Q4 2025 Market Wrap: The Year of Transition: Navigating the Intersection of Policy, AI, and Private Markets

2025 was a year marked by key policy decisions, the explosion of artificial intelligence (AI), and a resurgence in private markets. The introduction of China’s DeepSeek AI model kick-started the year, fueling a competition amongst the technology “hyperscalers” competing in the AI arms race. This year also witnessed major policy decisions and consequences, including tariffs, a new tax bill, a record-breaking government shutdown, and three interest rate cuts from the Fed.

Arguably the most notable policy conundrum was created by President Trump’s “Liberation Day” tariffs. Announced in April and broadly implemented in August, these tariffs and their chaotic roll-out added uncertainty to markets and put the Federal Reserve in a significant bind with how to best manage their ‘dual’ mandate of combating inflation and maintaining full employment. Throughout the year, the Fed found themselves torn between the potential inflationary impact of rising goods prices due to tariffs and the potential economic slowdown caused by dropping trade levels and delayed corporate investment due to supply chain uncertainty.

As it turned out, inflation has remained stubbornly above the Fed’s 2% target, while the labor market is showing early signs of weakness (compounded by a very fast uptake in AI), continuing to complicate the Fed’s ultimate monetary policy response. The Fed’s approach, viewed as overly cautious by the administration, has been one of “wait and see,” a stance that is expected to continue in 2026. The strong Q3 2025 GDP report slowed the expected pace of rate cuts, with the 2026 median Fed Funds rate projected at 3.4%, only about 30 basis points below current levels. While a new Fed Chair may influence the future path of interest rates, we do not expect the pace of cuts to accelerate dramatically, regardless of who helms the Board. Another consequence of this policy uncertainty was the shift away from U.S. assets, with international equity markets outperforming U.S. markets by over 16% and the U.S. dollar posting a sharp decline.

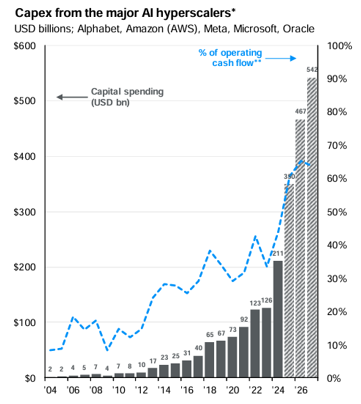

The other defining event of 2025 was the rapid adoption of AI. Regardless of where you turned, AI was the topic of discussion. From doomsayers to evangelists, everyone had a view; however, AI has undeniably become part of our daily lives. Adoption rates have been head-spinning: 99% of Fortune 500 companies report using AI in some capacity, and anecdotes suggest small- and medium-sized companies are not far behind. This rapid adoption led to a massive boom in capex for data centers and their surrounding ecosystems.

Source: JPM Guide to the Markets.

*Hyperscalers are the large cloud computing companies that own and operate data centers with horizontally linked servers that, along with cooling and data storage capabilities, enable them to house and operate AI workloads.

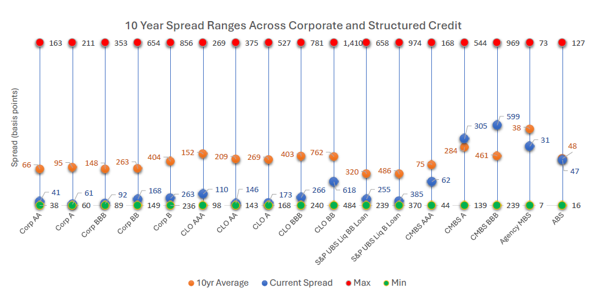

This spending was so significant that it accounted for an estimated 30% of total U.S. capex in 2025 and contributed nearly 1% to total U.S. GDP – much of it ($121 billion) funded by debt issuance. This AI boom has driven up index valuations and maintained the concentration of growth in the “Magnificent Seven,” who currently represent roughly one-third of the S&P 500’s total market capitalization and continue to trade at stretched valuations relative to the remaining constituents, despite a modest reduction in concentration from previous peaks. AI capex is expected to expand further in 2026, with some estimates exceeding $1 trillion. Whether these valuations are warranted will likely be determined in 2026 and 2027, as investors demand a clearer path to returns and lenders increase credit spreads to compensate for higher risk.

