nvidia alone producing 21% of the index’s return. Leveraging their financial flexibility and technological prowess, these companies positioned themselves at the forefront of market trends, setting the tone for technology-driven growth as we transition into 2025.

- Cryptocurrency, once considered a high-risk investment, is gaining greater acceptance among retail and, importantly, institutional investors. Bitcoin (BTC-USD) surged to an all-time high of $108,369 in December, pushing the global crypto market’s value over $3T for the first time in three years, as BlackRock, the world’s largest asset manager, stated that a Bitcoin allocation of up to 2% in portfolios is “reasonable.” The shifting regulatory environment with Trump’s victory further aided the advance of cryptocurrency. While Bitcoin contracted from its peak to close the year, as digital assets grow and regulatory acceptance increases, many investors may seek an opportunity to capitalize.

- Bloomberg Barclays U.S. Aggregate Bond Index experienced a rollercoaster year, though it turned into a positive year for the second in a row. Driven by growth prospects, inflation, and monetary policy projections, the 10-Year Treasury entered 2024 at 3.88%, only to rise and peak at 4.70% before collapsing to 3.63%. As growth improved and the “Trump Trade” took hold, rates reversed sharply to end the year at 5.58%. Despite the yield rising 0.77% in 2024; the bond index eked out a positive 1.25% return.

- Geopolitical Tensions and Volatility further supported the case for U.S. equities and pushed valuations higher. Tensions in the Middle East and Russia-Ukraine continued to escalate, as did tensions between China and Taiwan. Additionally, South Korea finds itself in the middle of a political crisis after their now impeached president briefly declared martial law, and both France and Germany saw their governments collapse in December, fueling geopolitical concerns.

- Gold Bullion returned the best year since 2010 with gains of +27%. Strong global central bank purchases, rising geopolitical uncertainties, and monetary policy easing all propelled the safe-haven asset’s record-breaking rally near an all-time high of $2,790.15 on Halloween. While the surging U.S. Dollar took some of the air out of gold’s sail, the same catalysts that pushed gold higher in 2024 remain, potentially supporting further gains in 2025.

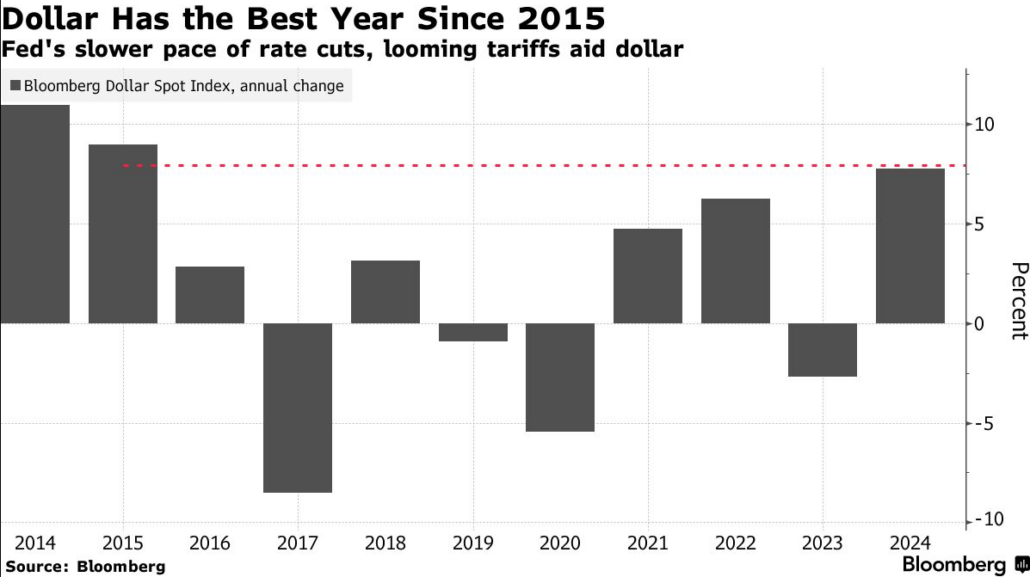

- U.S. Dollar strengthens nearly 8%, the most since 2015 as solid U.S. economic growth, sticky inflation, and Donald Trump’s potential fiscal policy initiatives signal rates will likely remain elevated.

