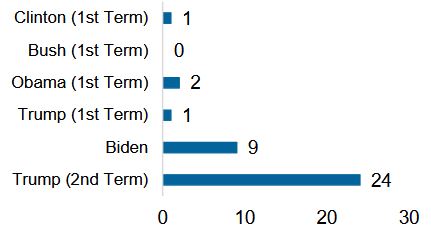

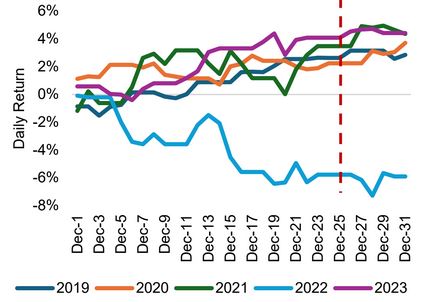

The first quarter of 2025 was marked by heightened volatility across global markets, driven by escalating trade policies and shifting investor sentiment. The uncertainty related to tariff decisions, including surrounding President Trump’s “Liberation Day” tariff announcement on April 2, dominated sentiment over the quarter, causing both the S&P 500 and the Nasdaq 100 to enter correction territory. This rampant uncertainty and subsequent volatility prompted asset managers like Goldman Sachs to slash their year-end target for the S&P 500 to 5,700 on heightened recession risks, which would only represent a ~1.5% increase from quarter-end levels.

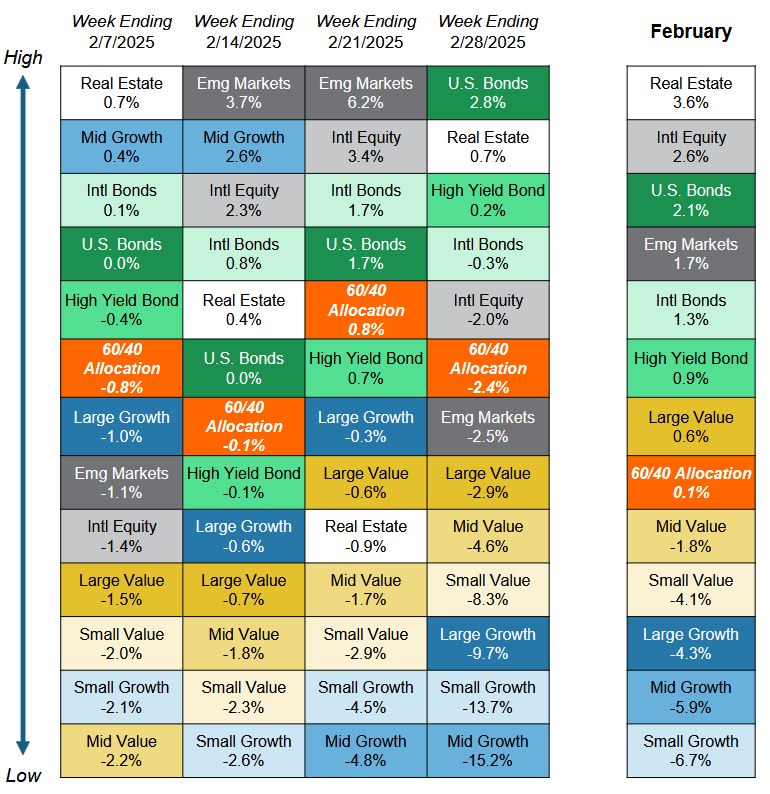

Signs of defensive rotations emerged over the quarter, as investors flocked to gold (up 19% YTD) and Treasury bonds (10-year yield down 35 bps YTD) while high-quality/low-volatility stocks outperformed their growth counterparts, illustrating a broader flight to safety. Below are highlights from the first quarter of the year.

- The S&P 500 and Nasdaq 100 hit correction territory in March, dropping more than 10% from February’s peak. At their worst, on March 13, the S&P 500 and Nasdaq 100 were down 10.03% and 13.23%, respectively, from their peaks on February 19. The declines were largely driven by uncertainty surrounding impending tariffs, while negative performance in the tech-heavy Nasdaq 100 was driven by significant setbacks in tech mega-caps due to rising competition and valuation concerns.

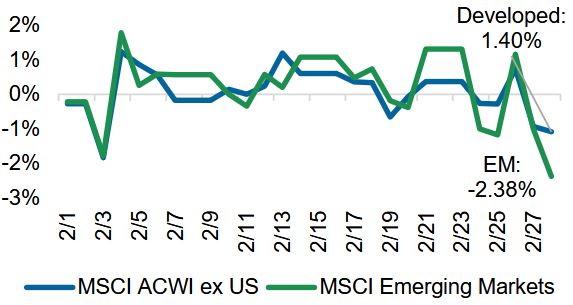

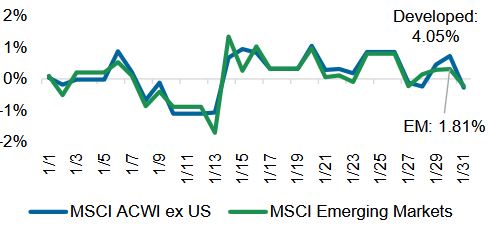

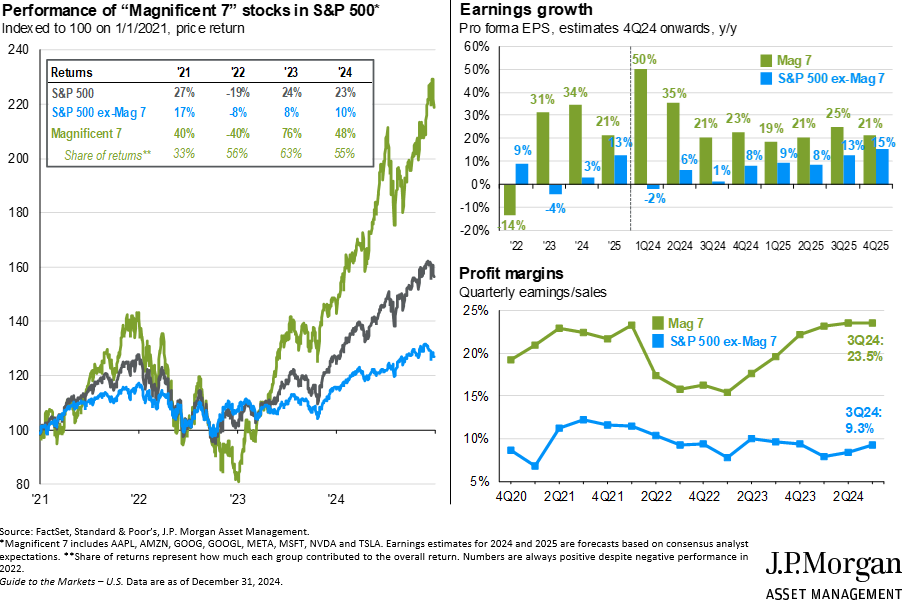

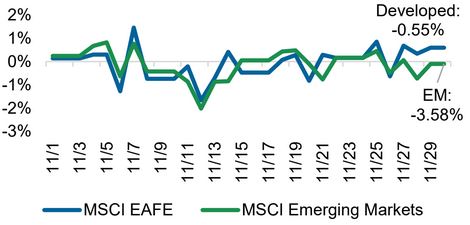

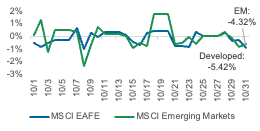

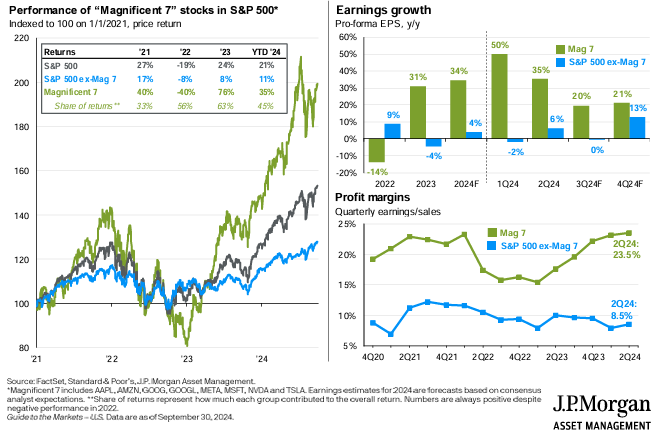

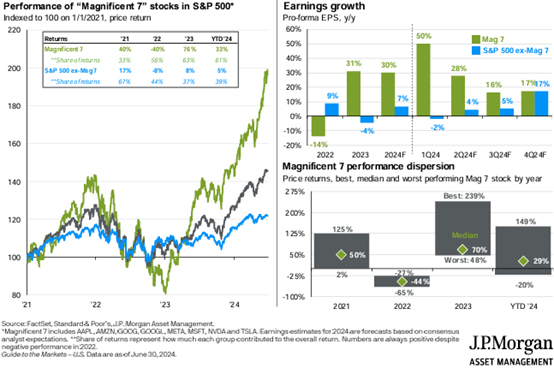

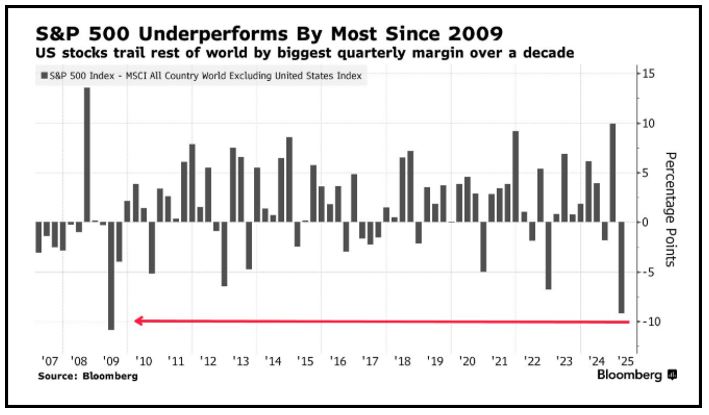

- Tariff Turmoil Reshapes Markets: The Trump administration’s planned reciprocal tariffs (targeting 25% on auto imports and 20% on various “country-based” levies) created crosscurrents: U.S. energy producers rallied on potential Russian crude restrictions; the “Magnificent Seven” stocks extended their quarterly rout to nearly 16%; market correlations plunged to 25-year lows as investors scrambled to price disparate sector impacts; and the S&P 500 underperformed foreign equities by the largest margin since 2009.

Source Link: Bloomberg

Despite this turmoil, Morgan Stanley’s Mike Wilson noted, “This isn’t a market falling apart; it’s a market fighting through uncertainty” with recent geopolitical developments heavily influencing market dynamics. President Trump’s tariffs have stirred anxiety across global markets as investors weigh the potential economic fallout, with many sectors preparing for the implications of increased trade barriers - European nations initiated major fiscal reforms aimed at bolstering infrastructure and defense spending, creating opportunities for domestic industries amid global uncertainty. U.S. equity markets have been particularly reactive to these developments, exhibiting pronounced swings due to potentially adverse impacts on U.S. economic growth and corporate earnings. While the Stoxx Europe 600 Index continues to benefit from renewed fiscal confidence, reinforced by Germany’s expansive infrastructure investment plans, U.S. indices grapple with regulatory and trade uncertainties. The crosscurrents between domestic and international equity markets reflect broader macroeconomic challenges as policymakers and investors navigate the evolving landscape of global trade and fiscal policy responses.

