Investing in the stock market can be an exciting and rewarding experience, but it can also be unpredictable and risky. One way to mitigate risk is to have a diversified portfolio, which means investing in a variety of different assets to spread out risk.

In today’s volatile market conditions, diversification is more important than ever to protect your investments.

Diversification: A Key Strategy for Mitigating Risk in Your Portfolio

Diversification is a crucial strategy for mitigating risk in an investment portfolio. By spreading investments across different asset classes, investors can reduce the overall risk and increase the potential for long-term returns. This section explores the significance of diversification and its benefits.

Understanding Asset Classes

To effectively diversify a portfolio, it is essential to understand different asset classes. Asset classes represent different types of investments, each with its own risk and return characteristics. This section provides an overview of some common asset classes and their roles in diversification.

Stocks

Stocks represent ownership shares in publicly traded companies. They offer the potential for high returns but also come with a higher level of risk. Stocks are influenced by various factors, such as company performance, industry trends, and overall market conditions.

Bonds

Bonds are debt instruments issued by governments, municipalities, or corporations to raise capital. They are considered relatively safer investments compared to stocks and typically provide regular interest payments. Bonds are influenced by interest rates, credit ratings, and the financial stability of the issuer.

Real Estate

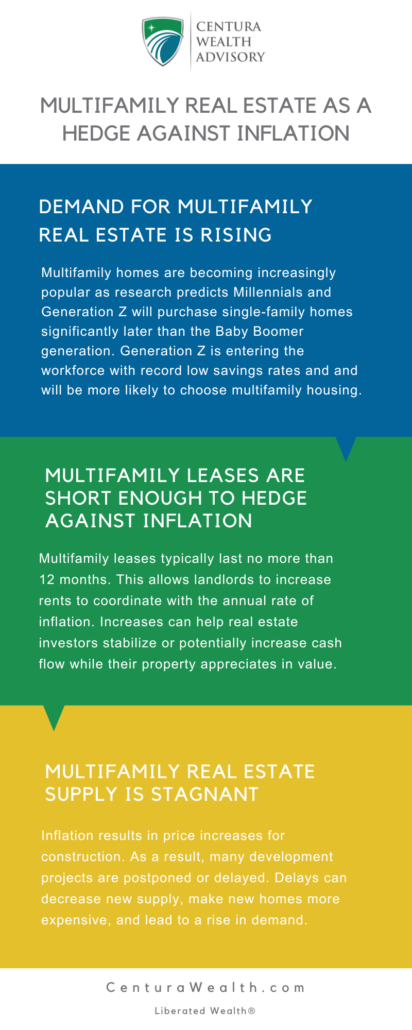

Real estate investments include residential, commercial, and industrial properties. They offer potential income through rental payments and the possibility of appreciation in property value. Real estate investments can diversify a portfolio by providing a different source of returns and a hedge against inflation.

Commodities

Commodities include physical goods such as precious metals, oil, natural gas, agricultural products, and more. Investing in commodities can provide diversification as their prices tend to have low correlation with traditional financial assets. They can serve as a hedge against inflation and provide opportunities for portfolio diversification.

The Benefits of Diversification

Diversification offers several advantages to investors, enabling them to manage risk and potentially enhance portfolio performance. This section explores the benefits that diversification provides.

Risk Reduction

Diversification helps reduce the overall risk of a portfolio by spreading investments across different asset classes. When one asset class experiences a decline, others may perform well or remain stable, helping to offset potential losses. By diversifying, investors can minimize the impact of any single investment’s poor performance on their overall portfolio.

Enhanced Stability

A diversified portfolio is typically more stable than one concentrated in a single asset class. Different assets tend to have varied responses to market conditions. While some investments may be affected negatively, others may be less influenced or even benefit from changing economic circumstances. This stability provides a cushion against extreme market fluctuations.

Capital Preservation

During market downturns or financial crises, a diversified portfolio can help protect investors’ capital. By including assets that tend to have a low correlation to the market, investors can reduce volatility of their portfolio. For example, in the 2008 financial crisis, investors with diversified portfolios were better positioned to weather the storm compared to those heavily concentrated in a single asset class.

Potential for Increased Returns

Diversification offers the potential for increased returns by exposing investors to different sources of growth. While some asset classes may underperform in certain market conditions, others may thrive. By diversifying across various asset classes, investors can tap into opportunities presented by different market cycles and potentially achieve better risk-adjusted returns.

The Importance of Rebalancing Your Portfolio in a Volatile Market

While diversification is an essential strategy for mitigating risk, it’s not a set-it-and-forget-it strategy. Investors need to regularly rebalance their portfolios to maintain their desired asset allocation. This means periodically selling some assets that have performed well and buying assets that have underperformed. Rebalancing helps to ensure that your portfolio remains diversified and aligned with your risk tolerance and investment goals.

In a volatile market, rebalancing can be especially important. For example, if the stock market experiences a significant decline, your portfolio may become more heavily weighted toward bonds, which may not be aligned with your risk tolerance. Rebalancing can help you maintain your desired asset allocation and potentially avoid significant losses.

