Executive Summary

Two retirement reform bills (the SECURE Act and RESA) have been circling around Washington, and if passed, may make significant changes to many retirement and estate plans. Notably, the proposed changes outlined in the bill(s) have meaningful implications as the rules on inherited IRA’s are up for debate. Both the House and Senate have different views on the technical aspects of how tax shelters for inherited wealth could be reduced. Read our blog to learn about the differences in proposed changes for “Stretch IRA’s” and what they could mean for tax planning, wealth accumulation and wealth transfer.

Introduction

Retirement savings and tax laws are inextricably linked. For example, IRA’s, 401(k)’s and other tax deferred retirement vehicles have been designed to assist savers in meeting their future income needs so that Social Security is not the sole source of retirement income. While lawmakers have created different ways to save (e.g., traditional IRA vs Roth IRA), the RMD (required minimum distribution) types of accounts that have currently garnered attention from lawmakers are “stretch” IRA’s. This post will examine new bill(s) from both the US House of Representatives and US Senate, as they pertain to stretch IRA’s, evaluating the potential implications from a financial planning perspective (especially taxes).

What is a Stretch IRA?

A stretch IRA is an estate planning strategy that extends the tax-deferred status of an inherited IRA when it is passed to a non-spouse beneficiary. This approach allows for continued tax-deferred growth of an individual retirement account (IRA) and sets limits to the amount that must be withdrawn each year. The goal of this type of strategy is to limit the required distributions on an inherited IRA, stretching them over time, in order to avoid a large tax bill.

The IRS blesses this approach through Required Minimum Distribution (RMD) factors (based on age), which guide how much of an IRA must be withdrawn each year (at a minimum). The RMD amount withdrawn is taxable and therefore represents revenue to the United States government. Thus, while investors seek to extend the period of withdrawal to be as long as possible, lawmakers looking to accelerate tax revenues have honed in on stretch IRA’s.

Proposed Legislation

On March 29, 2019 the House Ways and Means Committee presented HR 1994, also known as the SECURE Act, which eventually passed on May 23, 2019 and is currently awaiting senate approval. SECURE is an acronym for Setting Every Community Up for Retirement Enhancement and represents a bipartisan bill. In the House bill, inherited IRA’s would need to be withdrawn within a 10-year period. Depending upon taxpayer preference, this could be periodically, at regular intervals, or even ballooned on the back end. Taxes will be paid on the distribution(s) when taken and after 10 years the entire IRA balance must be depleted.

Following suit, on April 1, 2019 the Senate introduced a bipartisan bill known as RESA; Retirement Enhancement and Savings Act. The Senate version allows a “stretch” on the first $400,000 of aggregated IRA’s and the exceeding balance must be distributed within 5 years. Taxes would be paid on the distribution(s) when taken.

Both proposed bills cover a wide range of retirement issues, and allow exceptions for distributions to minor children, disabled or chronically ill beneficiaries, or beneficiaries who are not more than 10 years younger than the deceased IRA owner. Both versions would apply to inherited IRA’s for deaths occurring after December 31, 2019 and are applicable to Roth IRA’s as well as traditional IRA’s and Qualified Plans.

Potential Impact

To illustrate the potential impact of this legislation, we will model three scenarios to garner insight into how they compare and what they might mean for a beneficiary. The three scenarios we will model include:

- Current Law for stretch-IRA’s

- House Bill HR 1994 for stretch-IRA’s

- Senate Bill RESA for stretch-IRA’s

The assumptions we use for all three scenarios include a 50-year-old beneficiary with a 30% effective tax rate (federal & state), inheriting a $1,000,000 traditional IRA. For simplicity, we use a flat effective tax rate of 30% to illustrate the effects of legislation on taxation and assume a linear withdrawal rate on non-stretch assets; however, we note that in reality “bracket creep” is likely to occur, absent tax planning.

Bracket creep means that incremental income (e.g., RMD’s) moves you into higher tax brackets and increases the overall taxes that you pay. This would mean that effective tax rates are likely to be higher than 30% when RMD’s are accelerated (ceteris paribus), exacerbating the punitive effect of taxes and increasing the value of tax planning.

Thus, for individuals at or near retirement (and/or in high tax brackets) accelerated RMD’s as proposed by the House and Senate could have detrimental effects on wealth retention, and tax planning strategies should be considered.