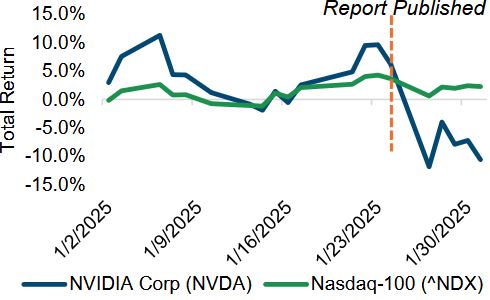

- Chinese startup DeepSeek emerged as a disruptive force with its advanced AI model. This development triggered a significant tech selloff, with the Nasdaq 100 experiencing a 3% drop in a single trading day. The announcement of DeepSeek’s low-cost, energy-efficient AI technology raised serious concerns over the valuations of U.S. tech giants that have dominated the AI landscape. Notably, Nvidia Corp., a key player in AI hardware, faced a dramatic market value reduction, losing almost $600 billion during this period. This unprecedented loss marked Nvidia’s worst performance since the initial pandemic-related market responses in March 2020. DeepSeek’s advancements have prompted a reevaluation of the high spending trajectory adopted by major companies like Microsoft Corp., Meta Platforms Inc., and Alphabet Inc., challenging their investment strategies in AI infrastructure and highlighting potential shifts in future technology investments.

- Cryptocurrency, once considered an ultra-high-risk investment, is gaining greater acceptance among retail and institutional investors. Despite the fluctuations in adoption, institutional interest in cryptocurrencies remains intact, demonstrated by recent fund inflows into crypto investment vehicles. A major example is BlackRock Inc. (BLK), who made headlines by announcing a significant expansion in its cryptocurrency offerings, attracting institutional investors and spurring additional fund inflows into the asset class, including the recent launch of a European Bitcoin ETP or exchange-traded product. Product expansions in this space underscore the sustained institutional interest in cryptocurrencies, with market analysts emphasizing the continued importance of monitoring regulatory dynamics and macroeconomic pressures as key drivers of cryptocurrency performance moving forward. Despite this recent momentum, Bitcoin (BTCUSD) is down nearly 11% to start the year.

- Geopolitical Tensions and Volatility: Mounting uncertainties within the financial markets due to global tariff dynamics and geopolitical tensions have added another layer of complexity to the investment environment. The tension between Israel and neighboring countries has intensified, impacting regional stability and influencing energy markets amid concerns over supply disruptions. Additionally, the war in Russia/Ukraine wages on with no clear path to a resolution, particularly after a heated discussion between President Trump and Ukrainian President Zelensky in February. These geopolitical strains have contributed to increased volatility in commodity prices, particularly oil, as market participants closely monitor developments for any potential escalation that could further disrupt supply chains. As countries in the regions navigate these challenges, investors are advised to remain cautious, considering the geopolitical risk premiums that might affect market sentiment and valuations.

- Gold prices set a new record in Q1 2025, surpassing $3,100 per ounce. The precious metal’s value soared more than 19% this quarter, marking its largest three-month gain since 2011. This substantial rise was fueled by heightened market uncertainty from U.S. tariff policy and geopolitical tensions, prompting investors to seek refuge in safe-haven assets. The rally in gold was further bolstered by significant inflows into bullion exchange-traded funds, which received $12.7 billion over the quarter, reflecting investor sentiment favoring risk-averse strategies amid the volatile economic landscape.

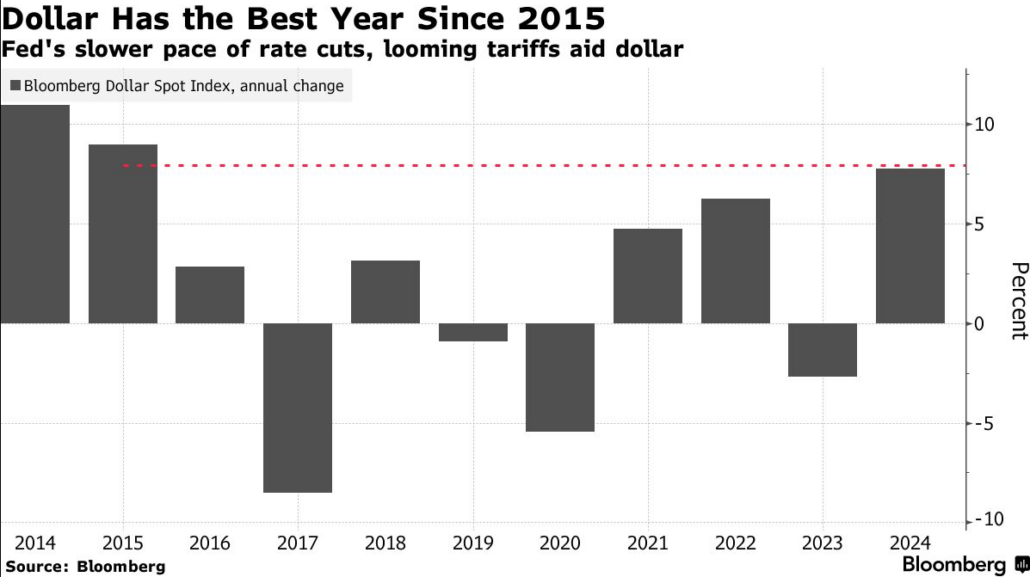

- The U.S. Dollar experienced notable fluctuations throughout Q1 2025, recording its worst first-quarter performance since 2017. The Bloomberg Dollar Spot Index, which rose slightly by 0.2% in the last week of the quarter, reflected broader concerns about rising tariff-related risks and global economic uncertainty. The Dollar’s declining strength can be attributed to increasing investor anxiety over President Trump’s trade policies, leading to movements toward safer currencies such as the Japanese yen and Swiss franc. These two haven currencies appreciated 1.8% against the Dollar amid escalating geopolitical and economic tensions.

