Capital Market Projections & Monte Carlo – Part 2 in series

Executive Summary

- Capital Market projections (mean & variance) serve as parameters for Monte Carlo simulation

- The Monte Carlo Method is used by Centura for Liberated Wealth planning in order to solve complex problems when other methods fail

- Relying on historical data for Monte Carlo simulation may produce misleading results with potentially harmful ramifications (e.g., spending too much, retiring too soon, etc.)

- Forward looking capital market projections incorporate structural market changes that are present today and/or are expected to continue in the future

- Careful consideration of inputs and related assumptions is paramount when crafting long term financial plans and forecasting portfolio returns & risk; garbage in, garbage out

Introduction

Sophisticated projections are critical to crafting a well-designed financial plan and capital market projections are one of many key inputs that play a vital role in doing that. At Centura Wealth Advisory, we pair forward looking capital market projections with the Monte Carlo Method to estimate:

- Probability of a client running out of money before their “end of plan” (i.e., death)

- Most likely “end of plan” value (e.g., wealth transfer, charitable giving purposes)

- Optimal asset allocation strategy for a given plan

Part 1 of this series introduced capital markets, historical returns and forward-looking return/risk projections. In Part 2, we explore the Monte Carlo Method and evaluate the potential pitfalls of using historical results vs. forward looking projections when conducting experiments/simulations. Part 3 of the series will focus on portfolio construction and strategic asset allocation using mean variance analysis. Readers can take our quick assessment survey provided at the end of this blog or found here.

Monte Carlo Method

The Monte Carlo Method is a risk management tool that allows financial professionals to model and predict the future with varying levels of confidence. This tool is particularly valuable when it comes to retirement planning, which tasks advisors with forecasting a wide range of variables including, but not limited to:

- Asset returns

- Future income from all sources

- Asset distributions (withdrawal rate) to support future income shortfalls

- Taxes (based on current law and potential for sunset provision)

- Varying inflation rates for different types of expenses (e.g., general vs healthcare)

- Other volatile, subjective and potentially unknown factors as well

Problems of this nature are too complicated to solve with one formula, so we must employ an alternate approach.

Enter, the Monte Carlo Method. This method uses scenario modeling to predict a range of future possibilities, all with varying levels of probability (or likeliness to occur). At the upper end of the range are the very best scenarios (90th percentile), and at the lower end of the range lie the worst (10th percentile). At the midpoint of this range (50th percentile) lies the median which represents the most likely end of plan value (best estimate). If all scenarios end in assets at the end of plan above $1, the simulation is considered a success. If assets are exhausted prior to end of plan, it is a failure. The percentage of successful simulations represents the plan’s overall probability of success.

Monte Carlo Experiment: Hypothetical example

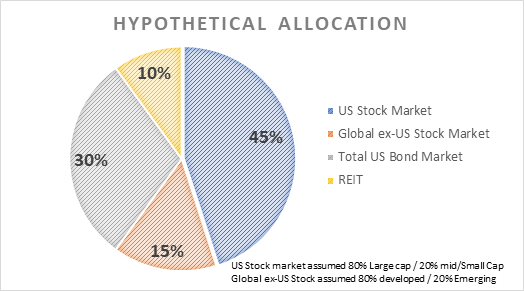

To illustrate how the Monte Carlo Method works, we will run a simple Monte Carlo simulation on a $1,000,000 portfolio invested as follows:

We will first conduct this simulation using historical returns & risk (Chart/Table 1) and then we will re-run the simulation using forward looking return & risk estimates (Chart/Table 2). Last, we will compare the results (Table 3) and highlight any key insights garnered.