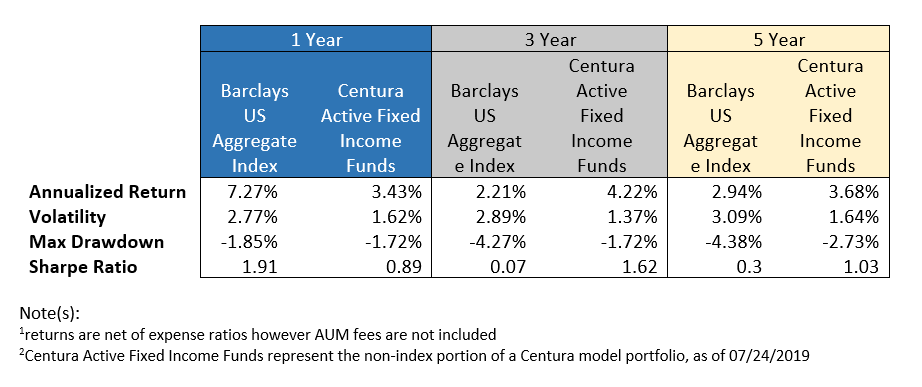

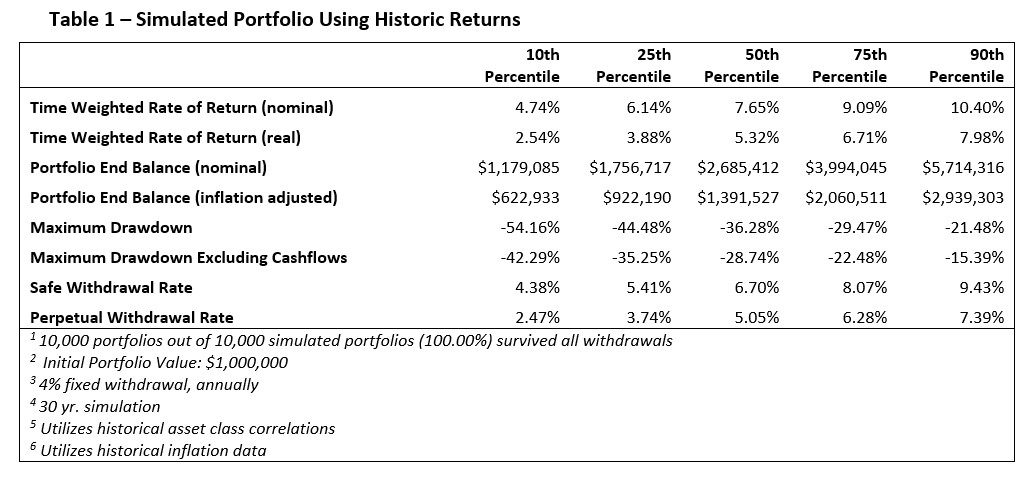

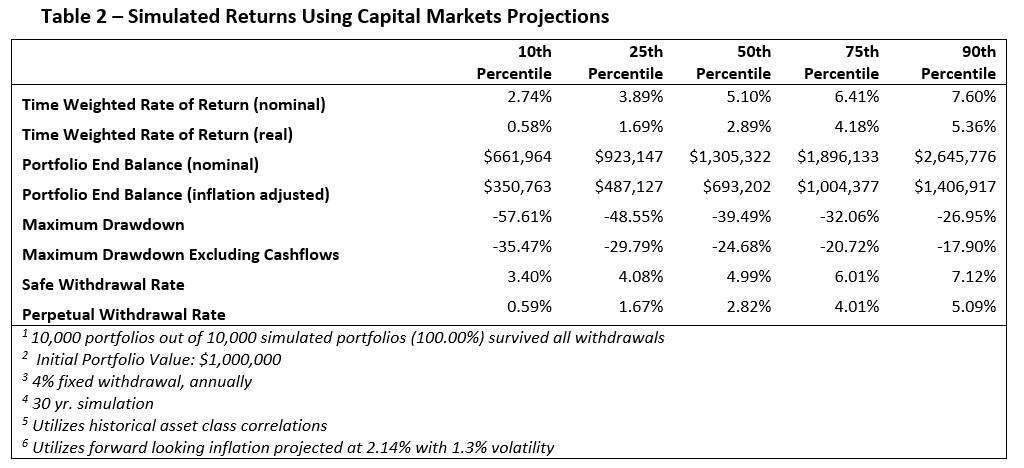

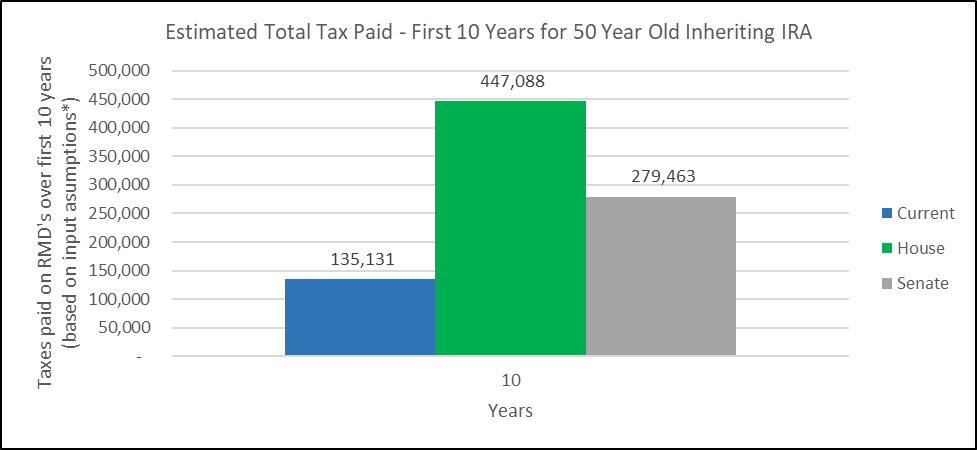

Ignoring the supplemental effects of “bracket creep,” we find that a $1,000,000 portfolio that earns an annualized 8% pays the following taxes over 10 years:

Chart 1 – Estimated Total Tax Paid: Hypothetical Example

Source: Centura Wealth Advisory© 2019

Evaluating the results shown above, we find that under the current law a 50-year-old, at a 30% effective tax rate, would pay $135,131 in total taxes over a 10-year period. This compares to $447,088 in total taxes paid over 10 years under the House Bill (HR 1994) and $279,463 under the Senate Bill (RESA). Intuitively these results make sense as the House Bill is asking beneficiaries to deplete entire account balances over 10 years, whereas the Senate Bill only asks that a portion (in this example 60%) is accelerated over 5 years. See summary results in Table 1.

Table 1 – Summary Results: Hypothetical Example

| Current Law | House Bill | Senate Bill | |

| Beginning IRA Balance | 1,000,000 | 1,000,000 | 1,000,000 |

| Total Tax Paid (10 years cumulative) | 135,131 | 447,088 | 279,463 |

| Total Distributions (10 years cumulative) | 2,207,449 | 1,490,295 | 931,544 |

| Remaining IRA Balance (EOY Yr 10) | 1,535,956 | – | 614,382 |

Source: Centura Wealth Advisory© 2019

Why It Matters?

These proposed legislative changes have huge financial planning implications as increased tax burdens are never welcome. At Centura, we specialize in tax and estate planning, designing plans for 10, 20, 30+ year periods so these changes create new opportunities and strategies for us to discuss (and potentially use) with clients.

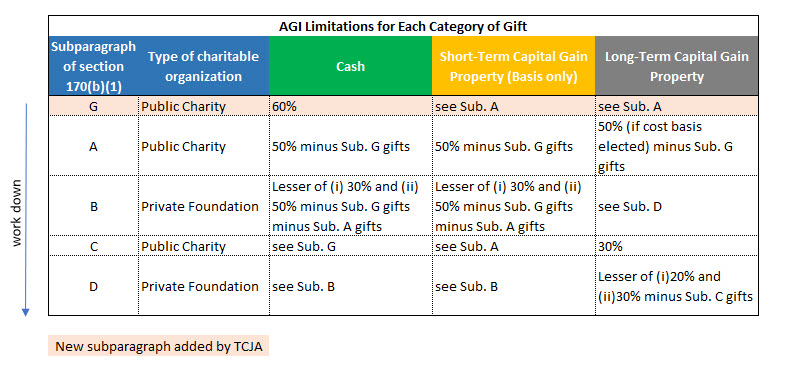