Market Recap

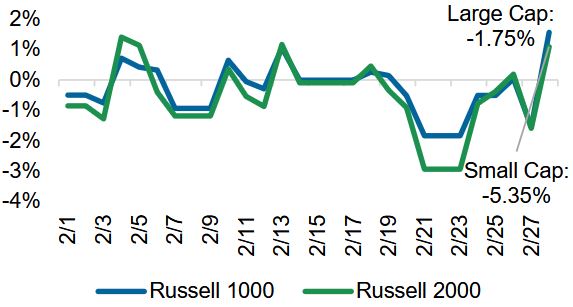

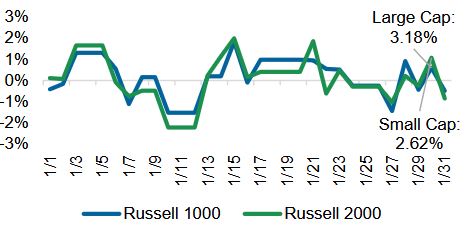

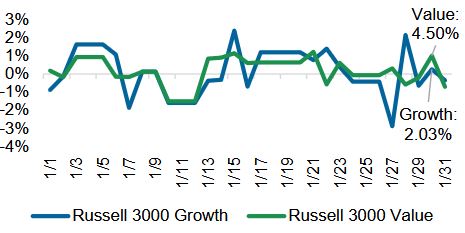

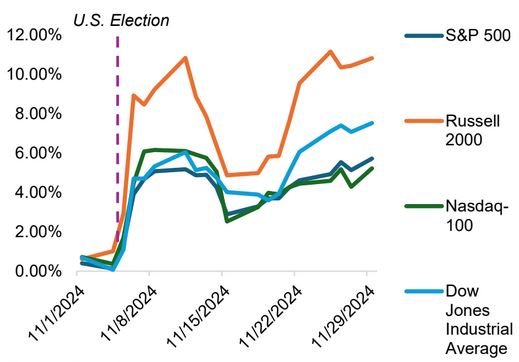

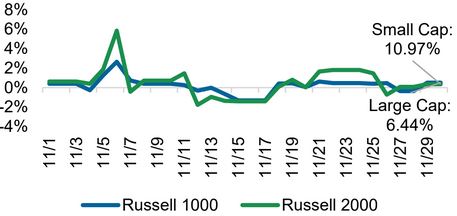

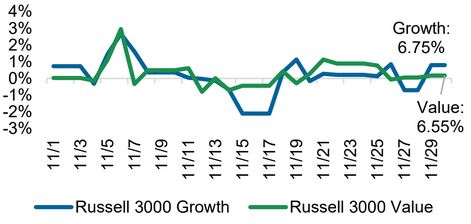

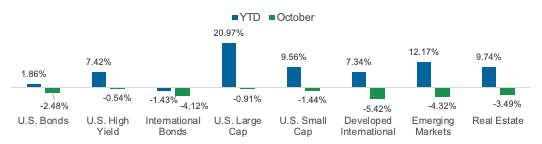

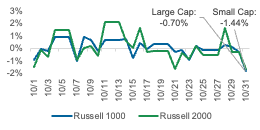

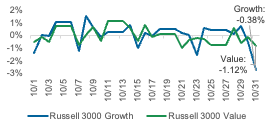

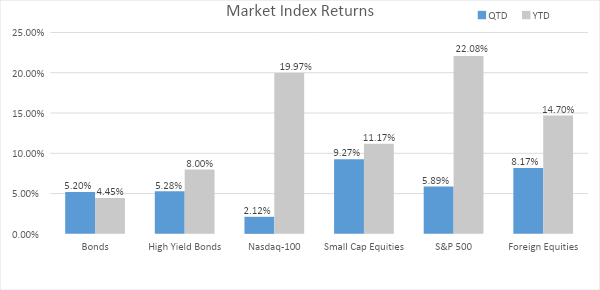

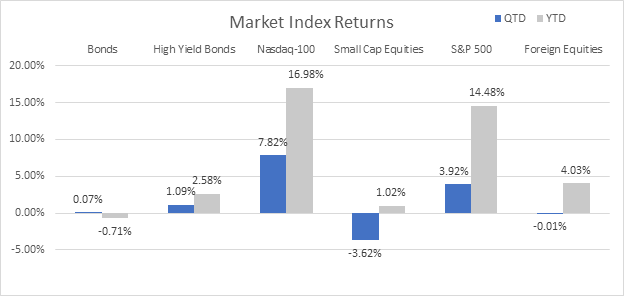

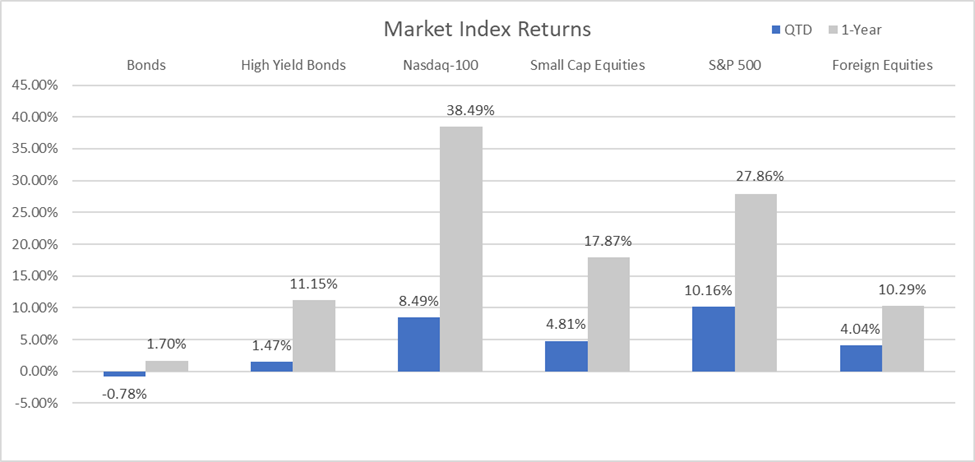

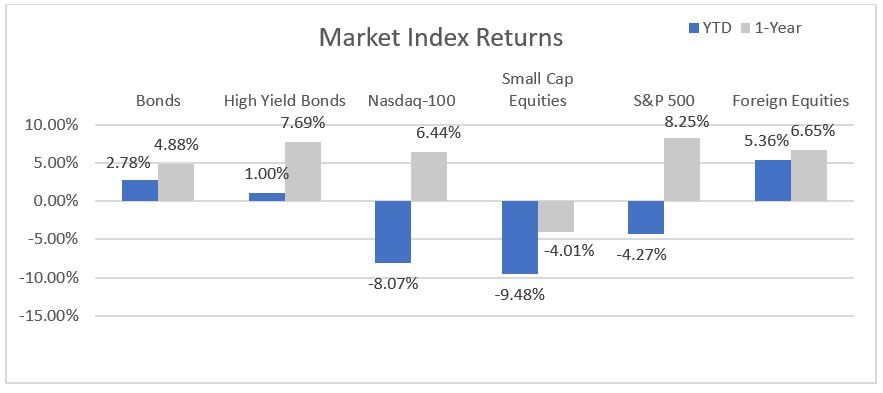

Equities – Equities in the U.S. struggled as the threat of trade wars and conflicting monetary and fiscal policies proved too much for stocks, resulting in their worst quarter since 2022. Under the hood of broad market performance, markets witnessed varied sector performances, painting a more nuanced picture of market dynamics in the current environment. The S&P 500 faced challenges, finishing the quarter down 4.27%, highlighting investor apprehension over President Trump’s evolving trade policies. The Nasdaq 100 experienced its worst quarterly performance in nearly three years, declining 8.07% amid fears of an AI investment bubble and uncertainties surrounding tech spending and valuation metrics.

Meanwhile, defensive sectors such as healthcare, utilities, and consumer staples thrived as investors flocked to safer corners of the market in response to mounting risks. Overall, the first quarter underscored the complexities and crosscurrents facing investors, with varied sector performances highlighting the necessity of strategic positioning in response to evolving fiscal policies and global economic dynamics. As Q2 unfolds, market participants remain vigilant, focusing on geopolitical developments and macroeconomic indicators to navigate the ongoing volatility in addition to sector diversification.

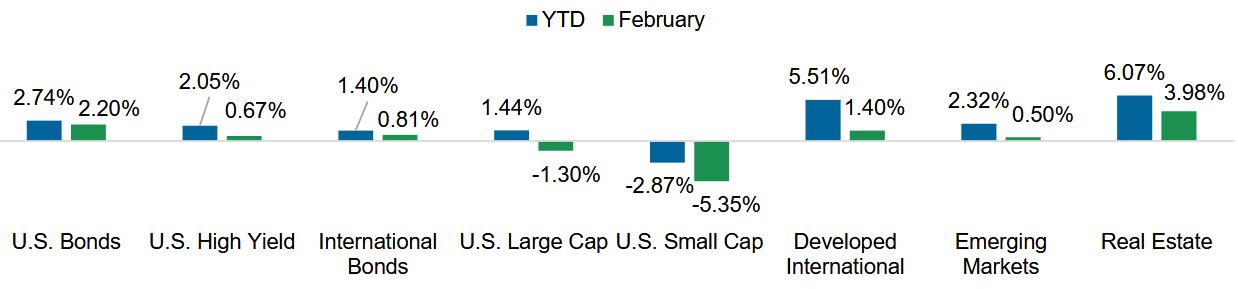

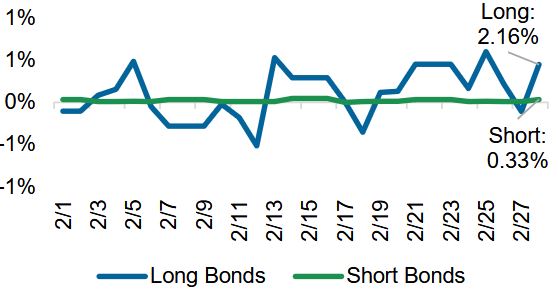

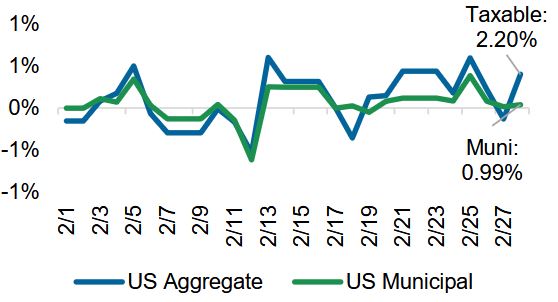

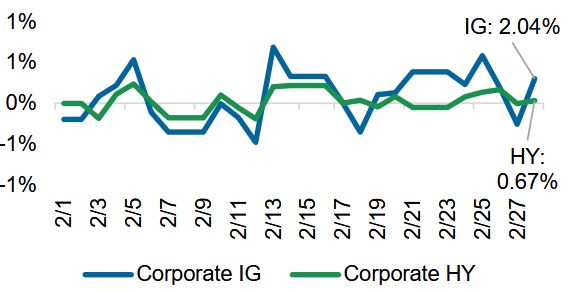

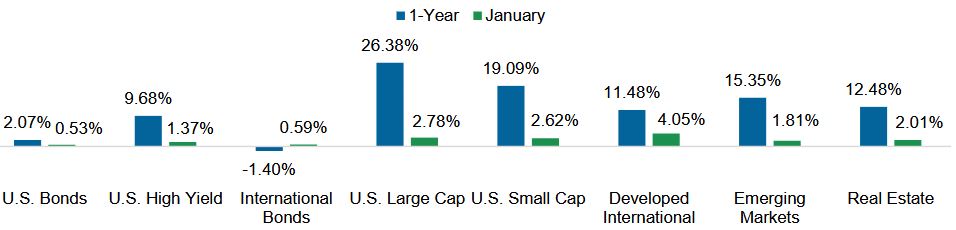

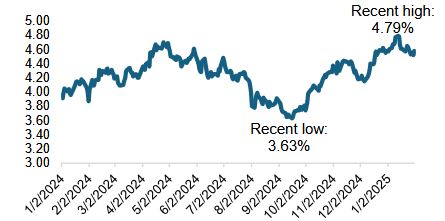

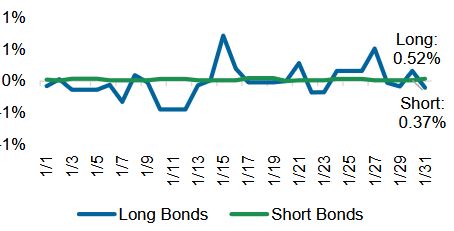

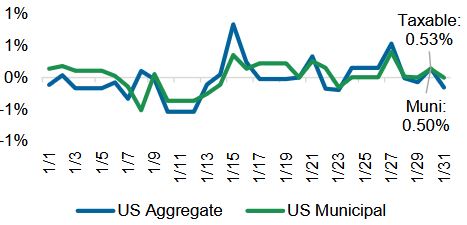

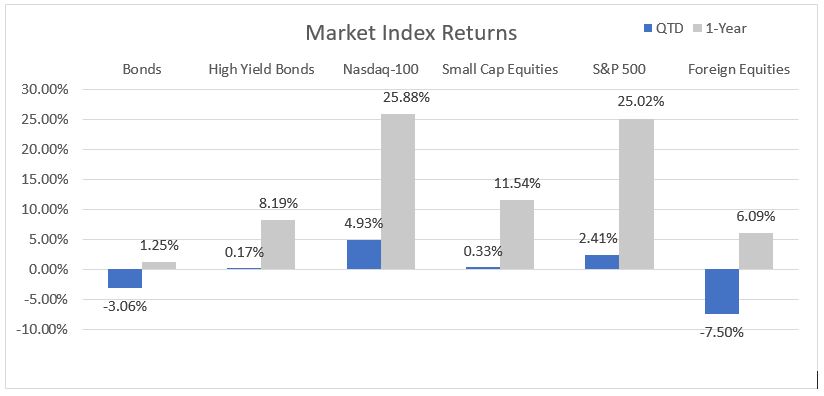

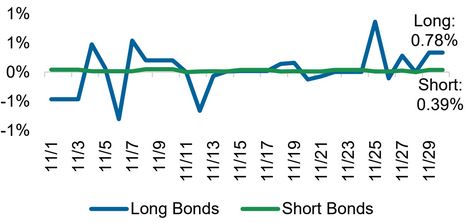

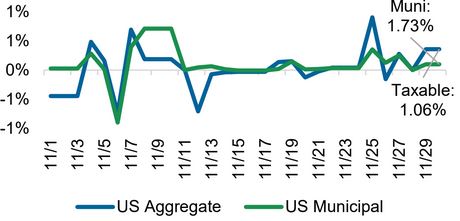

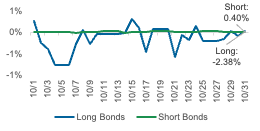

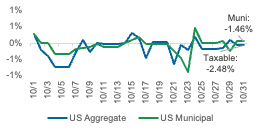

Bonds – The bond market also experienced significant volatility in Q1 2025, and, like its equity counterparts, this volatility was driven primarily by shifting economic expectations and geopolitical uncertainties. U.S. Treasury yields fluctuated notably, with the 10-year yield trading within a 65-basis point range, ending the quarter at approximately 4.23%. The uncertainty surrounding President Trump’s tariff policies has raised concerns about potential economic disruptions and inflationary pressures. As investors sought safe-haven assets amid these uncertainties, Treasury bonds saw increased demand, leading to periodic declines in yields and a positive 2.78% return in bonds, as measured by the Bloomberg U.S. Aggregate Bond Index.