Market Recap

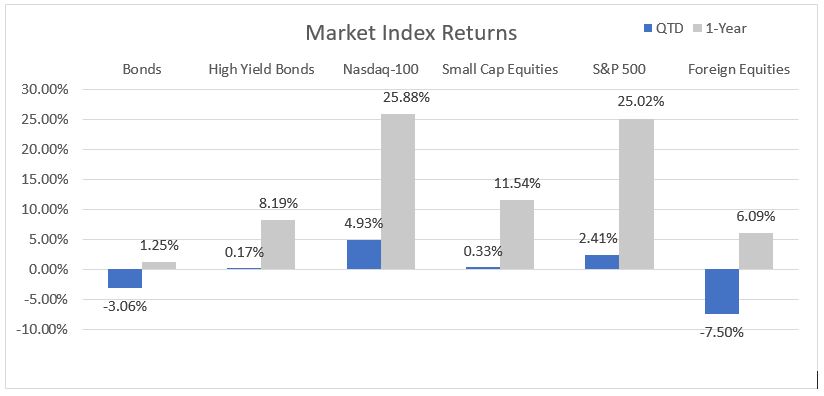

Equities – U.S. stocks continued their impressive run through Q4, building on gains from earlier in the year. The technology sector remained a key driver of market performance, buoyed by an ongoing enthusiasm for artificial intelligence and other emerging technologies. Nvidia (NVDA) continued its meteoric rise, solidifying its position as one of the world’s most valuable companies. The S&P 500 rose 2.41% for the quarter, bringing its year-to-date return to an impressive 25%.

Bonds – The bond market experienced significant volatility in Q4, largely driven by shifting expectations for the economy, hypothetical fiscal policy, Fed policy, and inflation. Entering the quarter at 3.81%, the 10-Year Treasury yield rose sharply over the course of 2024’s final months to end the year at 4.58%. Robust economic growth paired with a slower pace of Fed rate cuts and the prospects of pro-inflation fiscal policy initiatives caused the market to reassess both long-term growth and inflation expectations higher, lifting long-term bond yields. With the upward move in yields, the Bloomberg U.S. Aggregate Bond Index fell 3.06% in Q4, erasing earlier gains, though it still produced a positive calendar year, closing 2024 up 1.25%.

Source: YCharts. The Bloomberg US Aggregate Index was used as a proxy for Bonds; the Bloomberg US High Yield 2% Issuer Capped Index was used as a proxy for High Yield Bonds; the Russell 2000 Index was used as a proxy for Small Cap Equities; and the MSCI ACWI Ex USA Index was used as a proxy for Foreign Equities. All returns are based on total return levels as of 12/31/2024.

Economy: Robust Consumer Spending in 2024

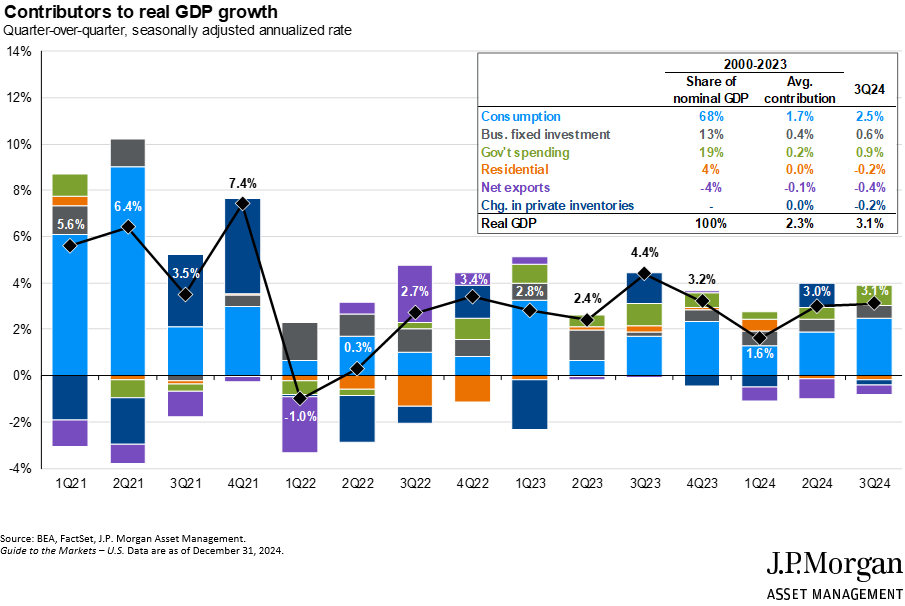

Consumption has remained one of the biggest drivers for the U.S. economy, whose real GDP is on track to expand more than 3% in Q4 2024. The consumer discretionary sector was the top-performing sector in December and one of the top sectors in 2024. Major retailers and discretionary companies capitalized on this year’s seasonal surge in holiday sales, which saw record-breaking transactions amid consumers’ willingness to stretch budgets for year-end gifting.