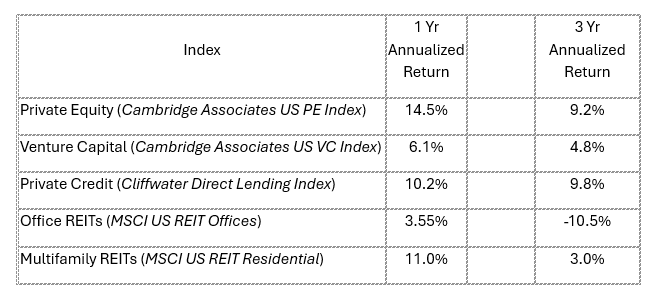

Lastly, 2025 saw the outlook for private assets improve after a difficult 2024. Private asset fundraising has skyrocketed over the last decade, with private equity (PE) reaching roughly $6 trillion in AUM and private credit on course to hit $3 trillion by 2028. This represents a near-doubling of private asset AUM over ten years. We initially saw signs that general partners (GPs) were struggling to deploy cash, as valuation mismatches and a moribund IPO market made investor distributions difficult to generate. However, conditions improved in the latter half of 2025: Q3 saw a record number of PE deals and a reopening in IPO market. Additionally, regulatory changes allowing 401(k) plans to invest in PE could unlock $500–$600 billion in new inflows.

Private credit markets have been bolstered by increased standardization and the surge in data center construction. Risk-adjusted returns remain solid, typically delivering high single-digit returns with relatively low volatility. Conversely, private real estate continues to struggle compared to other private assets and public markets. Offices remain the weakest sector, delivering negative returns through Q4 2024 (the most recent data available), while other sectors saw only modest returns as income just barely outpaced price depreciation.

All in all, 2025 was a year marked by transformation – whether transformative technologies like AI or policies like tariffs that threaten the current world order. The events of 2025 laid the foundation for what could be an interesting 2026, with broadly positive economic and market trends expected, but a need for prudent decision-making and risk management.

We expect much of these trends to continue albeit with the potential for higher volatility as the market focuses on AI profits and clarity on interest rate policy from the Fed, further described in our 2026 outlook below.

2026 Outlook: Climbing a Wall of Worry…

There is a phrase coined in the 1950s that markets “climb a wall of worry,” a phenomenon where prices rise amid uncertainty and pessimism. There are always lots of things to be worried about, and the markets rarely seem without pressing risks and downsides. Our job as investors is to rationally weigh the pros and cons and to be brave when others get fearful.

The outlook for markets in 2026 is constructive despite a range of headwinds – including labor market weakness, elevated valuations, and geopolitical uncertainty – that are likely to generate periods of heightened volatility. The U.S. economy is expected to deliver solid growth supported by an AI-driven productivity surge, while consumer price inflation should continue to moderate, providing the Federal Reserve with flexibility to respond should growth weaken more than expected.

The counterbalance to rising productivity is reduced demand for labor. Labor market softness remains a concern, particularly as unemployment among college graduates is expected to continue rising. We also expect the U.S. dollar to remain under pressure as foreign investors and central banks continue efforts to diversify away from U.S. dollar–denominated assets due to U.S. policy uncertainty. Debt markets may emerge as an additional source of volatility in 2026, as the rapid expansion of debt-financed investment in data centers has yet to be fully supported by corresponding revenue generation.

Outside the U.S., the global economy is expected to weaken only modestly as the effects of tariffs on trade flows stabilize. The global economy appears to be adjusting to the “new normal” in trade with greater resilience than initially anticipated. While concerns surrounding Chinese growth persist, a sharp deterioration in global growth is not expected over the next twelve months.

