Market Month in Review – November 2024

At a Glance

Inflation & Labor Data: Headline and core PCE inflation data increased in October to 2.3% and 2.8%, respectively (vs. 2.1% and 2.7% the month prior). The PCE increases were in line with expectations but introduce concerns that inflation will remain sticky. After September’s noisy labor report, the October report, published on December 6, will be widely anticipated. The unemployment rate remains at 4.1%.

U.S. Election: Since the election on November 6, markets have been assessing potential policy changes and cabinet appointees from President-Elect Trump, ushering in a “Trump Trade.”

Fed & Monetary Policy: The Fed continued their easing cycle by cutting interest rates another 25-bps in November. Inflation and labor market data remain hyper-important as the Fed continues to be data dependent. There is one final FOMC meeting in 2024 in December, which will likely witness another rate cut and an update to the Fed’s Summary of Economic Projections, providing insights into the possible monetary policy activity for 2025 and beyond.

Equity Markets: Equity markets continued their year-to-date run-up in November, with major equity indices continuing to notch record highs. The S&P 500 reached its 53rd all time high (ATH) in 2024 on November 29.

Asset Class Performance

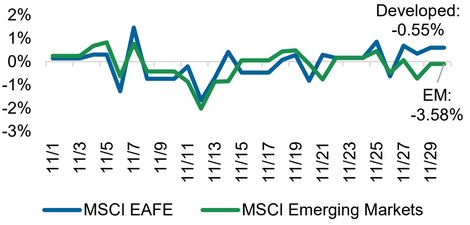

The “Trump Trade” took full effect in November, as news of President Trump’s re-election reverberated through global markets. Emerging markets were hit the hardest, a direct result of Trump’s tariff threats and a surging U.S. Dollar. Conversely, U.S. equities fared the best, led by small cap stocks, which stand to benefit from expected Trump policies, including de-regulation and greater reliance on domestic companies.

Source: YCharts. Asset class performance is presented using total returns for an index proxy that best represents the respective broad asset class. U.S. Bonds (Bloomberg U.S. Aggregate Bond TR), U.S. High Yield (Bloomberg U.S. Corporate High Yield TR), International Bonds (Bloomberg Global Aggregate ex-USD TR), U.S. Large Cap (S&P 500 TR), U.S. Small Cap (Russell 2000 TR), Developed International (MSCI EAFE TR), Emerging Markets (MSCI EM TR), and Real Estate (Dow Jones U.S. Real Estate TR).

Markets & Macroeconomics

Elections and Rate Cuts and Earnings, Oh My!

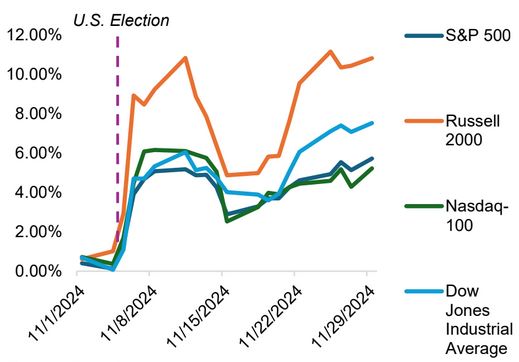

Markets digested a lot of information in the month of November, including the results of the U.S. election, another Fed interest rate cut, and a slew of 3Q earnings reports. While markets experienced volatility intra-month, they ended the month solidly up, with major indices like the S&P 500 and Russell 2000 turning in their best monthly results of the year, gaining 5.7% and 11.0%, respectively, in November.

The results of the U.S. election in early November brought news of another Trump Administration and a “red sweep” across Congress. Markets reacted positively to this outcome, with small caps as measured by the Russell 2000 up nearly 8% from November 4, the day before the election, through November 6, the day after the election. The market enthusiasm in small caps was primarily due to Trump’s promise of “deregulation,” which has the potential to positively impact smaller companies more than larger ones. Market participants also started positioning around Trump’s stance on tariffs, immigration, and other potential policy decisions. Cryptocurrency is another asset class benefiting from Trump’s re-election, illustrated by Bitcoin’s run-up of over 140% in 2024. Fervor related to the so-called “Trump Trade” waned over the course of the month as much uncertainty remains around the extent of Trump’s policies.