Despite the optimistic consumption data, businesses remain cautious and keenly aware of the potential risks posed by fluctuating consumer sentiment and the specter of inflationary pressures lingering from policy shifts both domestically and globally.

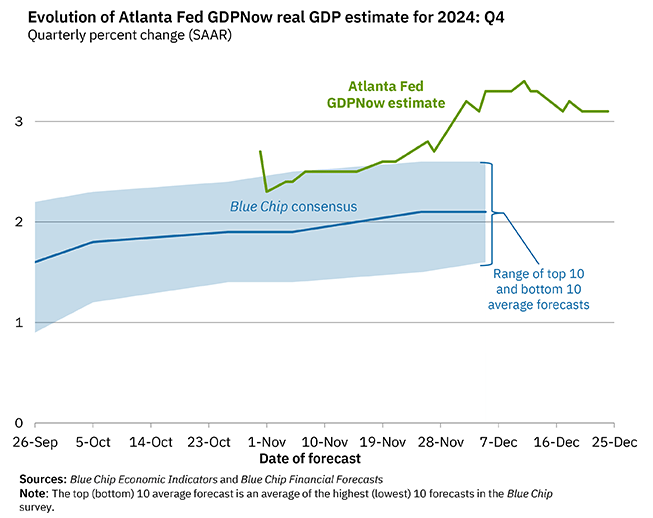

During Q4 2024, consumer spending remained a pivotal component of the economic landscape, although it exhibited signs of moderation. Robust consumer activity, invigorated by wage growth and stronger purchasing power than previous years, continued to support the broader economy. Despite elevated borrowing costs, consumers showcased resilience, navigating a complex environment marked by geopolitical tensions and evolving fiscal policies. The U.S. economy continued to demonstrate resilience in Q4. According to the Atlanta Fed’s GDPNow model, as of Christmas Eve, Q4 growth is estimated at 3.1%, reflecting a continuation of the robust 3.1% expansion seen in Q3. This growth aligns with the Federal Reserve’s efforts to reach a “soft landing” and avoid recession while combating inflation.

Consumer spending is a bellwether for economic growth, but it also faces notable headwinds, most notably the rising levels of household debt. U.S. credit card defaults jumped to the highest level since 2010 as credit card lenders wrote off $46 billion in seriously delinquent loans through September (50% year-over-year increase); a sign that the financial well-being of lower-income consumers is waning after years of high inflation. Trump’s planned fiscal policy changes also have the potential to further erode consumers’ purchasing power, particularly if his policies lead to a resurgence in inflation.