Monte Carlo Experiment: Historical Returns

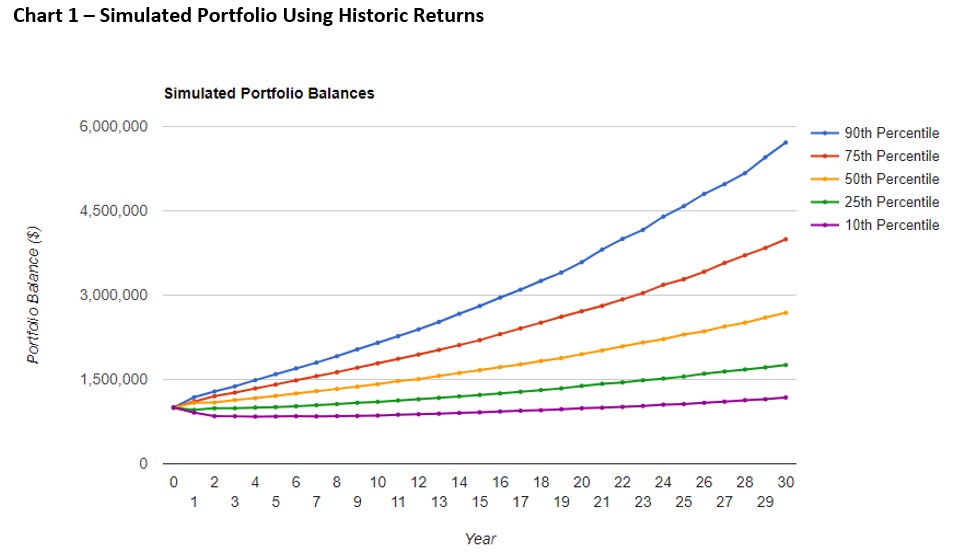

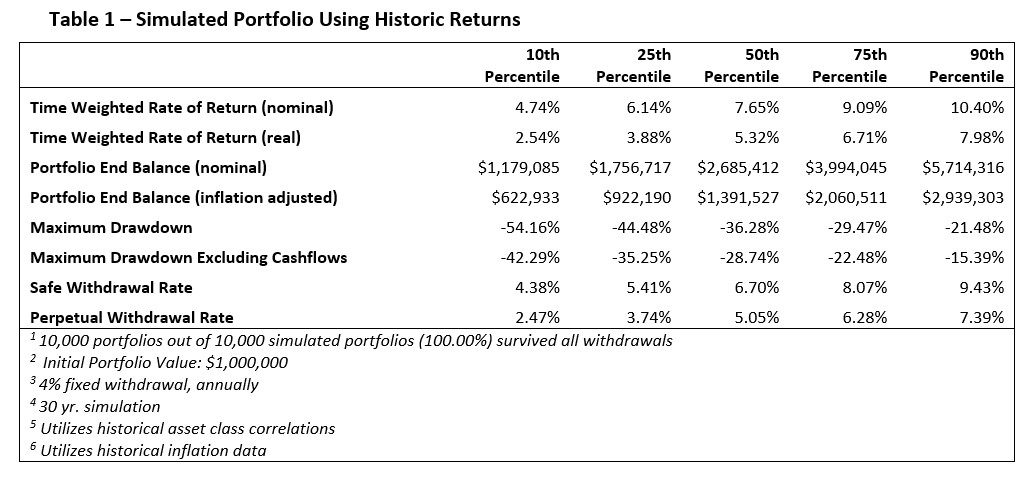

In Chart 1– Simulated Portfolio Using Historic Returns, we show a $1,000,000 portfolio simulation run 10,000 times based on historical asset class returns & risk. The different color lines indicate different percentiles of returns and summary statistics for each percentile can be found in Table 1.