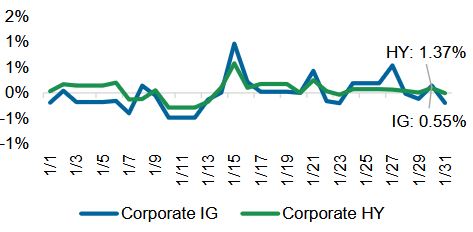

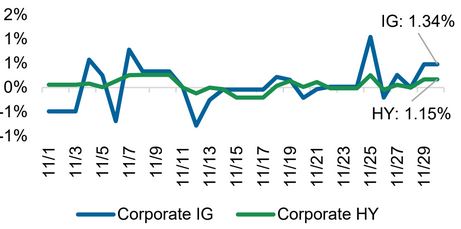

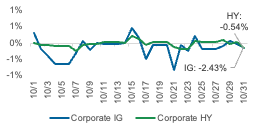

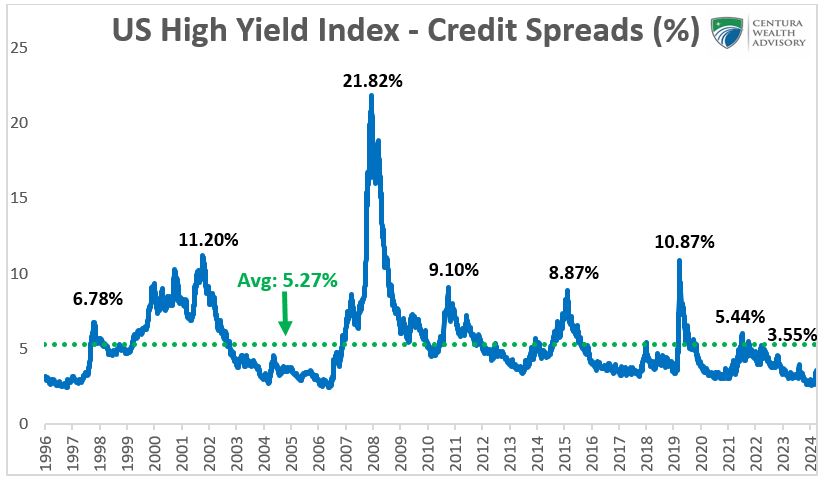

High yield credit markets also faced turbulence, as spreads widened 63-basis points (0.63%) from 2.92% to 3.55%, the highest level since August 2024. Concerns over economic growth and corporate earnings, magnified by geopolitical tensions and trade policy shifts, contributed to a risk-averse sentiment that impacted credit markets. Despite these challenges, high yields bonds exhibited relative stability and still produced a 1.00% return over the quarter.

Market participants are closely monitoring the Federal Reserve’s policy stance and anticipated economic data releases, which will likely influence bond market dynamics in the coming months.

Source: YCharts. The Bloomberg US Aggregate Index was used as a proxy for Bonds; the Bloomberg US High Yield 2% Issuer Capped Index was used as a proxy for High Yield Bonds; the Russell 2000 Index was used as a proxy for Small Cap Equities; and the MSCI ACWI Ex USA Index was used as a proxy for Foreign Equities. All returns are based on total return levels as of 3/31/2025.

Economy: GDP and Consumer Spending in Q1 2025

Consumer spending in the first quarter of 2025 demonstrated subdued growth, reflecting a cautious atmosphere among consumers due to economic uncertainty and rising inflationary pressures. After declining 0.6% in January, inflation-adjusted consumer spending edged up merely 0.1% in February, revealing hesitation in household expenditures. February was notably challenging, as Americans reduced spending on services for the first time in three years, a direct result of persistent price increases and economic concerns. The slow pace of consumer spending highlights mounting anxieties over the broader economic landscape, which is becoming further complicated by significant geopolitical and domestic policy challenges, including ongoing tariff disputes.

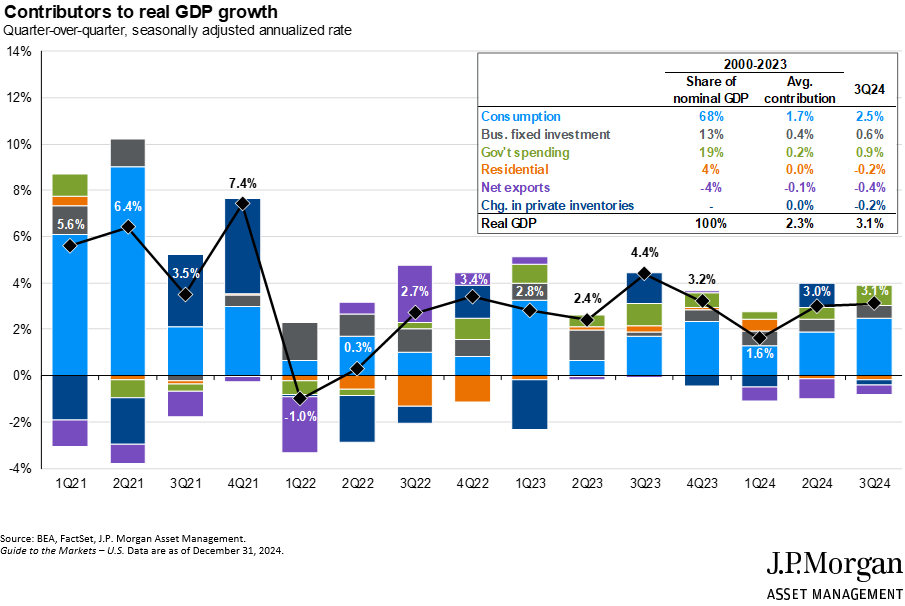

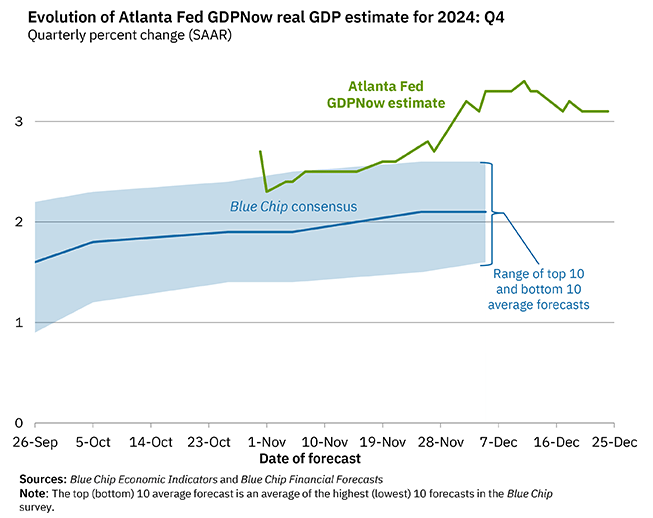

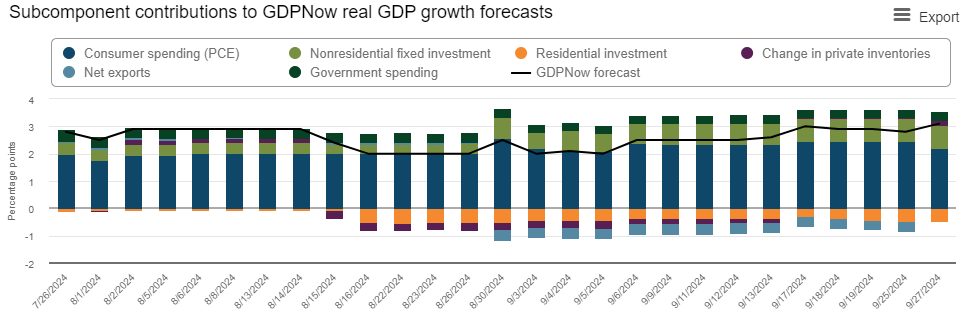

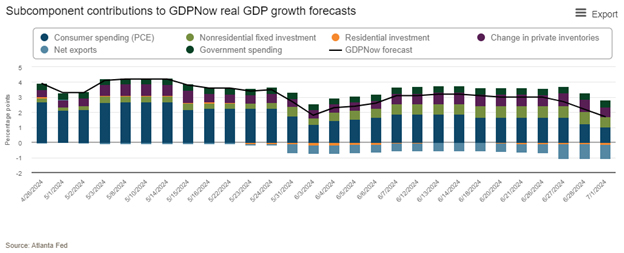

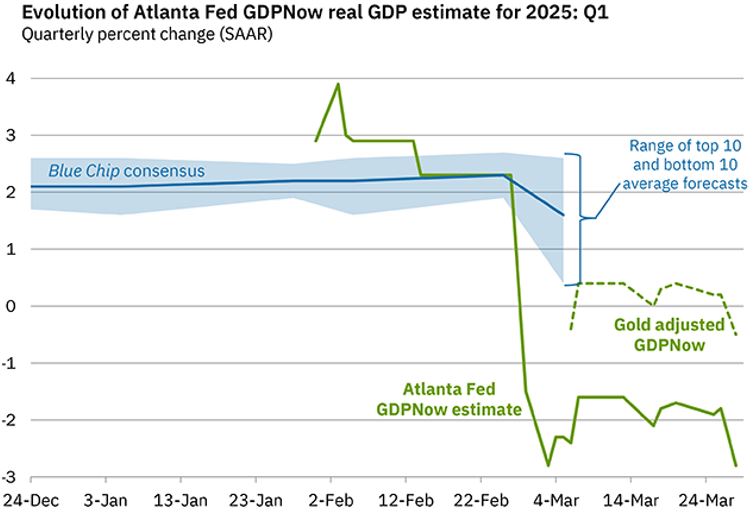

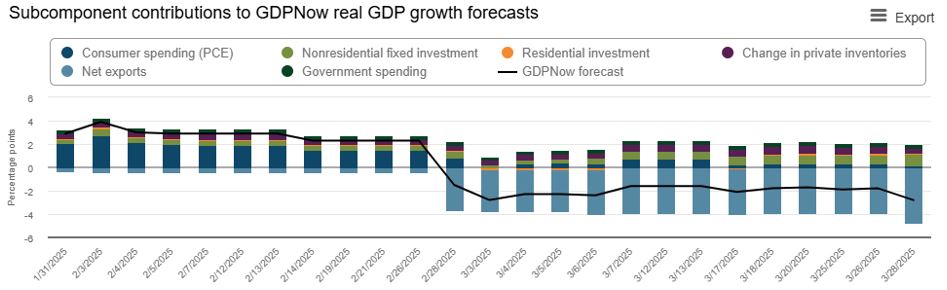

The challenges faced by the U.S. economy in the first quarter of 2025 were further demonstrated in the projections for real GDP growth. According to the GDPNow model estimate from the Atlanta Fed, real GDP growth for Q1 2025, as of March 28, is projected to be -2.8%, representing a stark contrast from the same model’s forecast on February 21, which projected the U.S. economy would grow at +2.3% annualized rate. This downturn also marks a notable shift from previous quarters, reflecting widespread economic uncertainties and the impact of tariff policies. The alternative model forecast, which accounts for imports and exports of gold, adjusted the decline to a milder -0.5%, a further illustration of investors’ flock to safety over the quarter.

