Private fiduciaries can play a critical role in managing and protecting the assets of their clients. They also help ensure that their clients’ wishes are carried out after they are gone and their assets reach their desired beneficiaries.

Estate planning is a crucial process that allows individuals to protect and distribute their assets and ensure their wishes are fulfilled after their passing. Within this realm, private fiduciaries play an essential role. Private fiduciaries, also known as professional trustees or estate administrators, are trusted individuals or organizations appointed to manage and oversee the affairs of an estate.

In this blog, we will explore the significance of private fiduciaries in estate planning and shed light on their responsibilities and benefits.

What is a Private Fiduciary?

A private fiduciary is a person or entity designated to act on behalf of an individual or their estate in the event of incapacitation, disability, or death. They are responsible for carrying out the wishes outlined in the estate plan and ensuring the smooth administration of the estate. Unlike family members or friends who may lack the necessary expertise, private fiduciaries are trained professionals with a deep understanding of the legal and financial aspects of estate planning.

Key Responsibilities of Private Fiduciaries

Private fiduciaries assume various critical responsibilities throughout the estate planning process. These include:

Asset Management: Private fiduciaries are entrusted with managing and safeguarding the estate’s assets. This involves overseeing investments, handling financial transactions, and ensuring the estate’s value is preserved.

Estate Distribution: Following the instructions outlined in the estate plan, private fiduciaries oversee the distribution of assets to beneficiaries. They ensure that the process is carried out accurately, fairly, and in compliance with legal requirements.

Debt and Tax Obligations: Private fiduciaries handle the settlement of debts, payment of taxes, and filing necessary documentation, relieving the family of these complex and time-consuming tasks.

Legal Compliance: They ensure that the estate administration complies with local laws and regulations, minimizing the risk of legal complications.

Conflict Resolution: Private fiduciaries can mediate and resolve disputes that may arise among beneficiaries, heirs, or family members, promoting harmony during the estate distribution process.

Benefits of Engaging a Private Fiduciary

Expertise and Experience: Private fiduciaries are trained professionals who possess extensive knowledge in estate planning, tax laws, and financial management. Their expertise ensures that the estate is administered efficiently and effectively.

Impartiality: By appointing a private fiduciary, individuals can ensure that the estate’s affairs are handled impartially, avoiding potential conflicts of interest that may arise within the family.

Continuity: Private fiduciaries provide stability and continuity in estate administration. They are available throughout the process and can navigate any unforeseen challenges that may arise.

Privacy and Confidentiality: Private fiduciaries prioritize maintaining privacy and confidentiality, protecting the estate owner’s sensitive information and minimizing the risk of public exposure.

Professional Network: Private fiduciaries often have extensive networks of professionals, including lawyers, accountants, and investment advisors. They can tap into these resources to provide comprehensive support during the estate planning process.

Selecting a Private Fiduciary

When choosing a private fiduciary, it is essential to consider their qualifications, experience, reputation, and fees. Engaging in thorough research, seeking referrals, and conducting interviews will help ensure that the selected private fiduciary aligns with the individual’s goals and values.

The Distinction Between Private Fiduciaries and Trust Banks

Private fiduciaries and trust banks both provide professional services in estate planning and administration, but there are notable differences between the two:

Personalized Attention: Private fiduciaries often offer a more personalized approach, taking the time to understand the unique goals, values, and circumstances of their clients. They typically have fewer clients, allowing for a closer client-fiduciary relationship.

Flexibility: Private fiduciaries can often provide more flexibility in tailoring their services to individual client needs. They are more adaptable to changing circumstances and can offer customized solutions.

Cost: Trust banks generally have a higher fee structure compared to private fiduciaries. Private fiduciaries may offer more cost-effective options, especially for smaller estates or clients with specific needs that do not require the extensive resources of a trust bank.

Expertise: Private fiduciaries bring specialized expertise in estate planning and administration. They often have a comprehensive understanding of tax laws, investment strategies, and legal requirements, enabling them to navigate complex situations effectively.

Client Focus: Private fiduciaries typically work with a select number of clients, allowing them to provide a higher level of attention and personalized service. Trust banks may handle a larger volume of clients, which can result in a more transactional approach.

How Private Fiduciaries and Wealth Advisors (Centura) work together to make UHNW individuals and family’s lives easier:

Private fiduciaries and wealth advisors (such as Centura) work together to make the lives of Ultra-High-Net-Worth (UHNW) individuals and families easier through seamless coordination and specialized expertise. Here’s how they collaborate:

Coordination on Compiling Information for Tax Returns:

Private fiduciaries and wealth advisors collaborate to gather all the necessary financial information required for preparing tax returns accurately. They work together to ensure that complex financial situations, such as multiple sources of income, various investment types, and international assets, are properly accounted for and compliant with tax regulations. By coordinating efforts, they minimize the chances of errors and ensure tax efficiency for their UHNW clients.

Trusted Professional to Complete Trustee Duties:

For UHNW individuals, managing trusts can be highly complex, time-consuming, and require specific legal and financial expertise. A private fiduciary can act as a professional trustee, handling the duties and responsibilities associated with trust administration. By doing so, they relieve the family members or friends of the UHNW individuals from this burden and ensure that the trust is managed impartially and in line with the client’s wishes.