U.S. equity market fundamentals remain intact, with double-digit earnings growth projected for fiscal year 2026 (approximately 14–15%). Although valuations remain elevated and could be a source of volatility, particularly in the first half of 2026, they do not appear extreme enough to warrant more than a market correction. Small-cap stocks should finally benefit from a supportive backdrop of lower interest rates, solid domestic growth, and more attractive valuations.

International markets should continue to be supported by a broadly accommodative global monetary policy environment, with Japan as a notable exception. U.S.-based investors are also likely to benefit from continued U.S. dollar weakness.

Bond markets are expected to remain relatively stable, with limited movement in yields or credit spreads unless triggered by equity market volatility. One area of focus will be the potential for stress in private credit markets to spill over into public credit, making credit spreads a key indicator to monitor.

Private assets are likely to deliver an “average” year. Returns may be constrained by a substantial overhang of undeployed capital in private equity and private debt, as well as a real estate market still recovering from excess capacity in office and multifamily segments.

The Bottom Line: We encourage investors to remain invested but to expect increased volatility given elevated valuations and leadership changes at the Federal Reserve, particularly in the first half of the year. Investors should view periods of market dislocation as opportunities to selectively deploy capital or rebalance portfolios.

Below you can enjoy deeper dives on the macro economy and each of the major asset classes.

As we enter 2026, our team is excited to continue bringing you market updates and managing your portfolios. Thank you for your continued trust and support. If you have questions or concerns, please contact your Centura Wealth advisor.

Economy & Asset Class Summaries

The Macro Economy

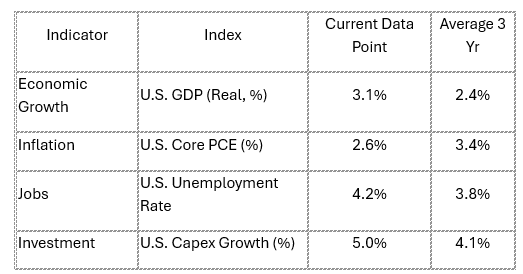

The U.S. economy appears to be in relatively robust shape: inflation has moderated, GDP growth remains solid, and the Federal Reserve has steadily, albeit cautiously, cut borrowing costs. Consumer spending and capital expenditures propelled the U.S. economy to a strong 4.3% GDP growth rate in Q3 2025 even as concerns about the lower-income consumer emerged. Inflation remained elevated above the Federal Reserve’s 2% target but does not appear to be on the brink of major reacceleration.

More recently, the labor market has shown signs of weakening, drawing concerns from both consumers and policymakers alike. Additionally, the emergence of a “K-shaped” economy has amplified the divergence in outlook between high- and low-income consumers – a theme that is likely to persist in 2026, particularly as returns to capital continue to outpace returns to labor thanks to the ongoing AI boom.

Economic growth in the rest of the world is also expected to slow modestly as economies move further away from pandemic-era stimulus and adapt to declining global trade volumes associated with tariffs. The IMF expects GDP growth in China, Japan, and India to slow in 2026 by roughly 0.4 percentage points relative to 2025 baseline levels, while the Eurozone is expected to continue to underperform with growth of approximately 1.1%.

Key Macro Indicators

Notes:

- Trailing 1-year GDP reflects strong late-2025 growth offset by weaker early-year quarters.

- Core PCE remains above target but has materially decelerated from the 2022–2023 period.

- Capex growth reflects AI- and infrastructure-related investment strength.

Outlook

The U.S. economy should post respectable real growth of approximately 2.2% in 2026. The consumer sector, while leveraged, remains in relatively solid financial condition, particularly in the higher-income cohort. Employment markets are softening modestly but remain healthy relative to long-term historical norms.

AI-enhanced productivity gains should be a defining feature of 2026. Provided inflation remains contained, further labor market weakness can likely be offset through additional monetary easing.

Risks

- Tariff-related price pressures emerge later and more forcefully than expected.

- The AI boom displaces workers faster than anticipated, leading to a sharper-than-expected decline in consumer demand.