Factors contributing to this sharp decline include a notable reduction in net exports, which dragged down GDP growth by an estimated -4.79% in the standard model. While we believe the economy is slowing and facing several headwinds marred with uncertainty, we recognize that the estimates from the Atlanta Fed may be more dire than we actually experience, particularly since the spike in imports is a result of companies accelerating purchases ahead of tariffs, which will likely be offset in the Inventories measure and result in a more negligible outcome than the Atlanta Fed model is forecasting. The ongoing trade tensions, particularly those involving tariffs, cast a shadow over economic activities, leading businesses and consumers to exercise caution. As these dynamics unfold, market participants should closely watch for potential policy responses and economic indicators that could signal recovery or further challenges in the quarters ahead. Additionally, as clarity is gained on tariff policy, we expect some of these trends to reverse or improve.

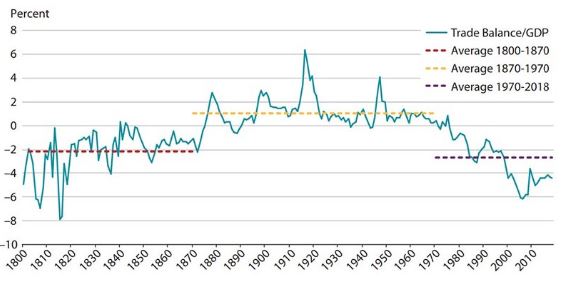

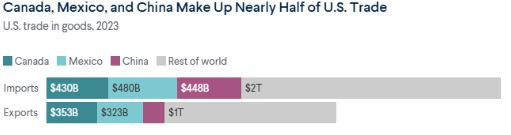

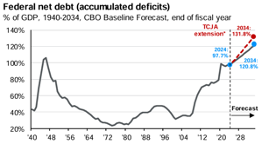

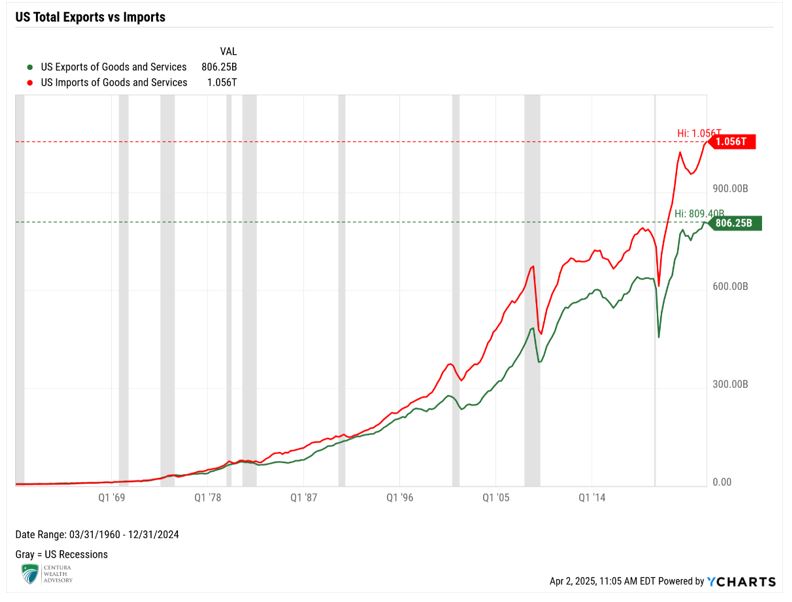

It is worth mentioning that the implementation of tariffs is largely motivated by reducing the federal trade deficit, which has been in deficit since the 1970s, meaning that the U.S. has been importing more than it has been exporting for decades. Observing this trend helps explain why President Trump is aggressively pursuing tariffs to help accomplish his “Make America Great Again” agenda – bringing manufacturing jobs back to America and incentivizing the consumption of domestic goods should theoretically improve the U.S. economy in the long-term, all while reducing the trade deficit. Additionally, when imports exceed exports, foreign economies benefit more, and the domestic government must stimulate domestic growth in other ways, typically through government spending, which ultimately can lead to budget deficits. This means that trade deficits are connected to budget deficits, so reducing the trade deficit through tariffs should bode well for the U.S. economy in the long-term, but, as President Trump has indicated, the consumer may feel some pain in the short-term.