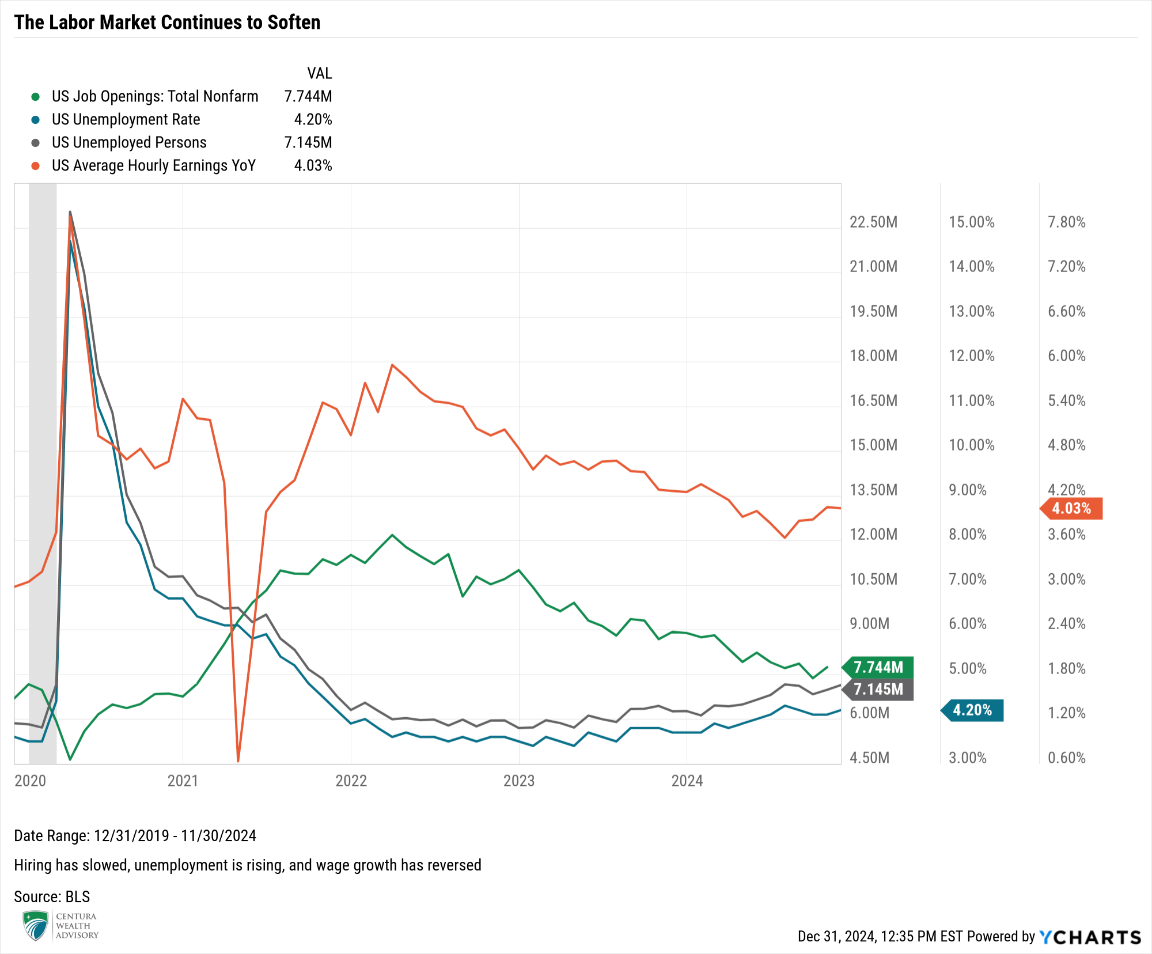

Labor Market Dynamics

As one of the dual mandates of the Fed, the labor market remains a focal point of economic analysis. Marred by two hurricanes and a Boeing strike, October’s labor gains were anemic. Meanwhile, 227,000 jobs were added in November, beating expectations, as the unemployment rate inched up to 4.2%, which represents a 0.5% increase in unemployment from 3.7% to start the year.

Higher unemployment figures and reduced job openings tested the labor market’s resilience, with October job openings (JOLTs) around eight million, a palpable decline from nearly nine million openings in January 2024. Another signal of labor market softening is the ratio of job openings to those unemployed, which moved down over the year to 1.08:1. While the ratio of 1.08:1 is near historical levels, the ratio has fallen significantly from nearly two job openings for every job posting in 2022, indicating the labor market is showing signs of tightening.

As the number of open jobs trended lower, the number of unemployed job seekers trended higher, as evidenced by the more than one million additional unemployed persons from January through November. The current levels show signs of tightening, reflecting a labor market that remains healthy but is gradually moderating after an extended period of strength. More concerning is the reversal witnessed in wage growth. After bottoming in June at 3.83%, wage inflation has risen back above the critical 4% threshold. Robust wage gains have bolstered consumer spending but have also heightened the risk of reigniting inflation. Heading into 2025, the job market will serve as a key indicator of economic stability, with any significant downturn threatening consumer spending and overall economic growth, and also prompting potential shifts in monetary policy.

Inflation and Monetary Policy

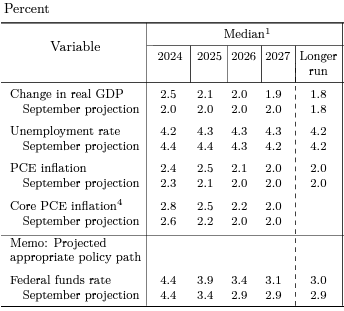

Inflation trends remained a central focus for markets and policymakers. After showing signs of moderation in early 2024, inflation has remained sticky, with measures ticking up slightly in the latter part of Q4. The headline Consumer Price Index (CPI) edged higher to 2.7% year-over-year in November, while core CPI (excluding food and energy) held steady at 3.2%. In line with CPI, the Fed’s preferred inflation gauge ran into the proverbial wall mid-year and has proven stubborn during this last mile of contraction as the Core Personal Consumption Expenditures (PCE) price index has risen from 2.6% in June to 2.8% in November. While significantly lower than the peaks seen in 2023, these figures remain above the Federal Reserve’s 2% target.