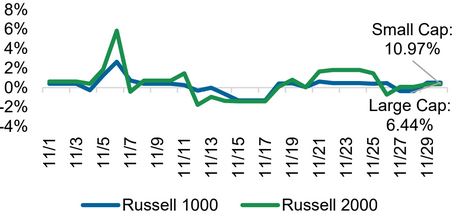

Exhibit 1: Equity Markets Pre- and Post-Election

One day after the Presidential election results were declared, on November 7, the Federal Reserve cut interest rates by 25 bps, continuing their policy easing. The Fed has continued to reiterate its “data dependent” approach, particularly as it concerns inflation and labor data. Whether the policies outlined in the Trump agenda have the potential to impact the course of monetary policy is of no concern to the Fed – they remain independent from politics and focused on a broad set of data to determine their policy trajectory, not speculation of potential fiscal policy changes. The Fed meets one more time in 2024 in December, where they will publish a new set of economic projections, providing important data on what to expect in 2025.

Source: YCharts

Finally, 3Q earnings season is drawing to a close, with over 95% of companies having reported already. Earnings have now grown for five quarters in a row, and expectations for 4Q are expected to double the growth seen in 3Q, with broader contributions from companies outside the Magnificent Seven expected. Year-over-year earnings growth was led by the Health Care and Communication Services sectors, meanwhile the Energy sector was the most challenged in 3Q. As company earnings continue to grow, so too do major equity indices, with the S&P 500 and Dow Jones indices notching multiple all-time highs over the course of the month. The S&P 500 now has 53 all-time highs in 2024. Equity markets remain slightly overvalued, making it important to not just consider large cap stocks, but diversify across asset classes and sectors.

The Bottom Line: November was an eventful month, with the U.S. election, an interest rate cut, and the 3Q earnings season keeping markets busy. As the “Trump Trade” took effect, we saw markets end the month higher, as illustrated by the number of all-time highs by major U.S. equity indices. The Fed continues its easing policy which may come into conflict with Trump’s fiscal agenda in 2025.

Looking Ahead

Wrapping Up 2024

With 2024 drawing to a close, there are still a few events left that have the potential to drive market activity in the final month of the year: the December Federal Open Markets Committee (FOMC) meeting, including the publication of the Fed’s latest economic projections, and, of course, Santa Claus!

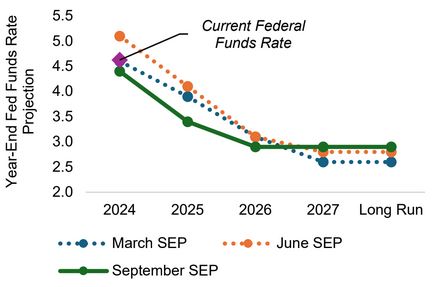

Every quarter, the Federal Reserve updates their projections for future GDP growth, unemployment, inflation, and interest rates in a publication titled the Summary of Economic Projections, the “SEP” or “Dot Plot” for short. Updates to the Dot Plot inform market participants about the trajectory of interest rates, both in the short- and long-term, and this trajectory can shift course as economic data changes. Throughout 2024, the Fed has been extremely “data dependent” with monetary policy, meaning their decisions have been heavily influenced by monthly macroeconomic data points, particularly inflation and unemployment data. This data has guided the Fed in their decision-making and has resulted in changes to their economic projections, as illustrated in Exhibit 2 below, which shows the March, June, and September SEP or Dot Plot projections. What we learned from these projections is that the latest Dot Plot in September showed interest rates elevated at a higher level in the long-term (2027 and beyond) than previous projections in March and June, indicating a slower pace of rate reductions. The December Dot Plot, which will be published on December 18, will provide important clarity on whether the Fed’s thinking has changed based on the latest macroeconomic data. We could also see an additional rate cut at the December FOMC meeting.

Exhibit 2: Changing Fed Funds Projections

Source: The Federal Reserve

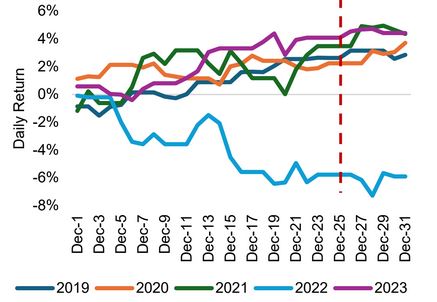

As markets assess the Fed and the direction of monetary policy, they may also get to experience the magic of Santa Claus this December. The “Santa Claus Rally” is a technical market phenomenon explaining why equity markets advance in the final week of the year. This phenomenon is illustrated in Exhibit 3 below, where four out of the past five years saw equity market gains in the last week of December. There are numerous reasons why this phenomenon can occur, with one major explanation being the lower institutional trading volume during the holidays. Some believe a Santa Claus Rally can help set expectations for market performance in the coming year; however, skeptics believe it to be a self-fulfilling prophecy. Either way, wrapping up 2024 could see continued growth in equity markets, and depending on the commentary and decisions from the Fed, may introduce short-term volatility to close out the year.