Labor Market Dynamics

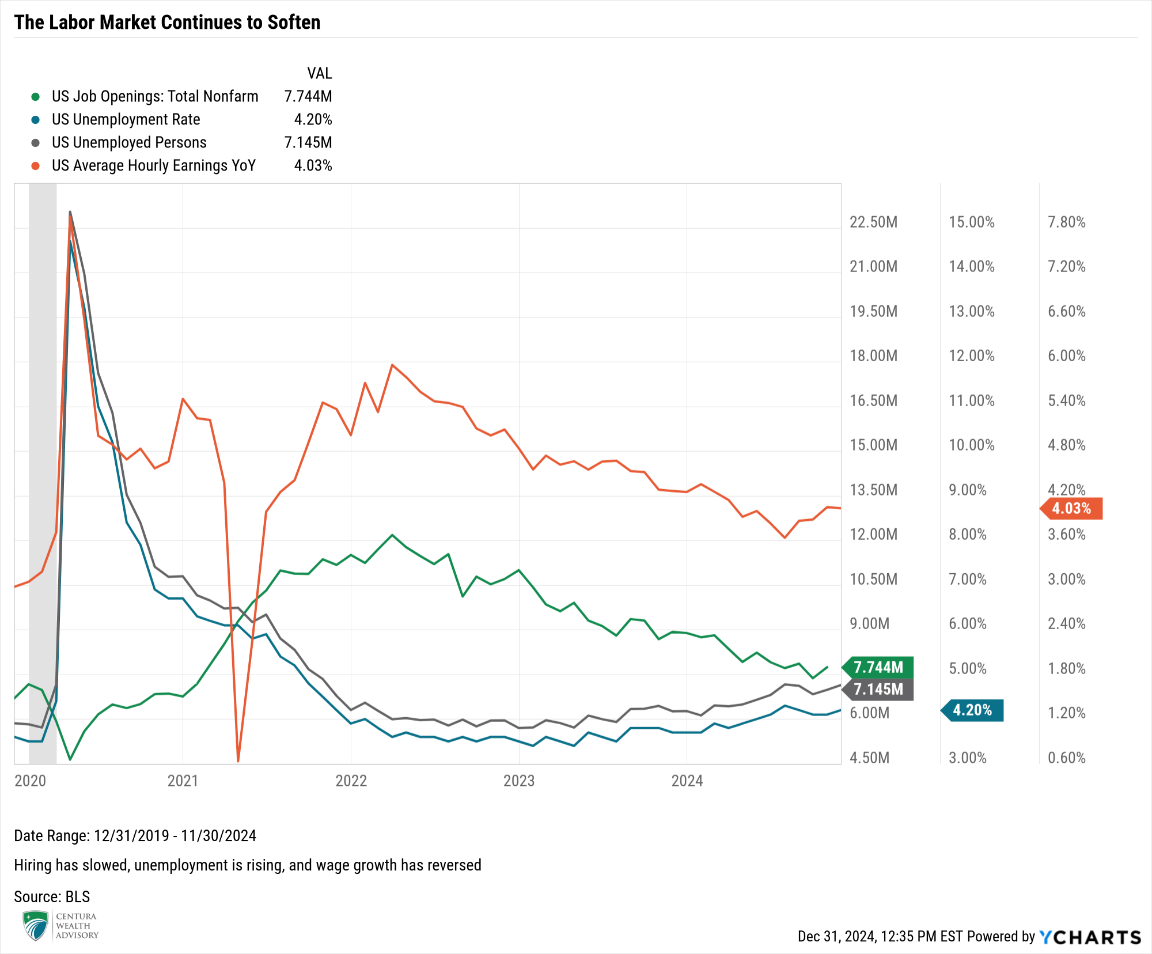

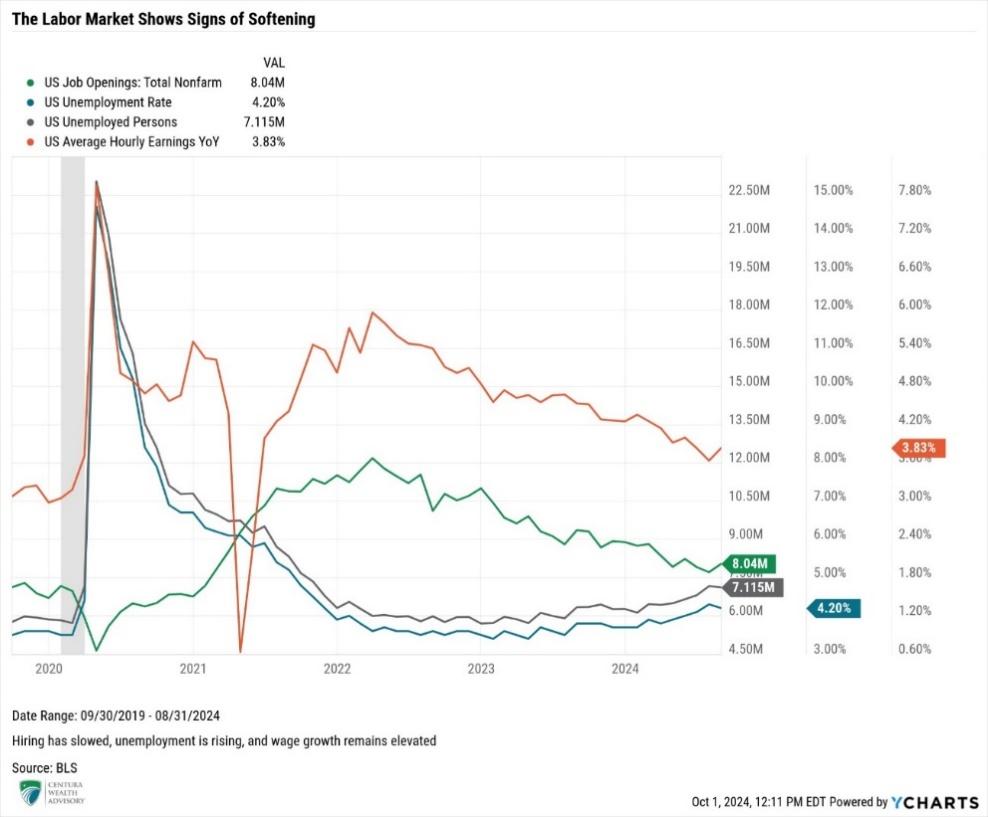

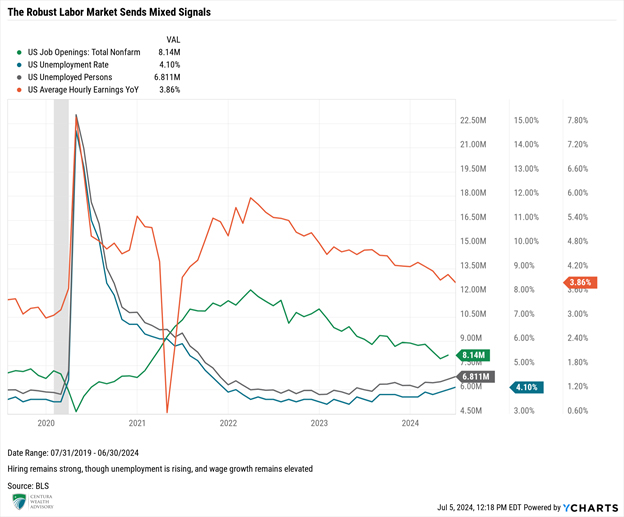

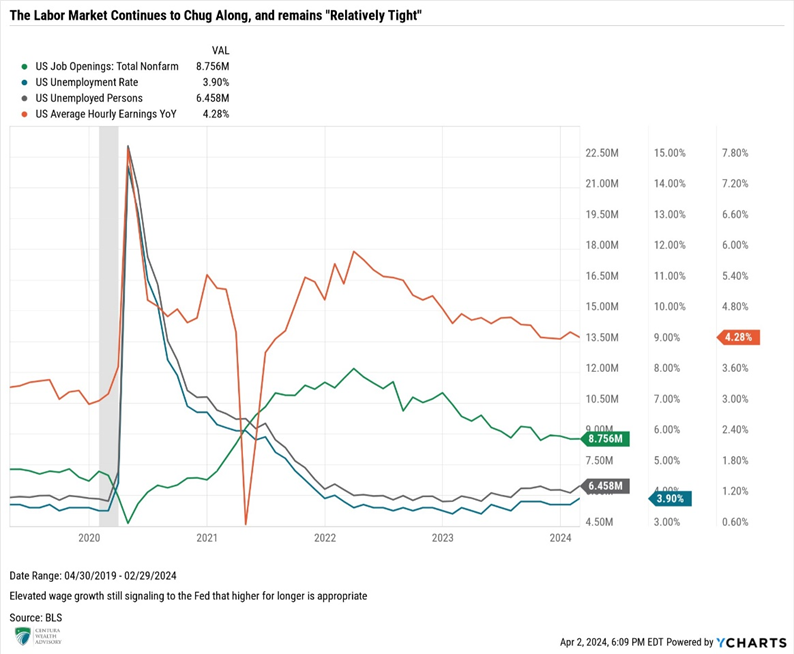

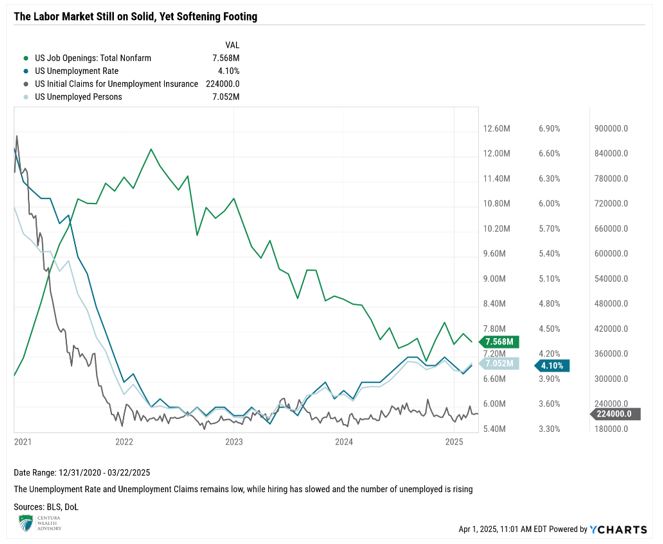

A mix of growth and challenges characterized the labor market in the first quarter of 2025, as the U.S. economy navigated the broader economic uncertainties. Nonfarm payrolls increased by a seasonally adjusted 151,000 in February, representing a stable yet cautious expansion versus expected figures of 170,000. Despite this positive trend, the unemployment rate edged higher to 4.1%, indicating some softening in labor market conditions.

Within this landscape, specific sectors exhibited varying employment trends. Healthcare continued to lead job creation with 52,000 new positions, followed by gains in financial activities and transportation. However, sectors such as retail and government experienced declines, reflecting the impact of administrative changes and fiscal policies being carried out by the Department of Government Efficiency (DOGE), led by Elon Musk. The reductions made by DOGE caused federal government employment to drop by 10,000 jobs as efforts to reduce the federal workforce began to manifest, with future reductions anticipated. These efforts, part of a broader initiative to streamline government operations and improve efficiency, are expected to continue over the coming months, potentially impacting labor market trends and federal services.

Market participants are keenly observing upcoming jobs report releases for signals of employment trends, especially as economic conditions remain highly influenced by geopolitical and domestic fiscal developments.

Inflation, Stagflation, and Monetary Policy

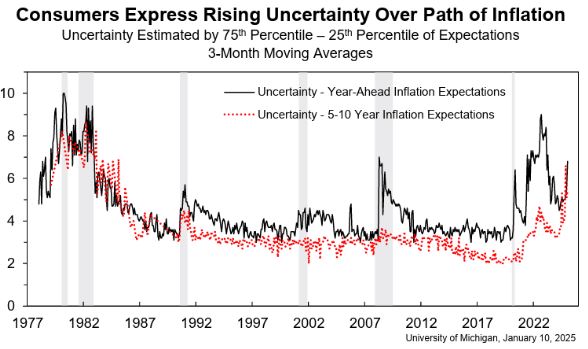

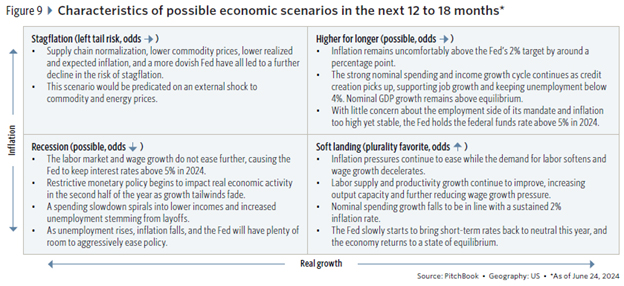

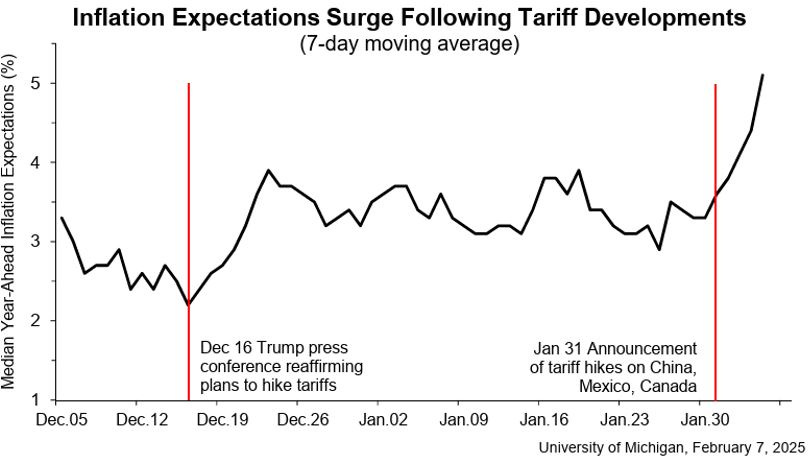

In the first quarter of 2025, inflation trends exhibited volatility, impacted by persistent economic uncertainties and evolving trade policies. Core inflation, as measured by the Personal Consumption Expenditures (PCE) price index, accelerated to 2.8% annually in February, indicating heightened inflationary pressures that outpaced the Federal Reserve’s 2% target. The rise in core inflation was driven by sustained increases in the costs of goods and services, fueled partly by anticipatory spending ahead of tariff implementations. February’s higher inflation reading, paired with retaliatory tariff projections and slowing consumer spending, has evolved into concerns about stagflation — a troubling combination of slowing economic growth and persistent and elevated inflation. These concerns were underscored by a Bloomberg Economics analysis, which warned that the anticipated tariffs could elevate U.S. tariff rates significantly, creating a drag on GDP of up to 4% and pushing inflation higher by about 2.5% over several years.

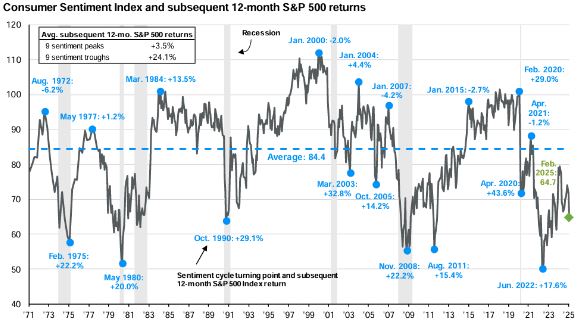

The consumer spending lethargy reflected heightened household budget constraints alongside an uptick in inflation expectations to a nearly 30-year high, as surveyed by the University of Michigan. Given these dynamics, combined with mounting consumer and business anxieties over Trump’s trade policies, economists are forming a growing consensus that the U.S. economy could face both a slower growth trajectory and elevated price levels, challenging policymakers to navigate these choppy economic waters effectively.

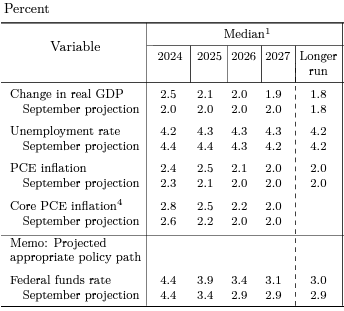

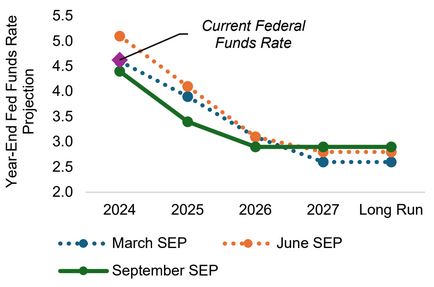

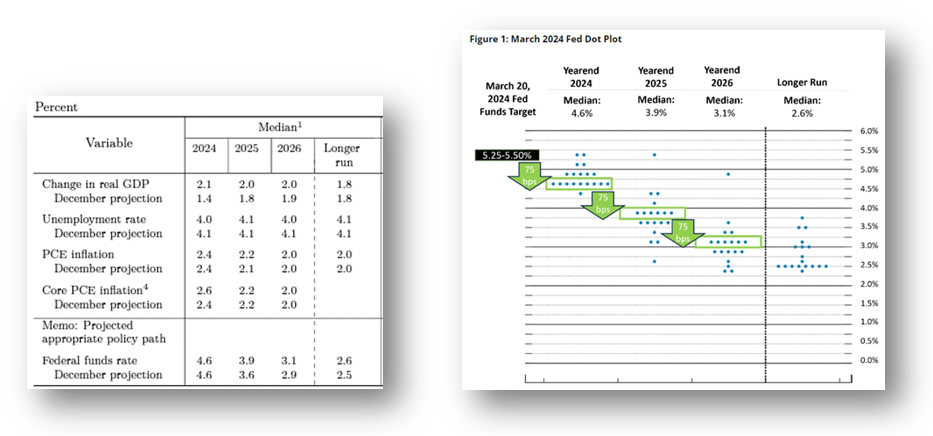

Though mostly taking a backseat to President Trump in the first quarter, monetary policy remained a focal point as the Federal Reserve maintained its benchmark interest rate in the 4.25% to 4.50% range at their March Fed Meeting. Central bank officials expressed concern over the potential inflationary impact of tariffs, with conflicting views on whether these price pressures would be transient or more persistent. Interestingly, Atlanta Fed President Raphael Bostic highlighted a cautious stance, refraining from labeling the inflationary effects as “transitory,” a word steeped in history. The Fed had initially termed the recent post-COVID inflation surge as transitory, when it ended up being the worst bout of inflation the U.S. has seen since the 1980s and a fight the Fed is still fighting today, so markets are sensitive to the use of this word in today’s environment. This cautious monetary approach indicates the Federal Reserve’s intent to closely monitor forthcoming data and global economic developments closely, ensuring that policy adjustments align with evolving inflation trends and economic conditions.