- Credit markets push back against rising U.S. government debt levels or an AI-driven investment bust triggers instability across public and private debt markets.

The Bottom Line: The U.S. economy is expected to remain “K-shaped,” with a widening bifurcation between workers who benefit from and those threatened by the AI boom. Interest rates should continue to decline modestly, providing support to housing activity and capital investment.

U.S. Listed Equities

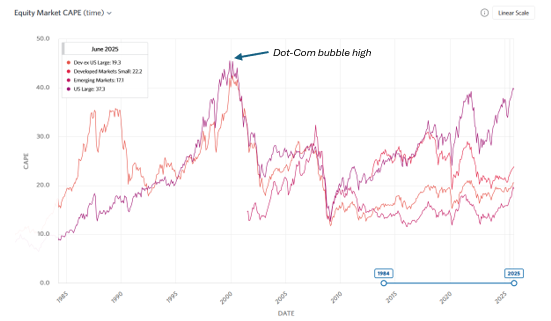

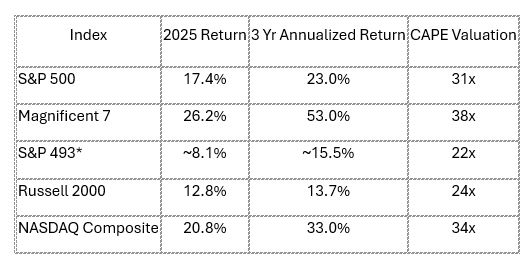

U.S. equity markets were driven primarily by investor expectations surrounding the AI investment cycle and anticipated Federal Reserve rate accommodation. Valuations for the S&P 500 remained elevated, though still below the extremes reached during the 1999–2000 Dot-Com boom. Valuations also remained clearly bifurcated between large-cap growth stocks and the rest of the market.

Market breadth improved over the course of the year; however, index-level returns continued to be disproportionately driven by the “Magnificent 7” and other AI hyperscalers.

Source: Research Affiliates

Equity Market Performance & Valuation

Notes:

- CAPE are cyclically adjusted Price Earnings (PE) ratios and are less sensitive to cyclical fluctuations than traditional PE measures.

- The S&P 500 ex-493 calculation is done using EOY index weights for each calendar year.

Outlook

Equity market fundamentals remain solid, with earnings growth expected to be approximately 14% for the S&P 500 and 35% for the Russell 2000. While valuations for the broad large-cap market remain elevated – largely driven by enthusiasm surrounding hyperscalers and AI-related capital investment – any valuation-driven pullback is more likely to take the form of a correction (<20%) rather than a full bear market (>20%).

Modest rate cuts should continue to support equity valuations, and tariff-related disruptions are expected to have largely worked through the system. Additionally, there is a record amount of money sitting in money market funds – suggesting any dip in markets may have plenty of buyers. A lower valuation hurdle combined with declining borrowing costs should disproportionately benefit small- and mid-sized companies relative to their larger peers.

Risks

- AI adoption proves real, but profitability fails to materialize at levels sufficient to justify current valuations.

- The K-shaped economy becomes more pronounced, with labor markets weakening faster than the Federal Reserve can ease policy.

- Rising U.S. public and private debt levels trigger concerns in credit markets, leading to higher yields and widening spreads.

The Bottom Line: We expect the S&P 500 to deliver solid but unremarkable returns in 2026 – high single-digit to low double-digit gains – with year-end results likely masking a volatile first half of the year. Small-cap equities should outperform in this environment, provided labor market conditions do not deteriorate more sharply than anticipated.

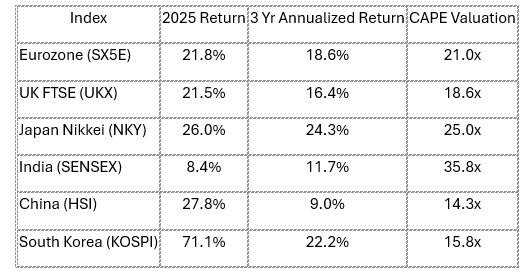

International (Ex-U.S.) Equities

With the global economy firmly in a “not too hot, not too cold” environment and a weaker U.S. dollar, overseas equity markets shook off tariff-related concerns and posted strong gains across the board. Emerging markets outperformed developed ex-U.S. markets, with several countries delivering returns in excess of 50% beginning shortly after the “Liberation Day” announcement by the Trump Administration.

