For many, real estate investing plays a significant role in achieving personal financial goals—and can be a crucial component of one’s long-term financial strategies. This considered, real estate is likely a factor you’ve considered when developing your financial plan.

So, how might real estate fit into your financial plan? Let’s discuss.

How Can Real Estate Be a Form of Financial Investment?

Real estate can include both residential and commercial property, including homes, offices, retail, parking lots, apartments, warehouses, multi-family homes, and more.

While owning your own home may be part of your financial plan, it is not necessarily an investment. Why? Primary residences are assets and their value can have a significant impact on retirement or estate plans.

However, real estate investments are defined by their ability to produce passive income for their owners. Some common examples of this real estate income include rental properties or earnings made from investment portfolios.

The Most Important Factors for Real Estate Investing

When looking into real estate, investors may start with questions such as: “What should I look for?” Here’s a shorthand list of factors to consider.

Property Location

“Location, location, location” remains the most important factor for profitability in real estate investing. For example, proximity to the following can affect the value of a property:

- Market Retails

- Warehouses

- Transport hubs

- Freeways

- Tax-exempt areas

- Amenities

- Green space, and

- Scenic areas

Property Valuation

According to Investopedia, property valuation is “important for financing during the purchase, listing price, investment analysis, insurance, and taxation—they all depend on real estate valuation.”

Expected Cash Flows and Profit Opportunities

Cash flow refers to how much money is left after expenses. With this in mind, positive cash flow is essential to a good rate of return on an investment property.

Investors can look for:

- “Expected cash flow from rental income (inflation favors landlords for rental income)

- “Expected increase in intrinsic value due to long-term price appreciation

- “Benefits of depreciation (and available tax benefits)

- “Cost-benefit analysis of renovation before sale to get a better price

- “Cost-benefit analysis of mortgaged loans vs. value appreciation”

Active vs Passive Real Estate Investments

Real estate investments can serve as both passive and active investments. Let’s review the difference between these two forms of investment.

Active Real Estate Investments

An active real estate investment is one where an individual or group of individuals comes together to purchase a property directly. The investor is “actively” involved in the process of finding, purchasing, and managing the property.

Passive Real Estate Investments

In a passive real estate investment, an investor receives periodic distributions, but otherwise has no involvement in the day-to-day operations of the property. Passive real estate investments are an excellent option for investors who are looking for passive income.

For more information on passive real estate investing, here.

Why Should You Invest in Real Estate? What Are the Benefits of Investing in Real Estate?

With the right assets, real estate investors can:

- Diversify their portfolios

- Leverage their properties to build wealth

- Create stable income streams, and

- Enjoy tax benefits

Additionally, real estate can appreciate with inflation long-term.

According to Forbes, “real estate investments have the characteristic of performing well in a rising rate environment. In particular, income-generating real property and multifamily have historically… Shown a greater ability to grow net income during expansionary periods than securities and other assets.”

Let’s take a look at some other benefits of investing in real estate.

Real Estate Investments Can Diversify Your Portfolio

Real estate investments are known to help increase a portfolio’s overall returns while reducing risk.

Real Estate Investments Can Provide a Stable Income Stream

A key benefit of real estate investing is its ability to generate passive income. For instance, investors who play their cards right can create a steady revenue from rental income while building equity through making improvements to the property.

Real Estate Investments Can Provide Tax Benefits

Tax benefits depend upon the type of real estate investment. For example, rental properties can include the deductions of:

- Mortgage interest payments

- Property taxes

- Ongoing property maintenance

- Property insurance, and

- Independent contractors

Real Estate Can Serve as a Hedge Against Inflation

Real estate can provide opportunities for investors to protect themselves against their declining purchasing power.

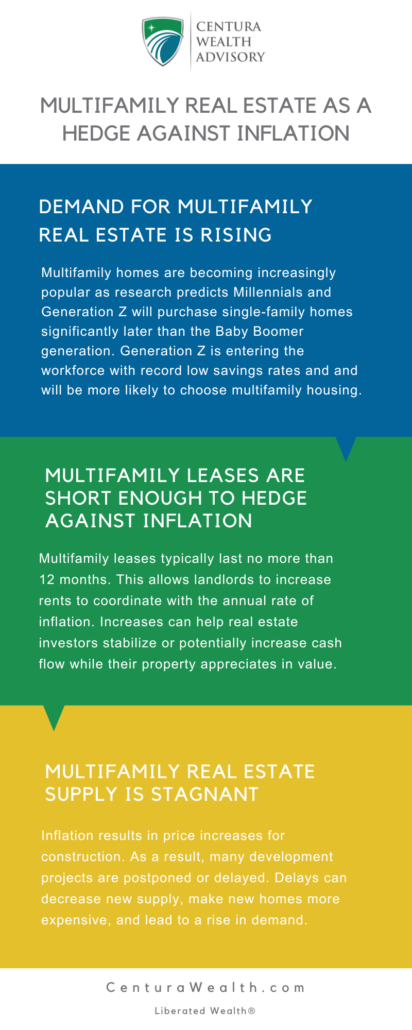

Real estate can serve as a hedge against inflation and be an attractive option for investors for several reasons, including that real estate:

- Has intrinsic value

- Recovers quickly, and

- Demand for real estate is rising, while supply is not

Read on to learn how to use multifamily real estate as a hedge against inflation.

Tune Into Our Podcast to Learn More

In Episode 57, Chris Osmond speaks with Paul Kaseburg, Chief Investment Officer of MG Properties, about investment opportunities in the multifamily real estate market and how they help you cope with rising inflation rates.

They discuss:

- How real estate, in general, responds to inflationary pressures

- The advantages of multifamily over other types of real estate investments

- Latest trends in cap rates and cost of debt that real estate investors should know about, and

- How inflation is impacting the affordability gap between single-family homes and apartment renting

What Else Can Fit Into Your Financial Plan?

At Centura Wealth Advisory, we are dedicated as fiduciaries to our clients’ stewardship of their assets.

One of our goals is to help our clients navigate and understand challenging economic changes, such as the current rising interest rate environment and inflation.

Review our article “How to Plan and Invest in a Rising Interest Rate Environment” for more information, then get in touch with us today.

Disclosures

Centura Wealth does not make any representations as to the accuracy, timeliness, suitability, or completeness of any information prepared by any unaffiliated third party, whether linked to or incorporated herein. All such information is provided solely for convenience purposes and all users thereof should be guided accordingly.

We are neither your attorneys nor your accountants and no portion of this material should be interpreted by you as legal, accounting, or tax advice. We recommend that you seek the advice of a qualified attorney and accountant.

For additional information about Centura, please request our disclosure brochure as set forth on Form ADV using the contact information set forth herein, or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you engage our firm for advisory services.