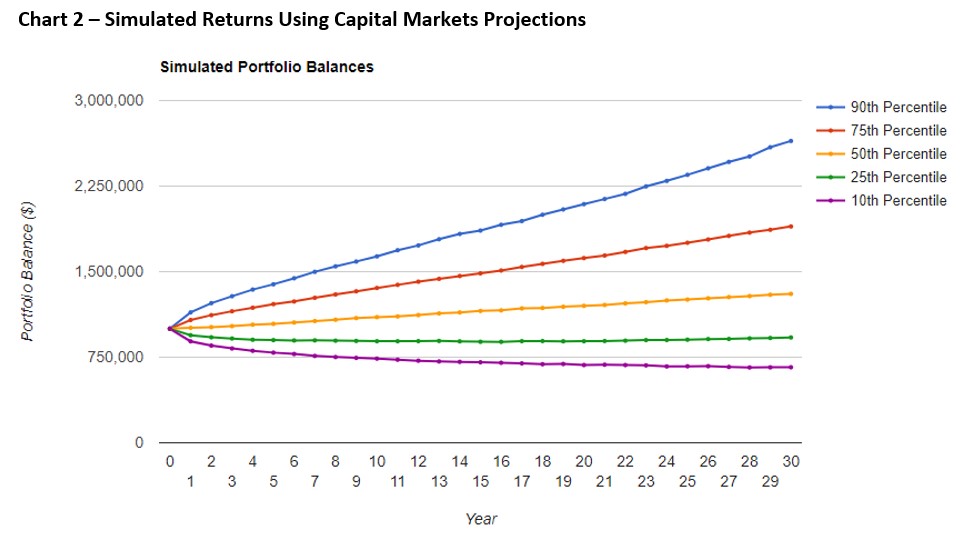

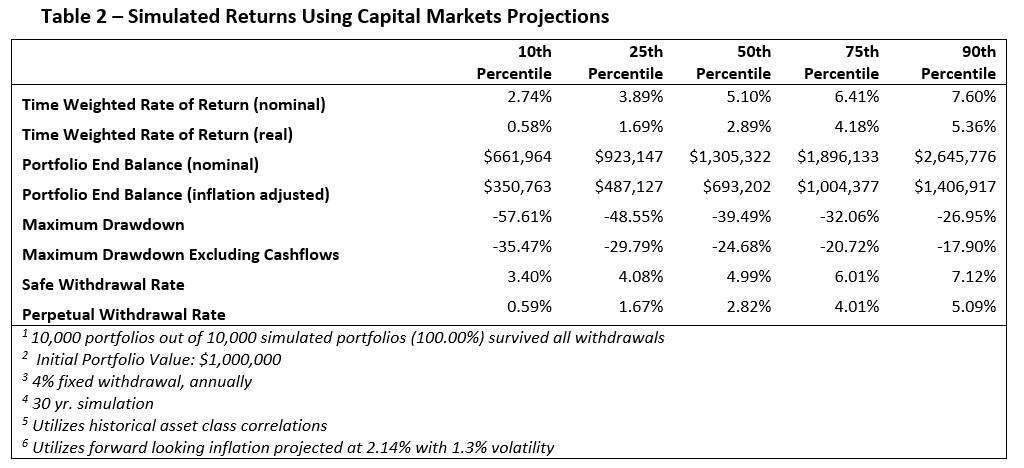

In Chart 2– Simulated Returns Using Capital Markets Projections, we show a $1,000,000 portfolio simulation run 10,000 times based on forward looking asset class returns & risk. The different color lines indicate different percentiles of returns and summary statistics for each percentile can be found in Table 2.

Monte Carlo Experiment: Comparing Results

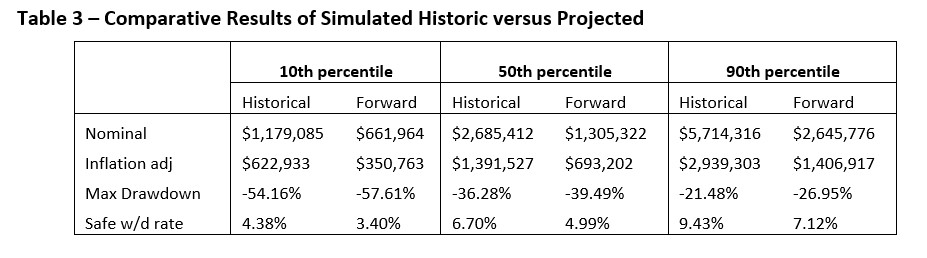

To analyze simulations using historical vs forward looking projections we will select the 10th percentile (worst) returns and 90th percentile (best) returns to compare the nominal and inflation adjusted ending portfolio values as well as maximum drawdown and the safe withdrawal rate; see Table 3 – Comparative Results of Simulated Historic versus Projected.

Comparing statistics in Table 3 reveals some key insights:

- Using historical returns may significantly overstate future portfolio values

- The portfolio’s safe withdrawal rate(s) may be overstated when using historical #’s

- Tail risk (max drawdown) is approximately equal, confirming that forward looking risk is commensurate with historical levels if not slightly higher (i.e., lower expected risk adjusted returns; see Part 1 of Capital Markets Blog)

These insights highlight some of the primary reasons why forward-looking capital market projections are preferred to historical numbers when modeling the risk that someone may run out of money before their “end of plan” (i.e., death). But why do they diverge? One of the primary reasons forward looking estimates diverge from historical results are due to what are known as “structural changes” or shifts.

Structural shifts are changes in the overall landscape of a market/economy, and if not handled properly, skew data. For example, a future riddled with tariffs and global tension is much different than the coordinated global easing (QE) that took place in the wake of the Great Recession. Similarly, the high interest rate environment of the 1980’s is materially different than the low interest rate environment of today, and not accounting for such structural components can produce misleading results; as evidenced above. Thus, investors and advisors must be careful when crafting plans and modeling long term risk.

Conclusion

Monte Carlo simulation is a complex, but effective risk management tool used by Centura that pairs asset forecasting with cash-flow modeling, over a long period of time and allows investors to evaluate the impact of different decisions on their long-term financial wellness.

Monte Carlo simulation usefulness is predicated upon the accuracy of input data whereby capital market return and risk forecasts represent the input parameters. You can determine the status of your current Retirement Plan analysis by taking our quick survey here.

In Part 3 of this series, we explore how these same capital market projections are used to construct portfolios and form strategic long-term asset allocation plans using mean variance analysis and optimization.

Disclosures

Centura Wealth Advisory (“Centura”) is an SEC registered investment adviser located in San Diego, California. This brochure is limited to the dissemination of general information pertaining to Centura’s investment advisory services. The statistical projections contained herein are provided only as an example to illustrate how the choice of methodology impacts those projections. Historical performance is no guarantee of future results and may have been impacted by market events and economic conditions that will not prevail in the future. Investing involves risk, including risk of loss.

Centura Wealth does not make any representations as to the accuracy, timeliness, suitability or completeness of any information prepared by any unaffiliated third party, whether linked to or incorporated herein. All such information is provided solely for convenience purposes and all users thereof should be guided accordingly.

For additional information about Centura, please request our disclosure brochure as set forth on Form ADV using the contact information set forth herein, or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you engage our firm for advisory services.