Following their surprisingly aggressive 50 basis point rate cut in September, the Federal Reserve reduced interest rates by another 50 basis points in the fourth quarter, bringing the interest rate cut total to 100 bps for 2024. December’s meeting also provided insight into the Fed’s outlook for 2025 and beyond. The Fed’s updated Statement of Economic Projections showed a slower pace of rate reductions in 2025 than previously projected in September, cutting projections in half from 100 basis points of cuts, to 50 basis points, or two potential 25 basis point cuts in 2025. This deviation sent long-term bond yields surging and prompted a risk-off mentality as investors started repricing a “higher-for-longer” outlook, causing a sell-off in interest rate-sensitive small-cap and technology stocks. With persistent inflation, wage growth elevated, and Trump set to take office, we anticipate the Fed to adopt a patient and methodical approach to future rate reductions.

Centura’s Outlook

We believe the Fed will ultimately deliver on their goal to lower inflation to its 2% mandate and avoid a recession for the U.S. economy. However, the Fed will need to monitor the state of the labor market deterioration and reversal of inflation closely if they are to fully avoid an economic contraction and achieve their inflation target. Successfully delivering lower inflation and monetary policy normalization should bode well for equities and bonds. As always, there are several potential risks looming, and investors should proceed carefully.

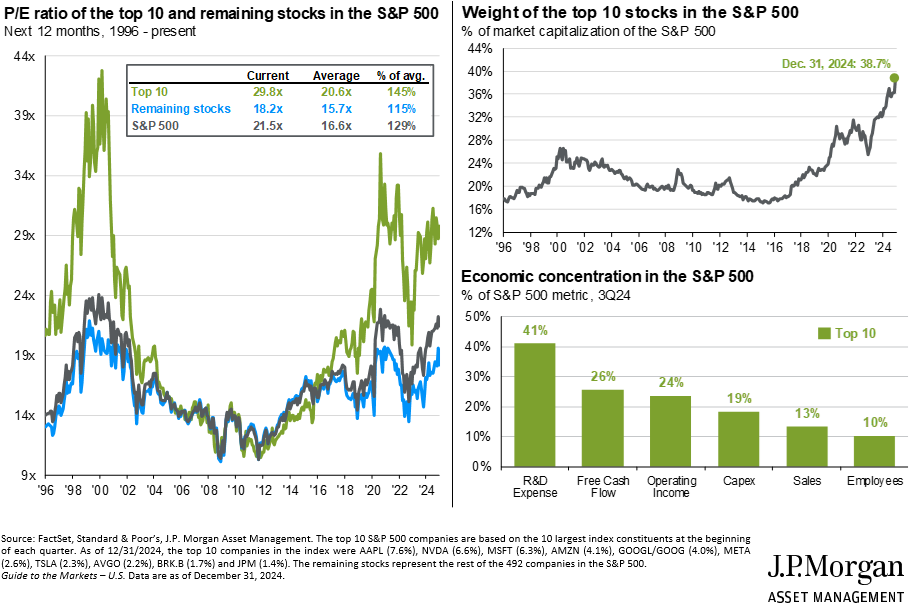

By most measures, the S&P 500 remains overvalued. According to FactSet, as of December 15, the forward 12-month Price-to-Earnings Ratio (P/E) was 22.3x, which is higher than both the 5-year and 10-year averages of 19.7x and 18.1x, respectively. Valuations continue to pose a risk to the market, as negative sentiment can lead to sharper sell-offs. Furthermore, the concentration of the Top 10 largest stocks in the S&P 500 poses a significant concentration risk. According to JPMorgan Asset Management, the 10 largest constituents represent 38.7% of the index as of December 31. Concentrations of this magnitude make the index more sensitive to changes in its top constituents, particularly when those 10 companies are significantly more overvalued than the remaining 490 companies, as is the case in the current environment. The P/E of the top 10 is currently 29.8x, while the remaining stocks currently boast a P/E of only 18.2x, both of which are above their historical averages. Concentrations like this are precisely why we favor global diversification across several asset classes, both public and private. This high level of concentration also supported our decision to reduce overall large-cap exposure, particularly to large-cap technology stocks, in our public model allocations as we enter the new year.

