During the process of selling a business, owners have many obstacles to navigate: processes, taxes, and, of course, deciding what to do next.

In this article, we’ll discuss the different types of taxes a business owner may encounter when selling their business, as well as options for how to invest the proceeds.

How to Navigate Taxes While Selling Your Business

In the process of selling a business, taxes tend to be one of the most significant aspects to consider.

The IRS separates taxable income into two main categories: “ordinary income” and “realized capital gain.”

Capital Gains Tax: What is it and How Does it Work?

In simple terms, a capital gain is a profit gained from an investment. When you sell a business, the capital gain is the difference between the original cost and the sale price.

Taxes on capital gains taxes come into play when you sell the business because capital assets are being sold. Capital gains tax is charged on all capital gains. A net long-term capital gain is usually no higher than 15% for most taxpayers, though there are some exceptions for high earners.

What is Ordinary Income?

Ordinary income includes earned wages, rental income, and interest income on loans, CDs, and bonds (except for municipal bonds). For tax purposes, short-term capital gains are treated as ordinary income on assets held for one year or less.

How does this relate to selling your business? Gains on some of the assets being transferred may have to be taxed at ordinary income tax rates rather than at the 15 percent maximum long-term capital gains tax rate.

Let’s Talk Depreciation Recapture

Depreciation recapture is “the gain realized by the sale of depreciable capital property that must be reported as ordinary income for tax purposes. Depreciation recapture is assessed when the sale price of an asset exceeds the tax basis or adjusted cost basis. The difference between these figures is thus “recaptured” by reporting it as ordinary income.”

What does this mean for business owners? The IRS can collect taxes on any profitable sale of an asset that the taxpayer had used to previously offset taxable income.

What to do After Selling Your Business

Business owners may not be sure where to start when it comes to investing the proceeds of the sale of their company. During this time, business owners may want to utilize the help of professional advisors – such as our team as Centura Wealth Advisory – to take a fresh approach curated to the current conditions of the market as well as the goals of the client.

Let’s review some investment options business owners can consider after selling their business.

Structured Notes

A structured note is “a debt obligation that also contains an embedded derivative component that adjusts the security’s risk-return profile. The return performance of a structured note will track both the underlying debt obligation and the derivative embedded within it.”

Structured notes, written by high credited banks, are customizable and well-suited for a rising interest rate environment and can help investors maintain returns. Due to these benefits, more individuals and families are investing using structured notes.

Listen to an Example: Our Client, Doug Pate

In Episode 62 of the Live Life Liberated podcast, Kyle Malmstrom interviews Doug Pate, a client of Centura Wealth Advisory (Centura), who recently sold his business, International Surf Ventures Inc., after growing it for 17 years.

Doug Pate co-founded ISLE with his best friend, Marc Miller. Doug and Marc share a lifelong passion for the ocean and the sports that surround it. In their first four years of business, they sold surfboards online. At the time, there was no direct-to-consumer surfboard company, and by default, they became the industry’s pioneers. In 2008, they shifted their focus from surfboards to stand-up paddle boards as a way to help more people get on the water across the country.

In this podcast, Doug discusses:

- His personal experience of navigating a business exit

- How the team at Centura guides him through investing using structured notes

- How CLATs helped him save seven figures in taxes and achieve his charitable goals

- Why wealth protection is as important as growing your wealth

- Centura’s involvement in his wealth management (including alternative investments)

- And more

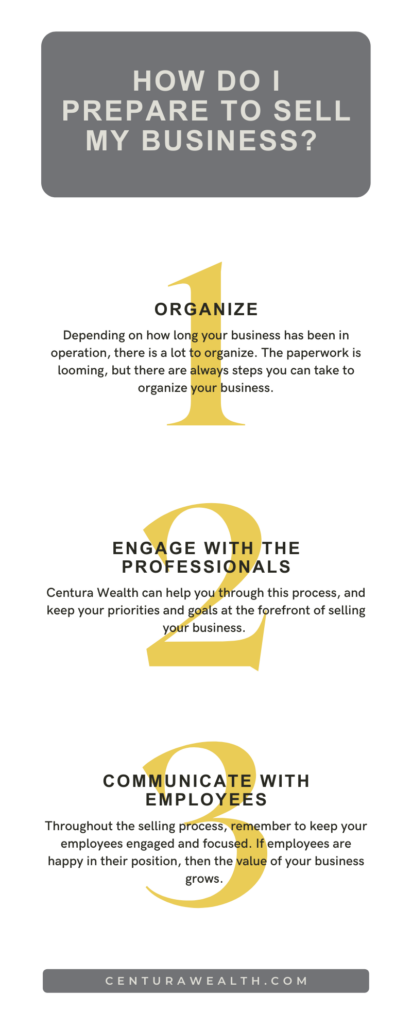

Selling Your Business?

Centura Wealth can help you navigate the process with ease. Learn how to prepare to sell your business here.

Disclosures

Centura Wealth does not make any representations as to the accuracy, timeliness, suitability, or completeness of any information prepared by any unaffiliated third party, whether linked to or incorporated herein. All such information is provided solely for convenience purposes and all users thereof should be guided accordingly.

We are neither your attorneys nor your accountants and no portion of this material should be interpreted by you as legal, accounting, or tax advice. We recommend that you seek the advice of a qualified attorney and accountant.

For additional information about Centura, please request our disclosure brochure as set forth on Form ADV using the contact information set forth herein, or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you engage our firm for advisory services.