How Centura’s Customized Investment Plans Help Clients Manage Risk and Achieve Their Financial Goals

Centura is a financial advisory firm that offers customized investment plans to help clients manage risk and achieve their financial goals. Centura’s team of experts works with each client to develop a personalized asset allocation strategy based on their unique financial situation, risk tolerance, and investment objectives.

One of the key benefits of Centura’s customized investment plans is ongoing monitoring and adjustment. As market conditions change, Centura’s team constantly monitors each client’s portfolio and adjusts their asset allocation to ensure it remains aligned with their objectives. This helps clients stay on track to meet their financial goals while also minimizing risk.

Centura’s investment plans have helped many clients achieve their financial objectives. For example, one client came to Centura with a desire to retire early and travel the world. Centura worked with the client to develop a plan that would help them to reach their goal within 10 years. Through a combination of diversified investments and ongoing monitoring and adjustment, the client was able to retire on schedule and embark on their dream adventure.

Strategies for Protecting Your Wealth During Market Downturns

Market downturns are an inevitable part of investing, but there are strategies that investors can use to protect their wealth during these periods. This section discusses some effective strategies for safeguarding investments during market downturns.

Hedging

Hedging is a strategy that involves investing in assets that move in the opposite direction of the market. By holding positions that counteract the losses in the rest of the portfolio, investors can offset some of the downturn’s impact. Common hedging instruments include options, futures contracts, and inverse exchange-traded funds (ETFs). However, it’s important to note that hedging strategies also come with their own risks and costs, and they may not provide complete protection against losses.

Stop-Loss Orders

Stop-loss orders are instructions to sell a security when it reaches a predetermined price. By setting stop-loss orders, investors can limit their potential losses by automatically selling the asset if its price falls below a certain threshold. Stop-loss orders help protect against further declines in the stock price and can be a valuable risk management tool during market downturns. However, it’s essential to set appropriate stop-loss levels, taking into account volatility and individual risk tolerance, to avoid triggering unnecessary sales.

Defensive Investing

Defensive investing involves seeking out companies or sectors that are less vulnerable to economic downturns. These companies typically have stable earnings, strong cash flows, and reliable dividends, even during challenging market conditions. Defensive sectors often include utilities, healthcare, consumer staples, and essential services. By allocating a portion of the portfolio to defensive investments, investors can potentially cushion the impact of market volatility and protect against significant losses.

Effective Implementation and Professional Guidance

Implementing these strategies effectively requires careful consideration and understanding of individual investment goals and risk tolerance. Working with a financial advisor can help ensure that these strategies align with your specific circumstances and objectives. A professional can provide valuable insights, monitor market conditions, and make adjustments to the portfolio’s risk management strategies when needed.

Maintaining a Long-Term Perspective

During market downturns, it’s crucial to stay calm and maintain a long-term perspective. It’s natural to feel uneasy during periods of market volatility, but panic selling can lead to significant losses. History has shown that markets tend to recover over time, and selling during a downturn can lock in losses and prevent investors from benefiting if they don’t reinvest before subsequent market rebounds. By focusing on a long-term investment strategy, maintaining a diversified portfolio, and managing risk effectively, investors can better weather market volatility and position themselves for long-term success.

In conclusion, protecting wealth during market downturns requires thoughtful strategies and a disciplined approach. Hedging, using stop-loss orders, defensive investing, and seeking professional guidance are some effective strategies to mitigate losses and safeguard investments. Additionally, maintaining a long-term perspective and avoiding panic selling are vital for preserving wealth and achieving financial goals.

Final Notes

Diversification is a key strategy for mitigating risk in your portfolio. Creating a diversified portfolio by investing in a variety of different assets, you can spread out risk and potentially benefit from different market cycles. Rebalancing your portfolio is also important to maintain your desired asset allocation and potentially avoid significant losses during market downturns.

Centura’s customized investment plans can help you manage risk and achieve your financial goals by offering ongoing monitoring and adjustment. While there are other strategies for protecting your wealth during market downturns, it’s important to implement them effectively and stay calm during market volatility. By working with a financial advisor and staying disciplined, you can potentially achieve long-term success in your investments.

Connect With Centura

At Centura Wealth Advisory, we go beyond a traditional multi-family office wealth management firm to offer advanced tax and estate planning solutions which traditional wealth managers often lack in expertise, knowledge, or resources to offer their clients.

We invest heavily into technology and systems to provide our clients with fully transparent reporting and tools to make informed decisions around their wealth plan.

Read on to learn more about our 5-Step Liberated Wealth Process and how Centura can help you liberate your wealth.

Disclosures

Centura Wealth does not make any representations as to the accuracy, timeliness, suitability, or completeness of any information prepared by any unaffiliated third party, whether linked to or incorporated herein. All such information is provided solely for convenience purposes and all users thereof should be guided accordingly.

We are neither your attorneys nor your accountants and no portion of this material should be interpreted by you as legal, accounting, or tax advice. We recommend that you seek the advice of a qualified attorney and accountant.For additional information about Centura, please request our disclosure brochure as set forth on Form ADV using the contact information set forth herein, or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you engage our firm for advisory services.