For example, under these proposals Roth conversions become increasingly valuable as does charitable giving; pairing the two together in the right way can liberate wealth transfer, decrease taxes and fulfill philanthropic goals for your estate. Additionally, permanent life insurance will be more valuable as it can be used to pass death benefits tax free to heirs, mitigating the negative impact of taxation on their inherited assets.

Challenges beget opportunities and we believe this legislation has the potential to make sweeping changes to many estate plans. As such, we are closely following this legislation and diligently working to be ahead of the curve with strategies and solutions to deploy. We encourage clients (and advisors) to follow this proposed legislation, and if passed, contact us to discuss the ramifications and appropriate solutions.

Disclosures

Centura Wealth Advisory (“Centura”) is an SEC registered investment adviser located in San Diego, California. This brochure is limited to the dissemination of general information pertaining to Centura’s investment advisory services. Investing involves risk, including risk of loss.

Centura Wealth does not make any representations as to the accuracy, timeliness, suitability or completeness of any information prepared by any unaffiliated third party, whether linked to or incorporated herein. All such information is provided solely for convenience purposes and all users thereof should be guided accordingly.

We are neither your attorneys nor your accountants and no portion of this material should be interpreted by you as legal, accounting or tax advice. We recommend that you seek the advice of a qualified attorney and accountant.

For additional information about Centura, please request our disclosure brochure as set forth on Form ADV using the contact information set forth herein, or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you engage our firm for advisory services.