This performance suggests that the ultimate impact of tariffs proved less severe than initially feared and, when combined with lower valuation hurdles, allowed international markets to outperform.

International Equity Performance

Outlook

The economic outlook outside the U.S. is weaker than domestic conditions, with the IMF forecasting modestly slower growth in 2026 relative to 2025 across most regions. However, the drivers of U.S. dollar weakness remain intact and should continue to bolster returns for U.S.-based investors holding international assets.

While valuation gaps have narrowed somewhat following the overseas equity rally, U.S. equities remain expensive relative to their international peers. In addition, sector composition outside the U.S. remains attractive, offering diversification benefits. Finally, although the AI investment boom has been concentrated primarily in the U.S., AI-related technologies are expected to diffuse globally over time, delivering similar productivity gains across international markets.

Risks

- The Trump Administration has made strategic ambiguity a hallmark of its trade negotiations, and any renewed trade hostilities could destabilize markets.

- The global economy is expected to weaken modestly; a more pronounced slowdown would likely weigh disproportionately on international markets.

- Geopolitical tensions in Europe (Russia/Ukraine) and Asia (China/Taiwan) could lead to periods of heightened volatility as markets reassess risk.

The Bottom Line: With U.S. equity valuations remaining elevated and U.S. dollar weakness expected to persist, international equities should remain a relatively attractive and defensive allocation for the next 12 months.

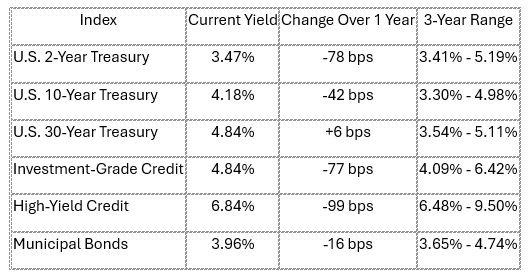

The Bond Market

The bond market entered 2024 with expectations of two 25-basis-point rate cuts by the Federal Reserve but ultimately received three, allowing the yield curve to steepen over the course of the year. Longer-term interest rates have declined less than short-term rates due to lingering concerns over inflation. Credit spreads – the premium investors demand over U.S. Treasuries – remained at historically tight levels, supported by the generally robust health of U.S. corporate balance sheets.

Fixed Income Market Snapshot

Outlook

Inflationary pressures stemming from tariff implementation are expected to continue moderating, and the Federal Reserve has indicated the potential for an additional 25–50 basis points of rate cuts in 2026, although there remains an unusually wide range of views among committee members. Credit spreads are expected to remain near the tighter end of their historical range.

Source: Palmer Square Capital Management. Data as of 9/30/2025.

Risks

- Underwriting standards in the below investment grade credit market continue to weaken, increasing the risk of future defaults.

- Commercial real estate remains a persistent area of concern for the banking sector.

- Stress among regional banks could become more systemic if economic conditions deteriorate.

The Bottom Line: The traditionally “boring” bond market is likely to remain so, characterized by a positively sloped yield curve and relatively narrow credit spreads. That said, credit markets could experience periods of volatility, particularly if equity market turbulence increases.

Private Markets

Private Equity

After a difficult period for exits in 2023 and 2024, the private equity market showed improvement in 2025, marked by increased deal flow, a reopening of the IPO market, and a narrowing of valuation gaps. Strong demand for liquidity and distributions to limited partners also drove a surge in the secondary market, which recorded historically high transaction volumes. Capital deployment remained disciplined, with managers favoring technology-enabled services, healthcare, infrastructure adjacencies, and niche industrials, while weaker consumer-facing businesses continued to face headwinds. Overall, performance dispersion widened materially, reinforcing the premium placed on manager selection, underwriting rigor, and portfolio operating capabilities.