Dealing with Matters for Larger Families Impartially:

Large families with diverse financial interests often face complex decision-making processes. Private fiduciaries and wealth advisors work together to navigate these complexities impartially. They act as neutral third parties, taking into account the interests and objectives of all involved parties, and strive to achieve consensus on important financial decisions. This ensures fair and equitable handling of family matters and preserves family harmony.

Reflecting Trust Terms and Client’s Wishes in Investment Management:

When managing UHNW individuals’ investments, wealth advisors collaborate with private fiduciaries to ensure that the investment strategy aligns with the terms of the trust and the client’s overall wishes. They consider any restrictions or guidelines specified in the trust document and develop an investment approach that meets the client’s financial goals while adhering to the trust’s requirements. By working together, they provide a comprehensive and well-aligned approach to wealth management.

Overall, the partnership between private fiduciaries and wealth advisors streamlines financial management for UHNW individuals and families, providing them with expertise, objectivity, and a coordinated approach to their complex financial affairs.

Interested in Learning More About Private Fiduciaries? Check Out Our Podcast

In this episode, Derek Myron speaks with David Stapleton, President of Stapleton Group, Inc., about private fiduciaries, their role in managing assets and estates, and the benefits they can provide to individuals and families.

Derek and David discuss:

- Services and benefits offered by private fiduciaries

- How private fiduciaries differ from trust banks

- The pros and cons of choosing family members to act as your trustee

- Real-world examples of what it’s like to work with a private fiduciary

- And more

Connect With Centura

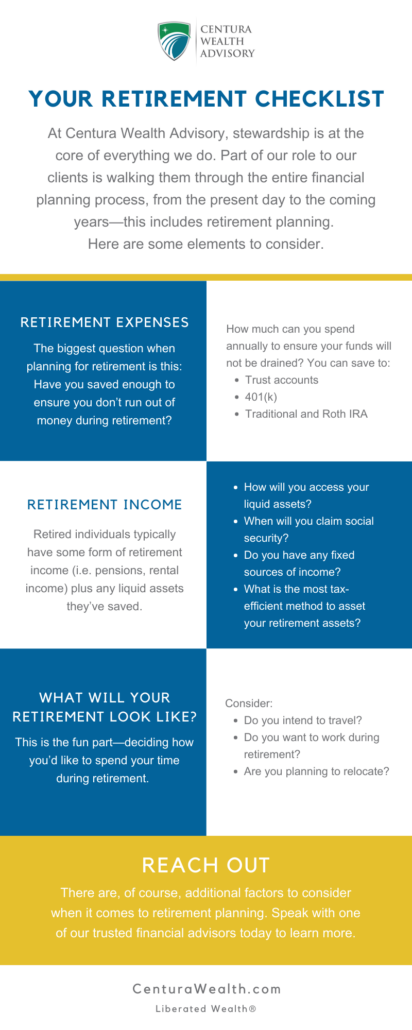

At Centura Wealth Advisory, we go beyond a traditional multi-family office wealth management firm to offer advanced tax and estate planning solutions which traditional wealth managers often lack in expertise, knowledge, or resources to offer their clients.

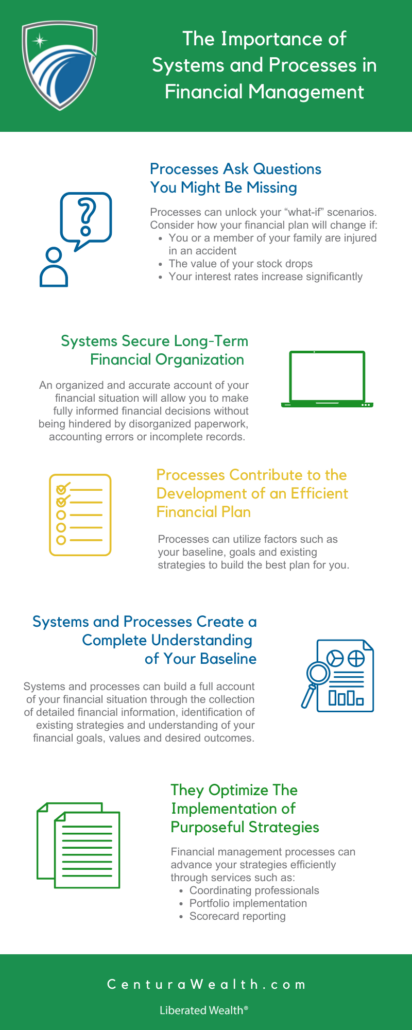

We invest heavily into technology and systems to provide our clients with fully transparent reporting and tools to make informed decisions around their wealth plan.

Read on to learn more about our 5-Step Liberated Wealth Process and how Centura can help you liberate your wealth.

Disclosures

Centura Wealth does not make any representations as to the accuracy, timeliness, suitability, or completeness of any information prepared by any unaffiliated third party, whether linked to or incorporated herein. All such information is provided solely for convenience purposes and all users thereof should be guided accordingly.

We are neither your attorneys nor your accountants and no portion of this material should be interpreted by you as legal, accounting, or tax advice. We recommend that you seek the advice of a qualified attorney and accountant.

For additional information about Centura, please request our disclosure brochure as set forth on Form ADV using the contact information set forth herein, or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you engage our firm for advisory services.