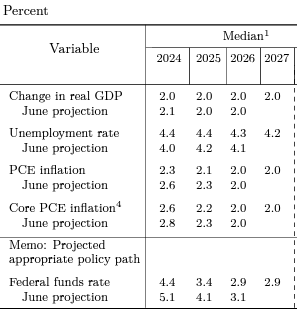

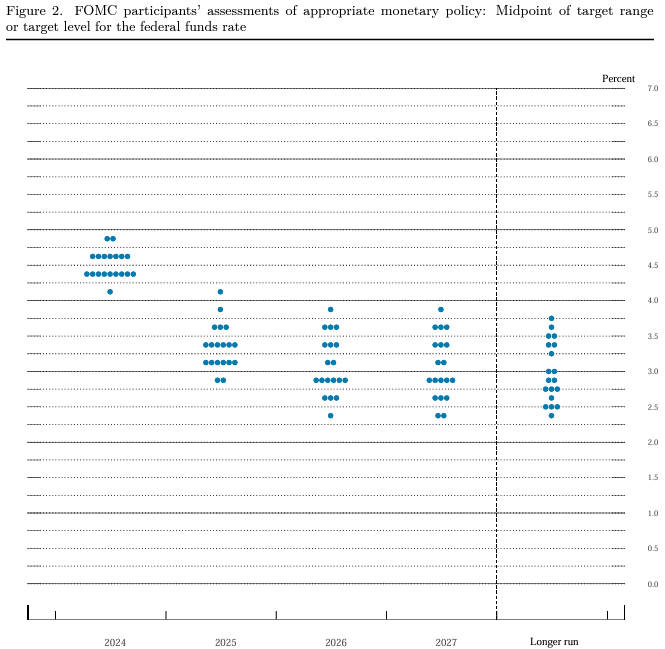

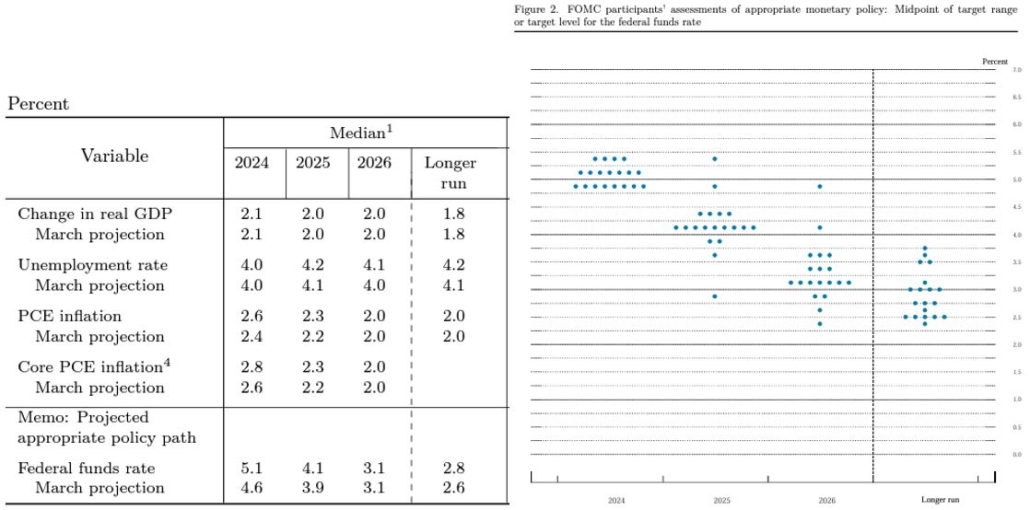

The Fed’s updated Statement of Economic Projections confirmed their pace of rate reductions in 2025 of 50 basis points or two potential 25 basis point cuts. The Federal Reserve updated its economic projections to reflect its concerns about a slowing economic environment, as evidenced by its lower real GDP outlook, higher unemployment, and elevated inflation estimates. As market participants navigate these nuanced dynamics, attention remains focused on future monetary policy decisions and their implications for broader economic stability. We anticipate the Fed to maintain its patient and methodical approach to future rate reductions, particularly in the absence of clarity on fiscal policy.

Centura’s Outlook

As we wrote in our letter to clients addressing the market volatility and correction in mid-March, “Ultimately, in the absence of clarity on the path of fiscal and monetary policy, now is not the time to make drastic changes to investment positioning.”

Unfortunately, the outcomes expected to result from proposed political changes are in direct conflict with the Fed’s dual mandate of maximizing employment and achieving price stability, at least for the near future. For example, sweeping tariffs on U.S. trading partners are likely to increase prices, stoking the very inflation that the Fed is trying to tame. This contrast has led investors to react to speculation and flock to safe-haven investments like bonds and gold. Given the erratic decision-making of our Commander in Chief, we expect volatility to continue to plague markets until more clarity is provided. As discussed, several potential risks are looming and investors should proceed carefully.

Prospects of a U.S. recession are mixed, not only among economists, but asset classes as well. As Chris Ellis, a high-yield bond portfolio manager at Axa Investment Managers stated, “Credit markets in the U.S. are pricing in a much lower chance of a recession than equity markets are and something has to give.” In mid-March, a JPMorgan Chase model indicated the S&P 500 was pricing in a 33% probability of a recession, while credit markets are implying a recession probability of 12%. While markets observed a selloff in high yield credit spreads along with equity markets, history would indicate a significantly larger selloff would need to occur to start sounding the recession alarm bells. Credit spreads generally foreshadow a recession when the premium for junk bonds approaches 8%, or 800-basis points. The current credit spread is 3.55%. The health of today’s credit markets illustrates how equity investors are likely overreacting to speculation surrounding the long-term impacts of the policies. While we don’t believe a recession is imminent, we are closely monitoring any further deterioration in credit as policies unfold.

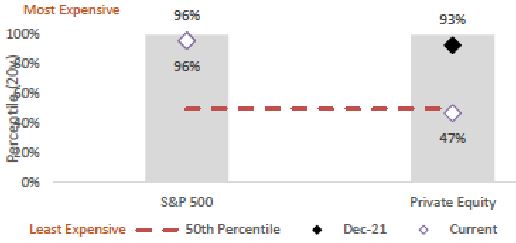

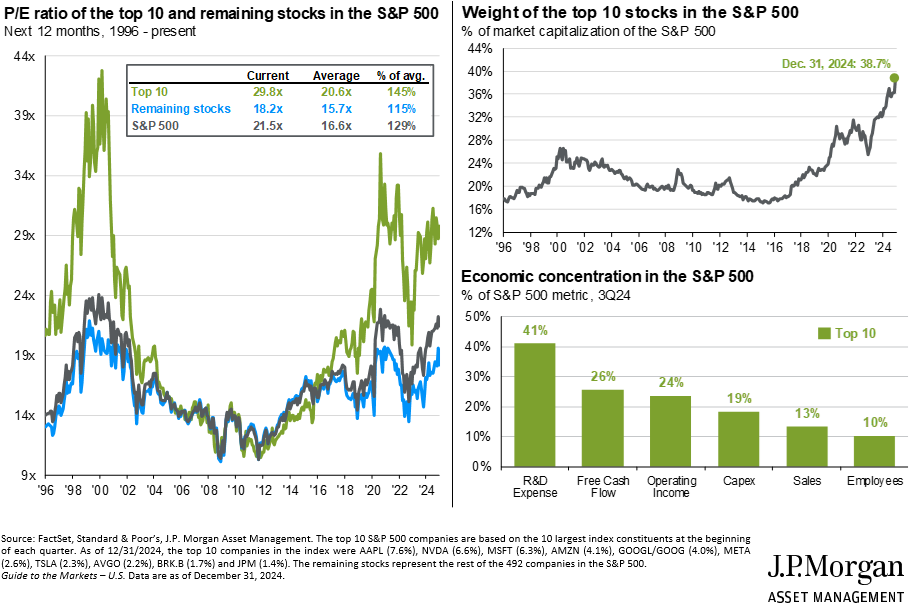

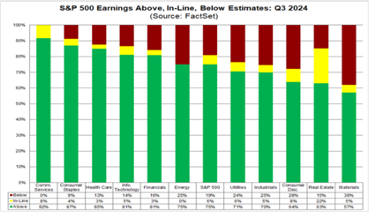

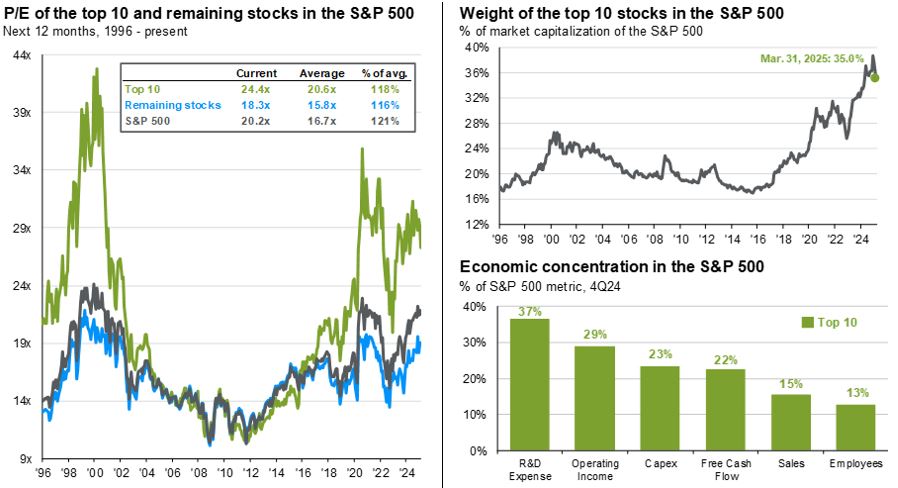

On a more positive note, the downward pressure on the price of stocks factored with stronger than expected earnings growth has brought valuations in line with more reasonable levels. According to FactSet, the forward 12-month price-to-earnings ratio (P/E) declined from 22.3x at year-end to 20.5x as of March 28, which is now only slightly higher than both the 5-year and 10-year averages of 19.9x and 18.3x, respectively. As we witnessed in the first quarter, valuations continue to pose a risk to the market, as negative sentiment can lead to sharper sell-offs on overvalued securities. While the concentration of the top 10 largest stocks in the S&P 500 fell in Q1 2025, they still pose a significant risk. According to JPMorgan, the 10 largest constituents represent 35% of the index, as of March 31, slightly down from 38.7% at year-end.

