Your Retirement Checklist: Elements to Consider

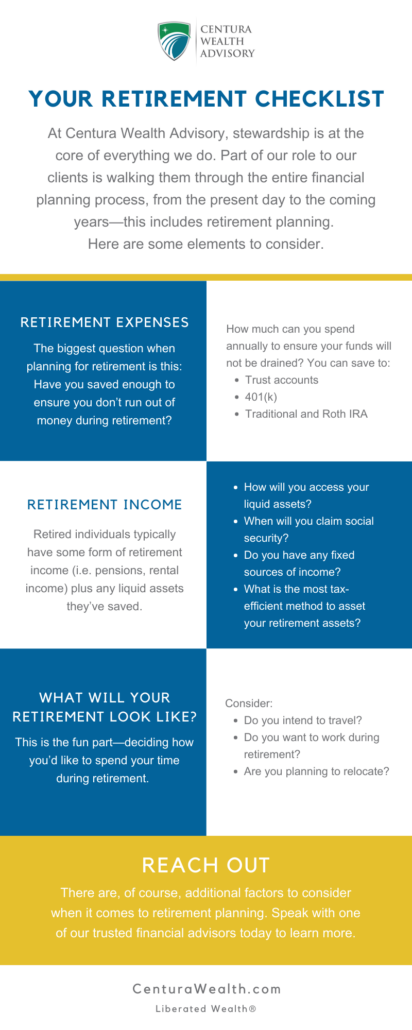

At Centura Wealth Advisory, stewardship is at the core of everything we do. We believe in partnering with our clients to liberate their wealth management process. Part of our role as stewards is walking our clients through the entire financial planning process, from the present day to the coming years.

One of the main areas we address with our clients is their retirement plans. After a long career, many people dream of retirement. Whether it be spending your free time volunteering, making memories with your grandchildren, or sipping a piña colada on a tropical beach, one thing you don’t want to have to worry about is money.

In order to relieve this stressor, a lot of financial planning and coordination has to occur. Today, we’ve outlined your retirement checklist, and while it is not your one-stop shop for all of your retirement planning (we’d recommend reaching out to a trusted financial advisor for that), it does include the various elements to consider prior to leaving your career.

Your Retirement Expenses: Questions to Consider

There are many questions an individual, along with their trusted financial planner, can review in order to fine-tune the logistics of their retirement. The biggest question when planning for retirement is this: Have you saved enough to ensure you don’t run out of money during retirement?

In order to answer this question, you need to identify how much you can spend annually to ensure your funds will not be drained. Luckily, throughout one’s life, there are a variety of different retirement accounts you can save to trust accounts, 401(k), traditional and Roth IRA accounts, and so on.

Once you retire, certain expenses will be reduced, eliminated, and/or added. To further carve out your budget, ask yourself if:

- You’ll be expected to financially support any family members

- You anticipate going on any big family vacations or need a medical procedure

- You might have any large one-off payments (for example, a wedding or car)

- Your mortgage will be paid off

- You will have to pay expenses that are currently being paid by your employer (i.e. medical and/or dental insurance, utilities, automobiles)

Consider all of these elements to help plan your expenses during this time.

Your Retirement Income

The idea of no longer receiving a recurring paycheck can be unsettling; however, research shows that retirement has been around since as early as the 1800s – this considered, we know there are ways to make it work.

Retired individuals typically have some form of retirement income (i.e. pensions, rental income) plus any liquid assets they’ve saved.

Tax Planning

Retirement tax planning, however, is a whole different story. You want to ensure that you can access your assets as tax-efficiently as possible.

Below are some questions to consider when identifying your retirement income.

- How will you access your liquid assets?

- When will you claim social security?

- Do you have any fixed sources of income? (i.e. rental income, pensions, annuities, etc.)

- Are there opportunities (Roth IRA) for creating tax-free income that you can access down the road?

- What is the most tax-efficient method to asset your retirement assets?

What Will Your Retirement Look Like?

This is the fun part—deciding how you’d like to spend your time. As previously mentioned, there are many ways to spend your retirement: volunteering, spending time with grandchildren, sipping down piña coladas on a tropical beach, and the list goes on.

Many people, however, fail to recognize just how much time comes with retirement. For most, they gain 40 or more hours a week (when you factor in commuting) to do whatever they please.

Having some sort of structure for the weeks and days can be helpful—especially for those who felt their career was a large part of their identity. Consider the following questions when deciding what your retirement might look like:

- Do you intend to travel? With family, friends, a partner, or alone? International or local?

- Do you want to work? On what level? Will you volunteer or work a part-time job?

- Are you planning to relocate? If so, in or out of state? Out of the country even? It’s important to consider how expenses and taxes in a different location than where you are currently might size up.

A Final Word

There are, of course, various additional factors and considerations when it comes to retirement planning; for example, asset allocation, loss of bonuses, your stock portfolio, and more. This article is just a jumping-off point.

There’s no article that could detail all these elements as precisely as speaking face to face with a trusted financial advisor like those at Centura Wealth Advisory.

Interested in more? Read on to learn how to optimize your retirement plan, then get in touch with our team of stewards today.