The Bottom Line: 2024 is wrapping up and two events have the potential to keep markets busy through year-end: the last FOMC meeting, where an interest rate cut is largely expected, in addition to updates to economic projections, and a potential for a Santa Claus Rally, which could drive equity markets even higher to end the year.

Exhibit 3: S&P 500 Recent December Returns

Source: YCharts

Capital Markets Themes

What Worked, What Didn’t

•Small Caps Take Off: Small cap stocks, as measured by the Russell 2000 Index, were up nearly 11% in November, spurred by the “Trump Trade” and policy implications that would stand to benefit smaller domestic companies.

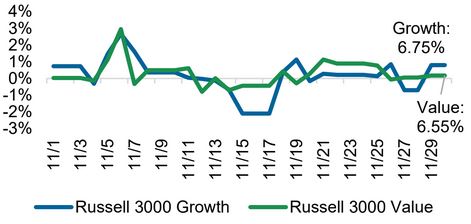

•Growth vs. Value Equity: While growth equities have largely outperformed value equities in 2024 due to the tech- and AI-boom, these two styles performed roughly in-line with one another in November, illustrating how equity market participation may be starting to broaden outside of tech.

Large vs Small Cap Equity

Growth vs Value Equity

Developed vs Emerging Equity

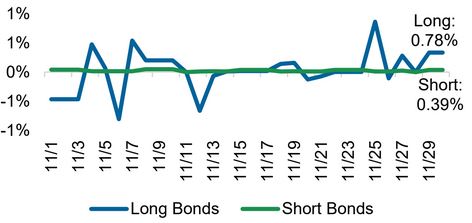

Short vs Long Duration Bonds

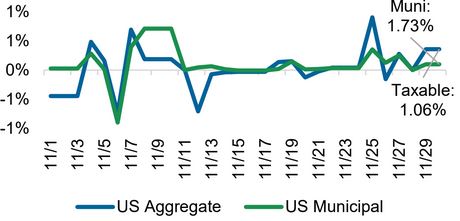

Taxable vs Municipal Bonds

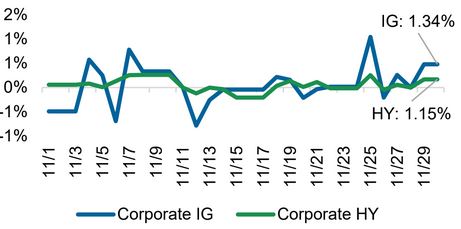

Investment Grade vs High Yield Bonds

Source: YCharts. Data call-out figures represent total monthly returns

On Alternatives

The Outlook for Private Credit

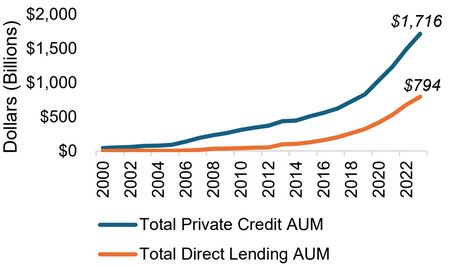

The private credit market is around $1.7 trillion in size and has grown nearly two-fold in the past 10 years. Most of this growth has been in the direct lending sector of the market, which represents close to 50% of the entire private credit market, illustrated in Exhibit 4 below. Direct lending is a form of private lending to small- or medium-sized companies without the use of an intermediary, typically in the higher quality, or senior, portion of the company’s capital structure.

Exhibit 4: Private Credit AUM

Source: Preqin. Data as of 6/30/2024

Direct lending, and private credit as a whole, is predominately floating rate, meaning that the underlying debt instrument is tied to a rate, typically the secured overnight financing rate (SOFR), that can fluctuate over its life, i.e., the rate “floats.” SOFR is an interest rate that is directly tied to the federal funds rate, meaning that as the fed funds rate increased in 2022 and 2023, so did SOFR, and, subsequently, the yields for private credit. Conversely, this means the opposite also holds true in the current environment: as the Fed cuts interest rates, the yields across private credit are expected to decline, albeit at a delayed cadence to rate cuts.