Private Credit

Private credit markets in 2025 remained resilient despite elevated credit differentiation and ongoing stress among cyclical and consumer-exposed borrowers. Market activity was supported by refinancing demand, sponsor-backed deal flow, and continued disintermediation from traditional banks, while spreads and covenant protections stayed favorable for borrowers relative to pre-2022 conditions.

Following strong performance in 2024, issuance was further bolstered by sustained demand for floating-rate structures and an AI-driven surge in financing for data centers, a trend expected to carry into 2026. Distress and amendment activity increased in select portfolios, leading to higher loss recognition among weaker managers, but top-tier lenders benefited from conservative capital structures, tighter documentation, and disciplined sector exposure. Overall, yield profiles remained attractive on a risk-adjusted basis, and investors continued to view the asset class as a strategic income allocation characterized by meaningful manager-to-manager performance dispersion.

Private Real Estate

Private real estate continued to face headwinds, particularly from weakness in the commercial office segment and oversupply in the multifamily sector, which depressed returns across the asset class. Capital rotated toward credit-oriented real estate strategies, single-family rental, specialized logistics, and select Sunbelt markets with stronger demographic tailwinds. Toward the latter part of the year, supply-and-demand dynamics began to show signs of stabilization, improving the outlook for 2026.

Private Market Performance Snapshot*

*Please note: all private asset index returns typically are subject to reporting lags and revisions. Additionally, different indexes have different compositions.

Outlook

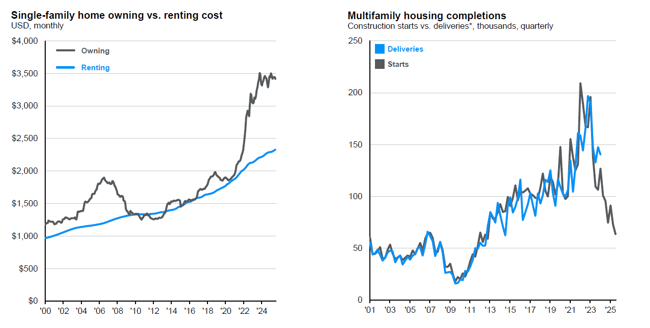

2025 was a lackluster year for real estate but there are positive trends worth monitoring: the cost of owning a home continues to be at all-time highs, strengthening demand in the multifamily sector, and multifamily starts have decreased dramatically since 2022 highs, showing signs of an improving supply-demand imbalance.

Source: JPM Guide to the Markets.

As a whole, private assets are likely to generate returns broadly comparable to public markets when adjusted for differences in leverage. While each asset class is influenced by distinct drivers and idiosyncratic factors, the recent influx of capital into private markets, combined with higher borrowing costs, is expected to compress returns relative to the post-GFC era, making manager selection increasingly important.

Risks

- A significant overhang of undeployed capital in private equity may pressure returns if capital is forced into lower-quality opportunities.

- Continued growth in private debt markets, alongside weakening covenant protections, increases the risk of contagion in the event of credit stress.

- Ongoing weakness in the office real estate sector, coupled with any additional deterioration in labor markets, could further weigh on multifamily performance.

The Bottom Line: There remains a compelling case for private assets, both for their potential to enhance returns and to reduce portfolio volatility. However, many of the same macroeconomic forces influencing public markets are also impacting private markets. As a result, while private assets have historically delivered excess returns as compensation for illiquidity, we expect this illiquidity premium to compress in 2026, with private market returns approximating those of public markets overall. In this environment, return outcomes are likely to become increasingly manager-dependent, with higher-quality managers continuing to generate alpha while weaker managers risk lagging even public market alternatives, making manager selection more critical than ever.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on the market and other conditions. These documents may contain certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Centura Wealth Advisory is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Centura Wealth Advisory and its representatives are properly licensed or exempt from licensure. 12255 El Camino Real, St. 125, San Diego, CA 92130.