Sophisticated wealth management is a term used to describe financial planning and investment strategies that are tailored to the unique needs and objectives of high net worth individuals. This type of wealth management typically involves a holistic approach that considers the client’s entire financial picture, including their investments, taxes, estate planning, and other financial matters.

A wealth advisor typically creates a specially tailored investment strategy and plan for their clients to help them manage their assets. This considered, advisors are constantly searching for the ways to streamline and support sophisticated wealth management. At Centura Wealth Advisory, we believe in five steps to support these goals.

Before we discuss, let’s review what wealth management is.

What Is Wealth Management?

In simple terms, wealth management is a service intended to help wealthy individuals meet a diverse set of needs and financial goals. This service is conducted through a consultative process in which an advisor begins by uncovering a client’s unique facts, assumptions and goals. This information then allows advisors to begin crafting a plan that is specific to each client and their situation. Once clients have evaluated options, and made decisions, maintaining a plan and keeping it on track is how advisors steward clients’ wealth over their lifetime (and beyond).

At Centura, the wealth management process includes:

- Uncover – Meticulous discovery process to identify facts, assumptions & goals

- Unlock – Analyzing & Triangulating to unlock issues and opportunities

- Design – Developing a multi-purpose action plan to chart new pathways

- Liberate – Implement planning & portfolio solutions

- Steward – Maintaining plan by monitoring and recalibrating as appropriate

This process allows advisors to define the scope of work and related value that can be provided to clients. Some of that value may be financial gain and other value may be found in more qualitative aspects such as peace of mind and fulfillment of life goals.

Why Are Some Clients Underserved in Wealth Management?

Some clients may notice a gap in comprehensive planning and the service they actually receive.

Financial professionals typically focus on a few key goals for wealthy families and individuals: growing wealth, retaining wealth, transferring wealth, and strategic giving.

While all of these goals are important, perhaps the most significant challenge in wealth management is tax planning. Why? Once a client accumulates a certain level of wealth, depletion by taxation becomes a major concern.

However, this phenomenon – and the overall focus on retaining wealth instead of simply building it – is often overlooked by financial advisors.

That’s why we do things differently at Centura. Let’s take a look at how we close this gap in service.

How do We Close this Gap in Wealth Management Services?

At Centura, we employ several strategies to close this gap:

- We take a holistic planning approach

- We utilize five steps to liberate wealth in a collaborative process

What Does a Holistic Financial Plan Include?

A holistic approach looks at an individual’s lifestyle, goals, values, and priorities to create a financial plan that works for them. Financial planners can coordinate these needs and the lifestyle of their clients in order to create a strategy.

A holistic approach looks at an individual’s lifestyle, goals, values, and priorities to create a financial plan that works for them. Financial planners can coordinate these needs and the lifestyle of their clients in order to create a strategy.

A holistic financial plan may include:

- Investments (portfolio, brokerage accounts, ETFs, mutual funds, etc.)

- Retirement planning (finances and lifestyle, cashflow & liquidity)

- Wealth Transfer planning (Estate Tax, Gift Tax, Generation Skipping Tax)

- College planning

- Budgeting and saving

- Tax allocation (Taxable, Tax Deferred, Tax Free)

- Risk Management Needs including insurance and asset protection

- Income tax planning (forward looking)

- Tax preparation & compliance (rear looking)

5 Steps to Support Sophisticated Wealth Management

As noted earlier, at Centura we have created a comprehensive process that’s specifically designed for ultra-high-net-worth families who have complex financial needs. Our process helps us uncover and solve big and small challenges. Sometimes these are common issues and opportunities for wealthy families, and sometimes they are unique. Our process does not discriminate between uniqueness versus common and therefore is well-adjusted to serve our audience.

Just as important is our passion for finding and solving complex problems. We flourish in the details and how to find creative, innovative and effective ways to find efficiencies that extend and expand your wealth horizon.

1. Uncover

First, we pursue holistic discovery by gathering and understanding data; the client’s purpose, path, and professional roster. Categorically this allows us to identify relevant facts, assumptions and goals.

2. Unlock

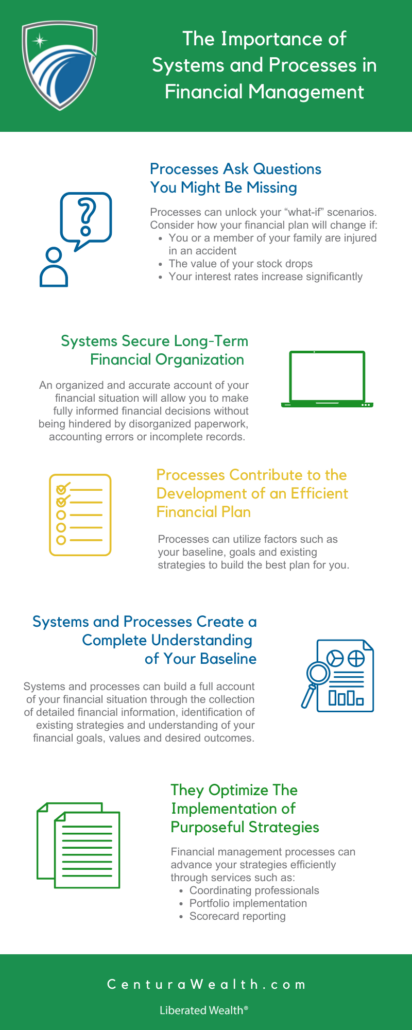

The next phase is to analyze the facts, assumptions and goals to identify issues and opportunities which is done by establishing a baseline plan. We then consider “what if scenarios, and identify a planning scope that can address the unique needs & wants of the client.

3. Design

The design element is a core piece of the Liberated Wealth® process. The design element includes a multi-phase action plan which drives innovative solutions across a span of professionals. At Centura, we serve as the plan architect and coordinate amongst required professionals. As part of this phase, a wealth scorecard is developed and a forward looking approach to the client’s situation is employed.

4. Liberate

This step involves understanding purposeful deployment. This includes implementation and advancement with plan implementation, coordination of professionals, portfolio implementation, and scorecard reporting.

5. Steward

The final step of the Liberated Wealth® process is to monitor and pivot through purposeful deployment. This includes plan monitoring, timely recalibration, and pivoting based on life events.

This is a detailed explanation of what a process can look like for a client. It’s important to understand what the short and long-term goals are for your wealth management and understanding your advisor’s process is the first step to achieving that goal.

All of these steps revolve around the importance of predicting and planning for the future.

Connect With Centura

At Centura Wealth Advisory, we go beyond a traditional multi-family office wealth management firm to offer advanced tax and estate planning solutions which traditional wealth managers often lack in expertise, knowledge, or resources to offer their clients.

We invest heavily into technology and systems to provide our clients with fully transparent reporting and tools to make informed decisions around their wealth plan.

Read on to learn more about our 5-Step Liberated Wealth Process and how Centura can help you liberate your wealth.

Disclosures

Centura Wealth does not make any representations as to the accuracy, timeliness, suitability, or completeness of any information prepared by any unaffiliated third party, whether linked to or incorporated herein. All such information is provided solely for convenience purposes and all users thereof should be guided accordingly.

We are neither your attorneys nor your accountants and no portion of this material should be interpreted by you as legal, accounting, or tax advice. We recommend that you seek the advice of a qualified attorney and accountant.

For additional information about Centura, please request our disclosure brochure as set forth on Form ADV using the contact information set forth herein, or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you engage our firm for advisory services.