Why Investors Use Multifamily Real Estate as a Hedge Against Inflation

With inflation reaching 40-year highs, investors are eager to find investments to hedge against the decreasing value of their money. Multifamily real estate can provide opportunities for investors to protect themselves against their declining purchasing power.

Before we dive into how investors can turn to multifamily real estate to navigate these changes, let’s begin with why inflation and rising interest rates are occurring in the first place.

The Fed’s Shift from Quantitative Easing to Quantitative Tightening

In 2020, the Federal Reserve began quantitative easing (QE) to encourage investment and spur economic activity. In this process, the Fed expanded its balance sheet.

These expansions included committing to purchasing:

- $80 billion a month in treasuries, and

- $40 billion in mortgage-backed securities

In June 2022, however, roughly two years after the quantitative easing plan was announced, the Federal Reserve began quantitative tightening (QT) to counteract inflation.

The quantitative tightening process includes allowing its purchased bonds to reach maturity and run off its balance sheet, which results in rising interest rates. Inflation is still heavily prevalent in the American economy. In fact, in Q2 2022, inflation sat at its highest point since 1982.

Why does this matter? Inflation can erode the value of an investor’s assets and negatively impacts the ability to purchase goods.

This considered, investors are looking for opportunities to shelter from inflation. Enter multifamily real estate.

Using Multifamily Real Estate as a Hedge Against Inflation

Multifamily real estate can serve as a hedge against inflation and be an attractive option for investors for several reasons, including that multifamily real estate:

- Has Intrinsic Value

- Recovers Quickly

- And more

Let’s discuss more below.

Multifamily Real Estate Has Intrinsic Value

Multifamily real estate is a necessity-based asset. To put it simply, residents need a place to live. Further, residents experience friction, such as time, cost, and effort if they are to move.

These factors suggest that multifamily real estate holds an intrinsic value and can lead investors to stable or potentially increased cash flow, despite inflation.

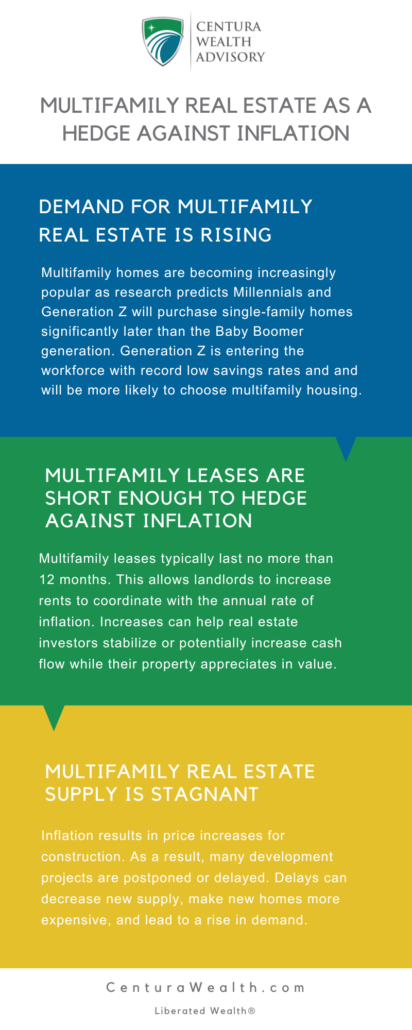

Demand for Multifamily Real Estate is Rising

Multifamily homes are becoming increasingly popular. Why? According to research, Millennials are moving into homes later than the Baby Boomer generation prior. Moreover, Millennials are still experiencing the effects of the recent2 020 financial crisis.

Additionally, Generation Z is entering the workforce with record low savings rates. This suggests most Gen Z will not be putting a down payment on a single-family home anytime soon, and will be more likely to choose multifamily housing.

Multifamily Real Estate Supply is Stagnant

Inflation typically results in price increases for construction. As a result, many development projects are postponed or delayed. These delays can decrease new supply, make new homes more expensive, and lead to a rise in demand.

Rent Rate Raising Due to Inflation

Rent rates across the nation have continued to trend upwards, climbing year over year. The average rental rate for a one-bedroom apartment is up 26.5% and two-bedroom apartments are up a similar 25.7%.

Rent raises allow investors to combat the effects of inflation.

Multifamily Leases: Short Enough Hedge Against Inflation

Multifamily leases typically last no more than 12 months.

This allows landlords to increase rents to coordinate with the annual rate of inflation. These increases can help real estate investors stabilize or potentially increase cash flow. Additionally, their multifamily investment appreciates in value.

Multifamily Real Estate Recovers Quickly

Investors often view multifamily real estate as “inflation resistant.” Why? This form of investment doesn’t typically drop in value as much as other assets during challenging market times. Additionally, multifamily real estate tends to recover faster than other investments.

For example, during the COVID-19 pandemic, the demand for other assets, such as office and retail buildings, dipped. However, the demand for multifamily real estate remained high. Short leases allow investors to utilize this demand and adjust rent raises.

Tune Into Our Podcast to Learn More

In Episode 57, Chris Osmond speaks with Paul Kaseburg, Chief Investment Officer of MG Properties, about investment opportunities in the multifamily real estate market and how they help you cope with rising inflation rates.

The discuss:

- How real estate, in general, responds to inflationary pressures

- The advantages of multifamily over other types of real estate investments

- Latest trends in cap rates and cost of debt that real estate investors should know about

- How inflation is impacting the affordability gap between single-family homes and apartment renting

- And more

How Else Can Investors Navigate Inflation?

At Centura Wealth Advisory, we are dedicated to our role as stewards in leading our clients to purposeful financial planning and investing strategies to ensure their success.

One of our goals is to help our clients navigate and understand challenging economic changes, such as the current rising interest rate environment and inflation.

Review our article “How to Plan and Invest in a Rising Interest Rate Environment” for more information.

Disclosures

Centura Wealth does not make any representations as to the accuracy, timeliness, suitability, or completeness of any information prepared by any unaffiliated third party, whether linked to or incorporated herein. All such information is provided solely for convenience purposes and all users thereof should be guided accordingly.

We are neither your attorneys nor your accountants and no portion of this material should be interpreted by you as legal, accounting, or tax advice. We recommend that you seek the advice of a qualified attorney and accountant.

For additional information about Centura, please request our disclosure brochure as set forth on Form ADV using the contact information set forth herein, or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you engage our firm for advisory services.