Looking under the hood of public markets, corporate profits remain resilient despite elevated borrowing costs. This trend is illustrated by the S&P 500’s fifth consecutive quarter of positive earnings growth, rising 5.9% in Q3 2024. As of December 20, FactSet estimates fourth-quarter earnings to expand at a faster pace of 11.9% year-over-year.

Since 2023, the Magnificent Seven has been responsible for most of the market’s earnings growth, increasing 31%, versus the -4% contraction of the remaining 493 companies’ earnings in the S&P 500 last year. This trend is expected to persist in 2024, but we remain optimistic as JPMorgan predicts the remaining companies outside the Magnificent Seven to catch up and accelerate earnings growth in the forward-looking environment. Both groups are expected to experience robust year-over-year earnings growth of 21% and 13%, respectively, in 2025. A broadening of earnings growth should bode well for increased market breadth and carve a path for higher broad-based returns for equities outside the Magnificent Seven.

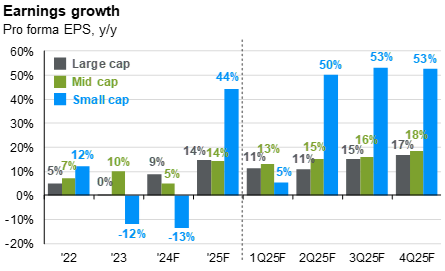

Perhaps even more encouraging is the rebound and contribution to earnings growth expected from both mid- and small-cap companies. While elevated rates will continue to cause issues for some smaller companies, earnings for small caps are expected to grow 44% in 2025. When coupled with easing monetary policy, potentially pro-business fiscal policies like deregulation, international trade, and lower tax rates, the backdrop appears encouraging for mid- and small-cap companies; hence supporting our decision to eliminate our underweight and increase exposure in our allocations to align with our long-term target allocations.

From the political crisis in South Korea, to the government collapses in France and Germany, to the armed conflicts, notably in the Middle East, where tensions between Israel and Iran escalated, and in Russia-Ukraine, and the threat of intensifying conflicts between China and Taiwan – international markets are on fragile ground. As these international disputes unfold, they have a cascading effect on market sentiment, influencing everything from currency valuations to sector performance. The specter of further geopolitical instability remains a crucial factor to monitor in the upcoming year, with potential policy responses from global leaders poised to have far-reaching consequences for economic forecasts and asset allocations worldwide. One of the most significant economic initiatives anticipated in 2025 is the resurgence of tariffs under President Trump’s administration. Known for a protectionist stance, Trump’s economic strategy could reignite trade tensions globally as the administration revisits import tariffs with the goal of reshoring jobs and boosting domestic manufacturing. This strategy is expected to lead to a more protectionist trade policy, potentially affecting global trade dynamics and introducing volatility into markets sensitive to international trade. Given the disruption abroad, paired with a strengthening dollar, we further reduced our allocations to foreign equities.

Interest rate volatility was once again prevalent in 2024, and while we expect this trend to continue in 2025, we do anticipate more moderate moves. Markets repriced their growth and inflation expectations over the second half of the year, pushing long-term rates (as measured by the 10-Year Treasury) back over 4.5%. At this point, with so much unknown on the path of inflation and the fiscal policy front with Trump entering office, barring an exogenous event, we would expect long-term yields to remain range-bound, producing a return relatively in line with the coupons on bonds. We also expect to witness further bull steepening – where shorter-term yields fall quicker than longer-term yields, eventually normalizing the yield curve back to upward sloping, albeit given the latest Fed rate projections, at a slower pace than previously anticipated.

In conclusion, Q4 2024 capped off another year of significant market gains and economic resilience. The Federal Reserve’s pivot towards monetary easing provided a tailwind for both stocks and bonds, setting the stage for an interesting 2025. With so much uncertainty surrounding the changing political landscape and resulting policy changes, we enter the year with our allocations balanced and in line with our long-term targets. The reset to our allocations reflects our expectations for volatility in 2025 as markets work through the political noise and reassess potential economic ramifications, and, on the other hand, our expectation for solid earnings growth across U.S. equities. Diversification across several public and private market asset classes should serve clients well in 2025. As always, investors should remain vigilant to potential risks while positioning themselves to capitalize on opportunities in the evolving market landscape.

Thank you for your continued confidence and support. If you have questions or concerns, please contact your Centura Wealth advisor.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on the market and other conditions. These documents may contain certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Centura Wealth Advisory is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Centura Wealth Advisory and its representatives are properly licensed or exempt from licensure. 12255 El Camino Real, St. 125, San Diego, CA 92130.