The Importance of Systems and Processes in Financial Management

Financial management is a process by which an individual or an organization organizes and enhances its financial situation through strategies such as:

- Investment management

- Retirement planning

- Tax planning

- Estate planning

- And more

Managing your financial portfolio alone can feel overwhelming. At Centura, we act as a financial partner to our clients, as we steward them toward the strategies that will work best for their unique situations. With that being said, we often use systems and processes to assist in the financial management process.

What are Financial Management Systems?

A Financial Management System (FMS) is the software and processes an organization uses to manage income, assets, and expenses. The FMS utilizes several functions to simplify financial management, such as maintaining complete audit trails as well as coordinating income statements, expense statements and balance sheets.

Further, a Personal Management System (PFM) performs similar functions to enhance the financial management of an individual or family, such as reducing accounting errors, maintaining audit trails, balancing checks, and automatically paying bills.

Why are Financial Management Systems Important?

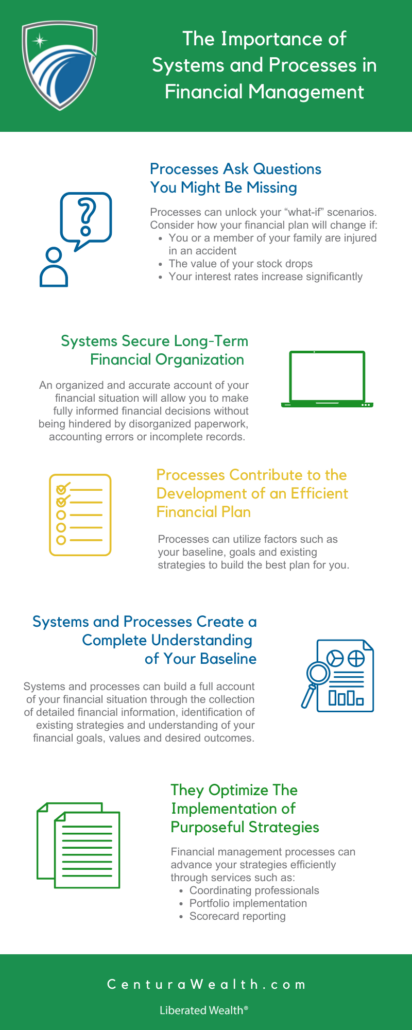

Financial management systems and personal management systems are important because they secure long-term financial organization and efficiency. This organization will allow you to make fully informed decisions about your finances without being hindered by disorganized paperwork, accounting errors, or incomplete or inaccurate records.

What are Financial Management Processes?

Financial management processes are, in their simplest terms, plans and procedures which will help an individual, family or institution reach their financial goals. These processes can include a series of steps, such as:

- Identifying financial goals

- Gathering financial and personal information

- Analyzing financial information

- Developing a customized financial plan to achieve these goals

Read on to learn How Centura Supports Goals-Based Investing.

Why Are Financial Management Processes Important?

You Gain a Better Understanding of Your Portfolio

Processes can build an accurate and complete account of your existing financial situation through the meticulous collection of detailed financial information, identification of existing strategies, as well as the development of an understanding of your financial goals, values and desired outcomes.

You are in a Better Position to Plan for the Future

Going through a financial plan can unlock your “what-if” scenarios. Consider how your financial plan will change if:

- You have to take care of your parents or family members

- You or a member of your family are injured in an accident

- You decide to become more philanthropic

- The value of your stock drops

- Your interest rates increase significantly

- You decide to move

- The college tuition for your child(ren) increases

Financial Management Processes Set You Up for Future Success

Regularly creating a financial plan can help you analyze your baseline, goals, existing strategies, and what-if scenarios. Through this analysis, you find what plan would best fit your needs.

At Centura, our advisors aim to understand not only your financial needs but also life events that may impact your finances. We work to create a relationship with you in order to guide you toward the best financial decisions.

It Helps You Keep a Pulse on Your Financial Performance

Implementing financial systems and processes that work for you is an essential aspect of analyzing your financial performance. Performing these processes on a regular basis allows you to make adjustments when necessary and gain a better understanding of your overall performance.

These regular adjustments ensure your plan is efficient, evolving with market conditions, and continues to align with your financial goals.

Interested in using financial processes to enhance your financial management but not sure where to start?

We want to help! Learn more about our 5-Step Liberated Wealth Process and how Centura can help you liberate your wealth.

Centura Wealth does not make any representations as to the accuracy, timeliness, suitability or completeness of any information prepared by any unaffiliated third party, whether linked to or incorporated herein. All such information is provided solely for convenience purposes and all users thereof should be guided accordingly.

We are neither your attorneys nor your accountants and no portion of this material should be interpreted by you as legal, accounting, or tax advice. We recommend that you seek the advice of a qualified attorney and accountant.

For additional information about Centura, please request our disclosure brochure as set forth on Form ADV using the contact information set forth herein, or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you engage our firm for advisory services.