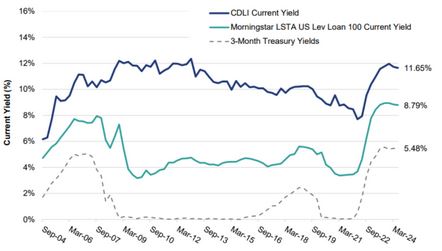

Illustrated in Exhibit 5, private credit has recently enjoyed elevated yields of close to 12%, measured by the private credit benchmark, the Cliffwater Direct Lending Index (“CDLI”). Compared to the public credit alternative, short-term Treasury bills, private credit offers a yield advantage of nearly 6%. This yield advantage helps explain why private credit has seen such strong inflows in recent years.

While declining interest rates typically lead to lower yields for private credit, they also reduce the interest burden on companies, particularly the smaller companies that direct lending targets. Smaller-sized companies are more sensitive to interest rates, meaning they benefit more when rates fall. This creates a double-edged sword in

the private credit market: lower rates mean lower yields, but they also ease the burden on borrowers, potentially reducing default risks and overall investment risk.

Although investors may not see yields of 11% or higher moving forward, private credit still offers elevated yields and other advantages, such as diversification from traditional fixed income – a key

benefit that has become even more important in the falling rate environment.

Exhibit 5: Private vs. Public Credit Yields

Source: Cliffwater

The Bottom Line: The outlook for private credit is changing, driven by falling interest rates which will reduce yields within the asset class over time. Falling rates should also reduce the interest burden on companies targeted by direct lending. Private credit still offers advantages against traditional fixed income, including higher yields and diversification benefits, which remain paramount in the current environment.

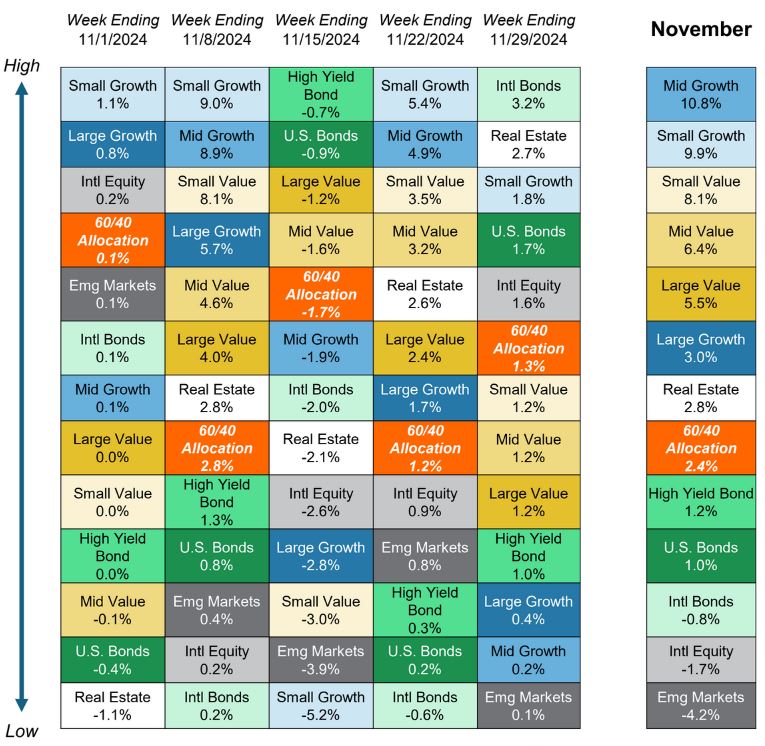

Asset Class Performance Quilt

Markets are ever-changing, making diversification across asset classes and sectors a critical component to portfolio construction. As illustrated below, a Balanced 60/40 portfolio provides greater consistency of returns and less volatility over time.

Source: YCharts. Asset class performance is presented using market returns from an exchange-traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by Centura Wealth Advisory. The performance of those funds may be substantially different than the performance of broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High Yield Bonds (iShares iBoxx $ High Yield Corp Bond ETF); Intl Bonds (Invesco International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares Core MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares US Real Estate ETF). The return displayed as “60/40 Allocation” is a weighted average of the ETF proxies shown as represented by: 40% U.S. Bonds, 12% International Stock, and 48% Large Blend.

Disclosure: CCG Wealth Management LLC (“Centura Wealth Advisory”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Centura and its representatives are properly licensed or exempt from licensure. Insurance products are implemented through CCG Insurance Services, LLC (“Centura Insurance Solutions”). Centura Wealth Advisory and Centura Insurance Solutions are affiliated. For current Centura Wealth Advisory information, please visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Centura Wealth Advisory’s CRD #296985.