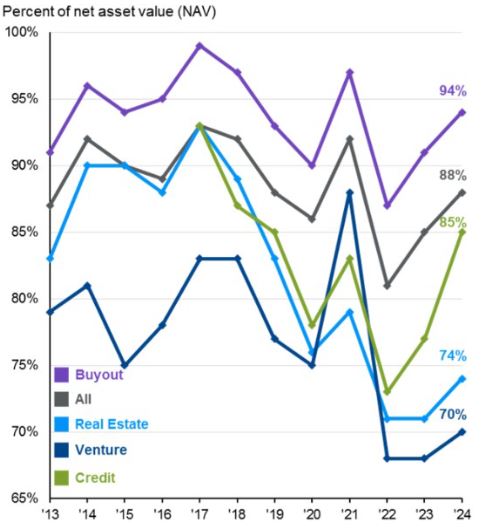

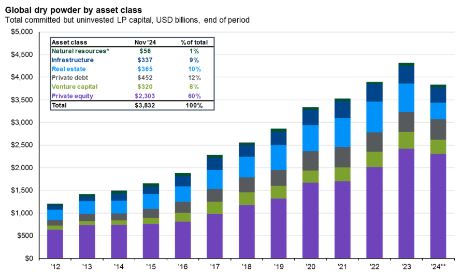

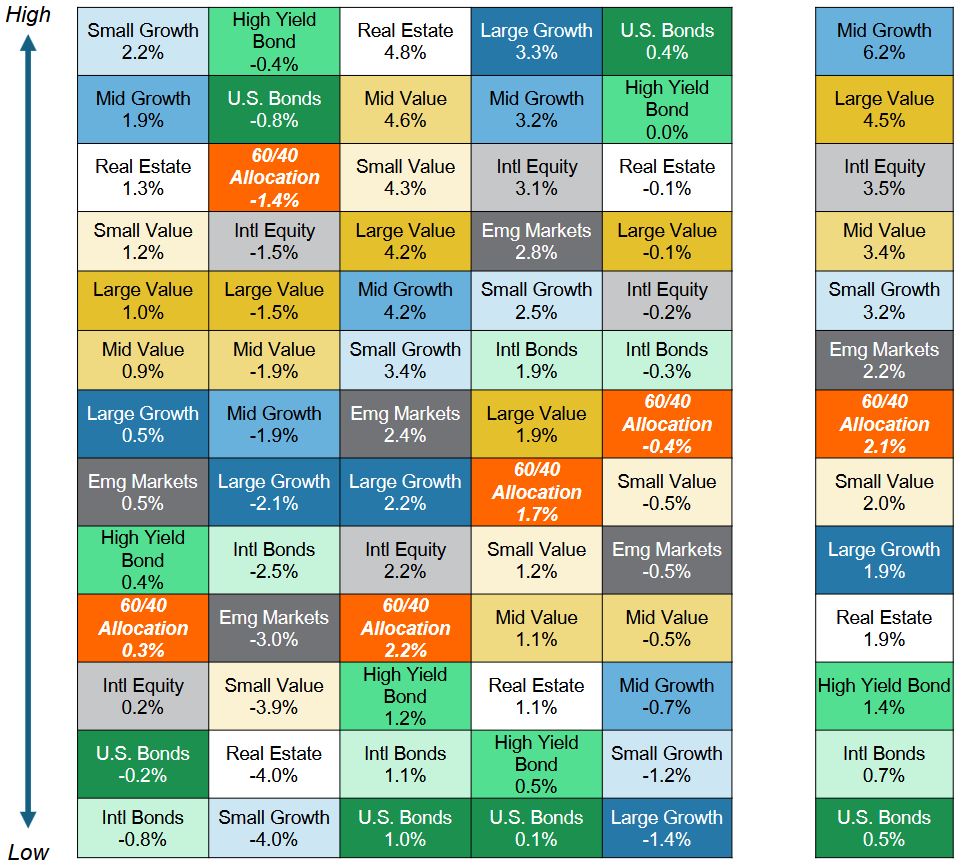

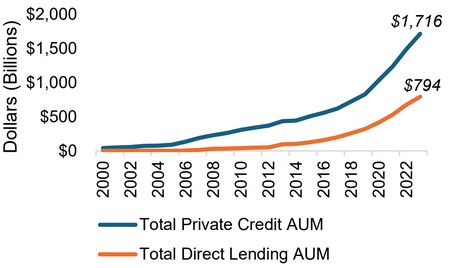

As we communicated in our 4Q 2024 Market Wrap, and reiterated in our March client letter, concentrations like this make the index vulnerable to significant changes in those underlying companies, particularly when those 10 companies are more overvalued than the remaining 490 companies. The P/E of the top 10 is currently 24.4x, while the remaining stocks currently boast a P/E in line with their 10-year averages of 18.3x. Concentrations like this are precisely why we favor global diversification across several asset classes – both public and private – and helped support our decision to reduce both large-cap and large-cap technology stock exposure in our allocations at the beginning of the year.

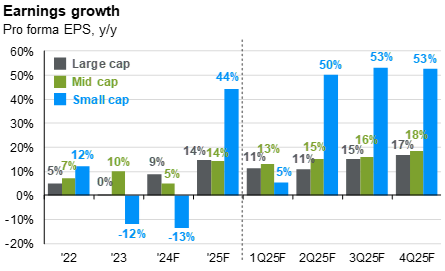

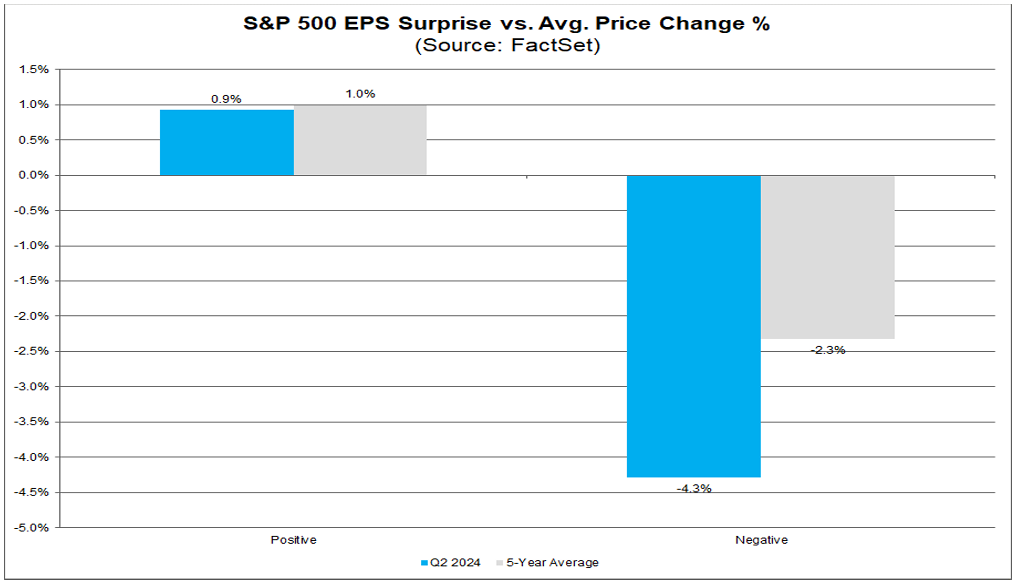

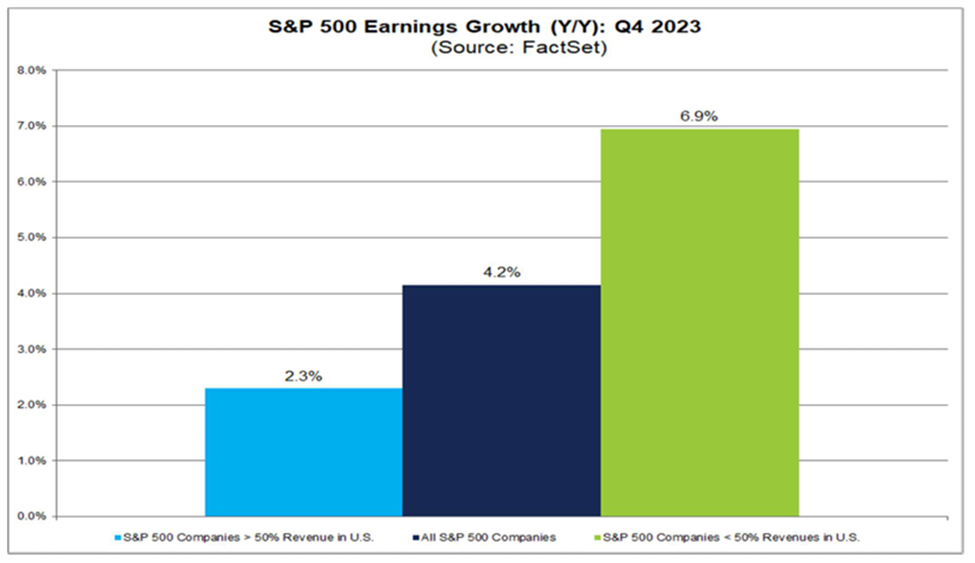

In the face of higher costs, corporate profits remain resilient, as illustrated by the sixth consecutive quarter of positive earnings growth by the S&P 500, rising a remarkable 18.2% in the fourth quarter. As of March 28, FactSet estimates first-quarter earnings to expand at a slower pace of 7.3% year-over-year. Earnings season will kickstart in early April, where we will be keying in on management’s commentary on the impacts of fiscal and monetary policy changes on forward-looking earnings projections and capital expenditures (investment), and we fully anticipate witnessing revisions to the downside.

From the political leader changes in France, Germany, and Canada to the ongoing armed conflicts, notably in the Middle East, where tensions between Israel and Iran remain escalated, and in Russia-Ukraine where discussions are evolving between Putin, Zelensky, and Trump – international markets remain on fragile ground despite their strong first quarter returns. As these international disputes unfold, they have a cascading effect on market sentiment, influencing everything from currency valuations to sector performance.

The specter of further geopolitical instability remains a crucial factor to monitor, particularly in retaliation to the unveiling of “Liberation Day” tariffs on April 2. Potential policy responses from global leaders are poised to have far-reaching consequences for economic forecasts and asset allocations worldwide. We anticipate that both the announcement of the “Liberation Day” tariffs and global leaders’ responses will generate increased market volatility, further supporting the case for global diversification across both public and private markets.

In conclusion, Q1 2025 started on a sour note, and until we have clarity surrounding fiscal and monetary policy, we expect sentiment to deteriorate further. Our allocations remain balanced and in line with our long-term targets. We expect volatility to remain in the short-term as markets work through the political noise and reassess potential economic ramifications; however, in the longer-term, we expect solid earnings growth to drive equity markets. Diversification across several public and private market asset classes should serve clients well in 2025 as we navigate this complex investing environment. As always, investors should remain vigilant to potential risks while positioning themselves to capitalize on opportunities in the evolving market landscape.

Thank you for your continued confidence and support. If you have questions or concerns, please contact your Centura Wealth advisor.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on the market and other conditions. These documents may contain certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Centura Wealth Advisory is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Centura Wealth Advisory and its representatives are properly licensed or exempt from licensure. 12255 El Camino Real, St. 125, San Diego, CA 92130.